It’s Tuesday, which of course means it’s time for… #TopTipTuesday !

If you are self-employed, you can claim the running of your car as a company cost, which can be added to your tax return, helping you pay less tax.

#accountancytips #taxtips #businessmileage

#TopTipTuesday

Make sure you claim the maximum amount of tax back from your business spending - don’t forget things like membership of professional bodies, charity donations and unpaid invoices.

#accountancytips #tax

👋 Meet the team 👋!

Lyn joined Beatons in 2012 and specialises in audits for large companies as well as small companies and clubs. Lyn is a Fellow of the Association of Chartered Certified Accountants.

#meettheteam #b2b #businessnetworking #businessnetworks #accountancytips

Register with HMRC as soon as possible after you start trading, and by 5 October following the end of the tax year in which you started self-employment at the latest #TaxTips #TuesdayTaxTips #TopTipTuesday #Tips #AccountancyTips

✅ Professional accreditations

✅ Experience

✅ Proactive

These are just some of the considerations to bear in mind when you are looking for an accountant. Our blog provides a few more top tips!

bit.ly/3t4LI4y

#accountancy tips #accountancy #tax

Student loan repayments will be collected via your self assessment return if your earnings are high enough.

#TaxTips #TuesdayTaxTips #TopTipTuesday #Tips #AccountancyTips #SelfEmployedExpenses

If your turnover is more than £85k in any 12 month rolling period you will need to register for VAT and charge the additional 20% to customers. You can then also claim back any VAT you incur on expenditure.

#TaxTips #TuesdayTaxTips #TopTipTuesday #Tips #AccountancyTips

Our new guide to Profit and Loss Report reports, and how they can reveal important information about your business.

buff.ly/3WbUtKp

#AccountancyTips #ProfitLoss

If you are married or in a civil partnership, look to see whether you or your partner can claim the marriage allowance.

The claim can be backdated up to 4 years.

#TaxTips #TuesdayTaxTips #TopTipTuesday #Tips #AccountancyTips

If your annual gross property income is £1,000 or less, from one or more property businesses, you won’t have to tell HMRC or declare this income on a #taxreturn

#TaxTips #TuesdayTaxTips #TopTipTuesday #Tips #AccountancyTips #SelfEmployedExpenses

From 1 April 2021 companies were able to reduce their tax bill by 130% of the cost of new plant and machinery, this has now ended on 31st March of this year.

#TaxTips #TuesdayTaxTips #TopTipTuesday #Tips #AccountancyTips

You need to check that the information Companies House has about your company is correct every year and pay a £13 fee.

This is called a confirmation statement (previously an annual return).

#TaxTips #TuesdayTaxTips #TopTipTuesday #Tips #AccountancyTips

Pension contributions have to be physically paid before the year end to be included in the accounts and to obtain a relief against Corporation Tax.

#TaxTips #TuesdayTaxTips #TopTipTuesday #Tips #AccountancyTips

In the tax year to 5 April 2023, you can earn £1,000 of interest on savings tax-free if you're a basic-rate taxpayer. If you're a higher-rate taxpayer, your tax-free allowance is £500.

#TaxTips #TuesdayTaxTips #TopTipTuesday #Tips #AccountancyTips

Tax relief is available on charitable donations made by an individual who has paid income tax equivalent or more than the tax on the donation.

#TaxTips #TuesdayTaxTips #TopTipTuesday #Tips #AccountancyTips

[Newsbrief] Self-assessment mistakes to easily avoid | Are you a procrastinator? Half of us are | Business success hacks from entrepreneurs | - mailchi.mp/007d0c4890d5/n…

#TaxDeadlines #FreeEvents #AccountancyTips #SMEs

![Clifford Towers (@CliffordTowers) on Twitter photo 2023-01-24 11:02:53 [Newsbrief] Self-assessment mistakes to easily avoid | Are you a procrastinator? Half of us are | Business success hacks from entrepreneurs | - mailchi.mp/007d0c4890d5/n…

#TaxDeadlines #FreeEvents #AccountancyTips #SMEs [Newsbrief] Self-assessment mistakes to easily avoid | Are you a procrastinator? Half of us are | Business success hacks from entrepreneurs | - mailchi.mp/007d0c4890d5/n…

#TaxDeadlines #FreeEvents #AccountancyTips #SMEs](https://pbs.twimg.com/media/FnO5OtpXgAAkgPy.jpg)

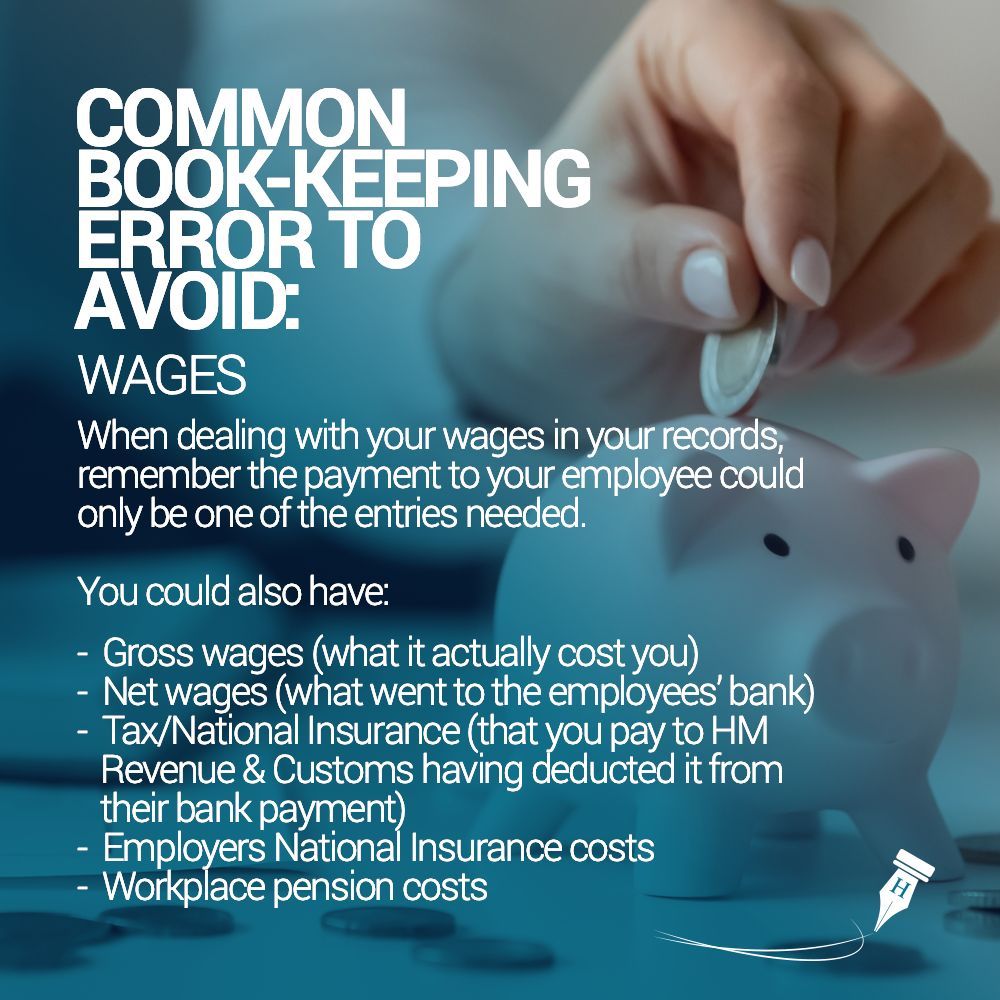

Doing your own business accounting? Entering wages can be trickier than it looks. There’s probably more than one entry needed. Take care.

#bookkeeping #AccountancyTips

Turnover is a key number that measures the success of your business and you should monitor it to see whether your business is growing or declining.

You can find this in your sales records or reports in your online systems.

#SmallBusiness #AccountancyTips

Do you understand your balance sheet? Follow our 4 easy steps to understanding your numbers.

buff.ly/3IxwX2n

#Bookkeeping #Accountancy Tips #Accountancy