Tax Justice Network

@TaxJusticeNet

Equipping people and governments with the data and tools they need to reprogramme their tax systems to work for everyone.

ID:78990577

http://www.taxjustice.net 01-10-2009 19:59:57

30,7K Tweets

40,0K Followers

952 Following

Follow People

Alongside our blog on the recent UN tax negotiations, we're publishing:

💾Our database on what countries said they want from a #UNtaxConvention during the negotiations: airtable.com/appElNW04vjl9t…

🎙️Transcripts of the negotiation meetings: taxjustice.net/2024/04/25/%F0…

What happened at the 1st round of UN tax negotiations & what’s next? Sergio Chaparro & Markus Meinzer provide a jam-packed recap of the First Session, breaking down negotiation tactics, country positions, emerging blocs & next steps to a #UNtaxConvention .

taxjustice.net/2024/05/17/wha…

“This will supersede them all.” Offshore specialist Paul Beckett and Tax Justice Network’s Bob Michel sound the alarm over the rise of “blockchain havens” which are overtaking physical offshore tax havens.

Sterling work from The Taxcast Naomi Fowler naomifowler.bsky.social youtu.be/Se97bpUX6r8?si…

Now listened to in 90 countries, don't miss our podcast The Taxcast with Naomi Fowler naomifowler.bsky.social: 'This will supersede them all.” Offshore specialist & human rights lawyer Paul Beckett & TJN's Bob Michel sound the alarm on the fast development of ‘blockchain havens’

podcasts.taxjustice.net/episode/142-bl…

The first substantial negotiating round of the #UNTaxConvention process ended last night. All countries reached a consensus agreement on a roadmap towards the next - and final - negotiating round, starting in July. Read our press release here: eurodad.org/un_tax_convent…

Nuestros investigadores Mariana Matamoros y Sergio Chaparro participan de las primeras discusiones sobre cómo funcionará la Convención Marco de la #ONU sobre Cooperación Internacional.

A successful #UNTaxConvention must address the differential impact of international tax practices on gender to promote fair and inclusive tax systems in Africa.

This blog by Lurit Yugusuk and Naomi Majale discusses how we can collectively ensure fiscal justice for women and

⚡Watch now! Markus Meinzer delivering a statement on behalf of the Tax Justice Network on public Country by country reporting. #UNTaxConvention

youtube.com/watch?v=XNlEUY…

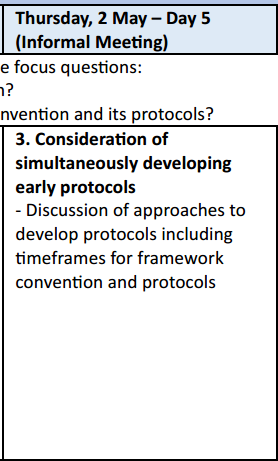

OECD Tax Department of State The longer than usual break after the morning session indicates that this penny might be beginning to drop here & there...

After the break, a compromise proposal, initiated by the UK, for overlapping negotiation timelines, but not full simultaneity, was elaborated by the Chair.

The negotiations for Terms of Reference of a #UnTaxConvention focus today on two crucial procedural questions:

1. should early simultaneous protocols be negotiated?

2. what timeline for any protocols and the Framework Convention?

Watch live or later:

webtv.un.org/en/asset/k1h/k…

A technical note published by IMF 'is a much welcomed breath of fresh air' for beneficial ownership #transparency , says Tax Justice Network

The paper discusses the dangers of opaque bank ownership & provides proposals to combat the issue. Read more: bit.ly/3w7cMpL

⚡Watch now! Markus Meinzer delivering a statement on behalf of the Tax Justice Network on public Country by country reporting. #UNTaxConvention

youtube.com/watch?v=XNlEUY…

Making History: The Federal Ministry of Finance delegate speaking on behalf of the 54 countries of the African Union today delivered a powerful statement that may mark a turning point in the negotiation dynamic.

Watch starting about 2:47:00 in the recording:

webtv.un.org/en/asset/k11/k…

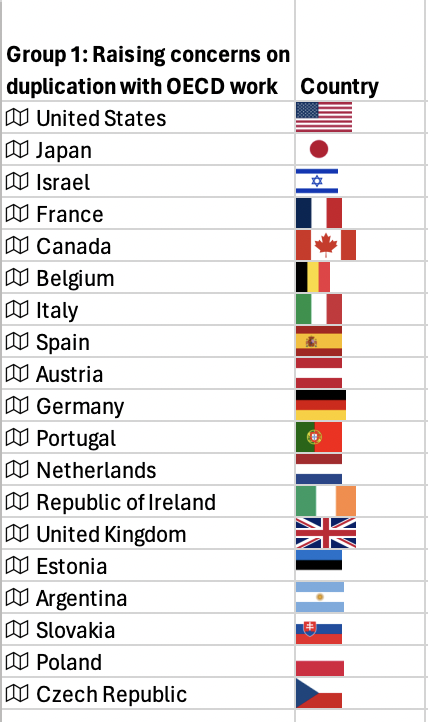

Tax Justice Network International Centre for Tax and Development Irma Mosquera Valderrama Allison Christians South Centre Icrict Sol Picciotto Paris School of Economics Markus Meinzer Alex Cobham @[email protected] A second group 2 (majority - over 60 countries) supported the inclusion of corporate taxation as a sustantive issue to include in the ToRs. A few countries made some nuances in regards to the need to build on the progress made in the context of the OECD's Inclusive Framework.

Tax Justice Network International Centre for Tax and Development Irma Mosquera Valderrama Allison Christians South Centre Icrict Sol Picciotto Paris School of Economics The item to be addressed in the morning is corporate taxation. Two clear blocks emerge from the interventions so far, as shown in chart. Group 1 (minority, if positions of country blocs are acknowledged) raised concerns on duplication with the OECD's two-pillar agenda.

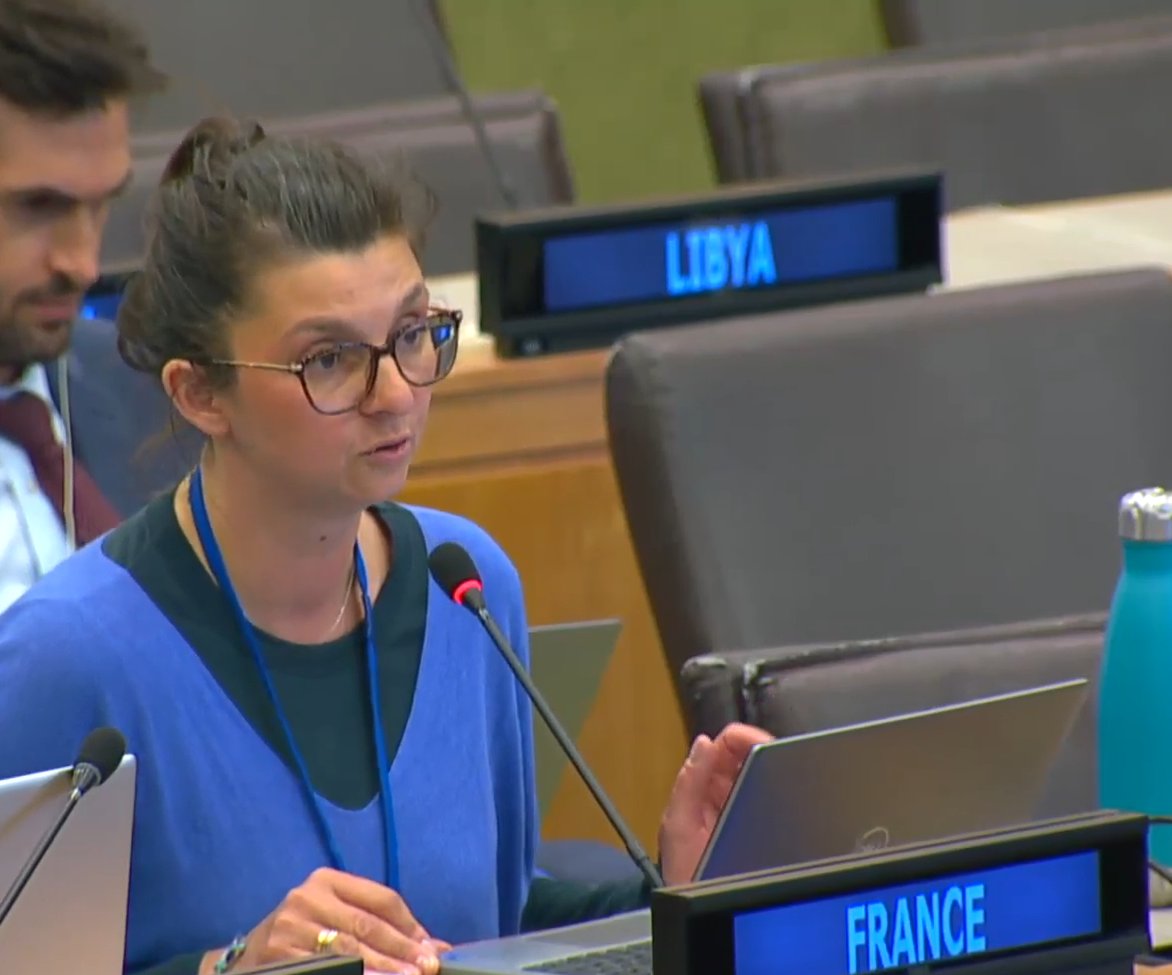

OECD Tax Patrick Kaczmarczyk Anke Hassel Achim Truger Adam Tooze Netzwerk Steuergerechtigkeit Marcel Fratzscher Misereor Martin Hearson (@[email protected]) Fabio De Masi 🦩 Bastian Brinkmann A somewhat surprising procedural hickup happened just now, when France objected to the proposition by the chair to allow contributions by civil society to be made during the session rather than only at the end of the session, when no other member state raises their hand.

El Financiero El Economista REFORMA EL PAÍS México Aristegui Noticias Proceso El Universal Milenio SinEmbargo Animal Político Tax Justice Network México, como parte de la mesa de trabajo en la ONU del Comité Especial, tiene la oportunidad de poner fin a los abusos fiscales globales y ampliar los recursos disponibles para los derechos humanos.

Aquí nuestro 𝗰𝗼𝗺𝘂𝗻𝗶𝗰𝗮𝗱𝗼: i.mtr.cool/kzwxiazomu

Our latest podcast The Taxcast: “This will supersede them all.” Offshore specialist & human rights lawyer Paul Beckett sounds the alarm on blockchain havens + TJN's Bob Michel on the challenges regulators, anti-corruption campaigners &poorer countries face

podcasts.taxjustice.net/episode/142-bl…

The latest Tax Justice Network podcast, the #Taxcast is out! “Cryptocurrency & transactions through the blockchain are tax havens in themselves. [They can provide] the deliberate deletion of corporate oversight, an enormous black hole for transparency purposes” podcasts.taxjustice.net/episode/142-bl…