EU Tax Observatory

@taxobservatory

Independent research lab focusing on #taxation, corporate tax avoidance, tax evasion, and solutions to these issues. Directed by @gabriel_zucman

ID:1333841823475793921

http://taxobservatory.eu 01-12-2020 18:34:52

950 Tweets

6,2K Followers

894 Following

Don't miss Gabriel Zucman's lecture on global tax evasion at AK Österreich in Vienna 🇦🇹

🗓️ Save the date: May 15, 7:00 pm (CET)

Register by May 13: veranstaltung.akwien.at/de/globale-ste…

Recently published in International Tax and Public Finance:

The long way to tax transparency: lessons from the early publishers of country-by-country reports' by Sarah Godar, Giulia Aliprandi, Tommaso Faccio, Petr Janský & Katia Toledo Ruizthat

Available at: link.springer.com/article/10.100…

📖 We are honoured to host Gabriel Zucman, Professor at Paris School of Economics, in this month's #MWP Lecture.

His keynote delved into the findings of 'The Global Tax Evasion Report 2024', addressing the current situation of tax evasion and the policies aimed to reduce it.

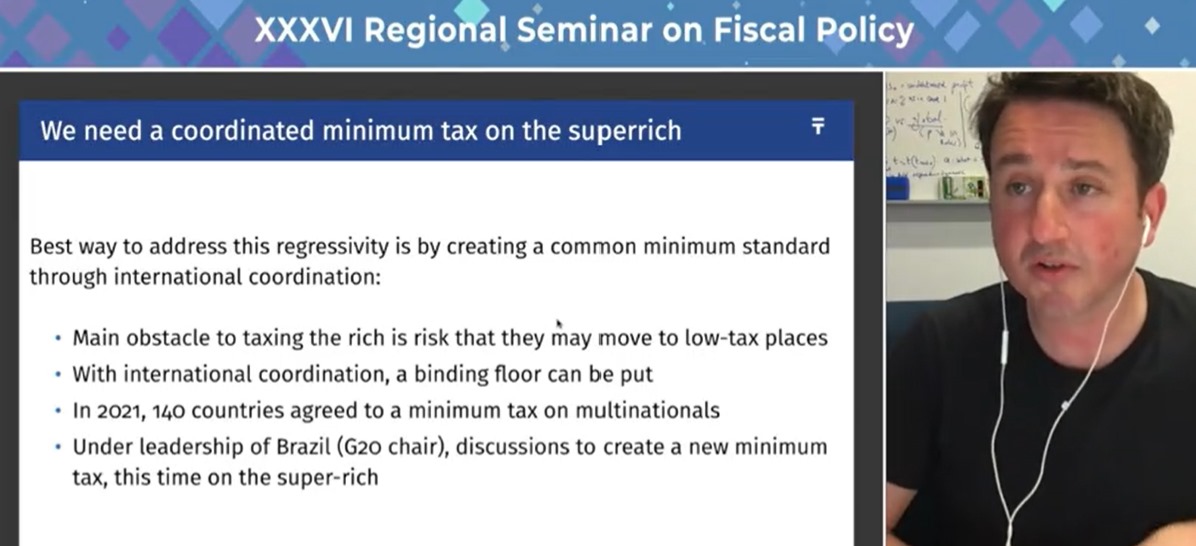

'We have the precedent with the global minimum tax on corporations, we have the political space, and most importantly, we have the technical tools to design such a tax on the super-rich that will work,' says Quentin Parrinello at the Global Solutions Initiative.

🔴 Live: 'Effective Strategies for Climate Finance Mobilization' at the Global Solutions Initiative

The session explores collaborative approaches for debt relief and climate resilience, emphasizing intensified global efforts in climate finance.

📺 Watch here: youtube.com/watch?v=j5Jqcv…

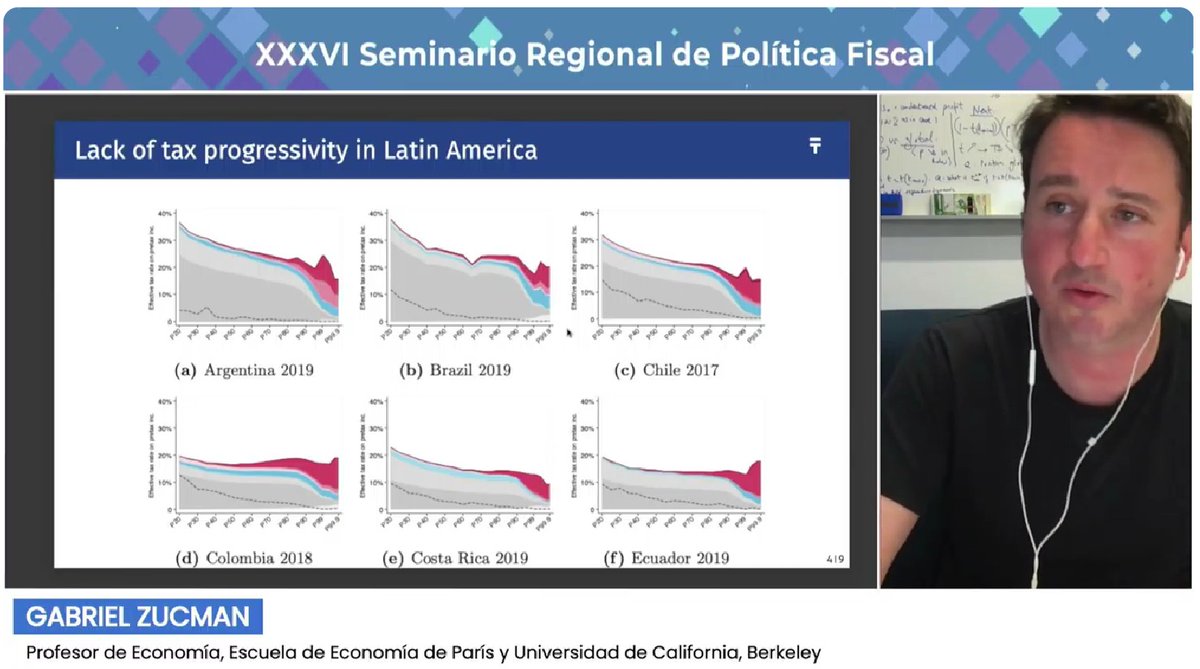

🗨️Basándose en los éxitos de los últimos 10 años, el siguiente paso lógico de la cooperación fiscal internacional debería consistir en un impuesto mínimo coordinado para los más ricos: Profesor Gabriel Zucman UC Berkeley Paris School of Economics en Seminario Regional de #PolíticaFiscal #CEPAL .

The Global Tax Evasion Report 2024, which our EU Tax Observatory released last year, estimates that a minimum tax on global billionaires equal to 2% of their wealth would generate ~$250 billion per year in tax revenue

$250 billion, from less than 3,000 under-taxed individuals

Catch Gabriel Zucman's upcoming lecture at European University Institute on May 8, 5pm (CET)!

🔍 Delve into crucial questions: Is global tax evasion declining or rising? What new challenges are emerging? Discover insights from the Global #TaxEvasionReport 2024.

Register ➡️ eui.eu/events?id=5621…

In New York Times Opinion

“The idea that billionaires should pay a minimum amount of income tax is not a radical idea,” writes the economist Gabriel Zucman. “A coordinated minimum tax on the superrich will not fix capitalism. But it is a necessary first step.”

nyti.ms/3WraI6y

The idea is simple. Let’s agree that billionaires should pay income taxes equivalent to a small portion — say, 2% — of their wealth each year.

Read Gabriel Zucman's The New York Times op-ed on why a global minimum tax on the super-rich is crucial & how it can work: nytimes.com/interactive/20…

🔴 Attention! Important Update: Today's #LunchSeminar with Barbara Stage will be exclusively held on Zoom.

📌 Register here for the seminar: us06web.zoom.us/meeting/regist…

Want to chat with Barbara later? Sign up for the evening meet-up: tally.so/r/mKMPbX

'The Brazilian government has an even more ambitious proposal – for an annual global tax levied at 2% on the wealth of the world’s billionaires. Gabriel Zucman has been asked to draw up a detailed plan for how a billionaire wealth tax would work..' theguardian.com/commentisfree/…