build on your japanese 🥰

more info: languageloopllc.com/contact/

#financialdistrict #learnanewlanguage #chicago land #midwest #languages #uptown #nyc #newyork #manhattan #chicago #indiana #texas #ohio #seattle #usa #thursdaythoughts #japan ese #japan #anime #manga #jpop #june #summer

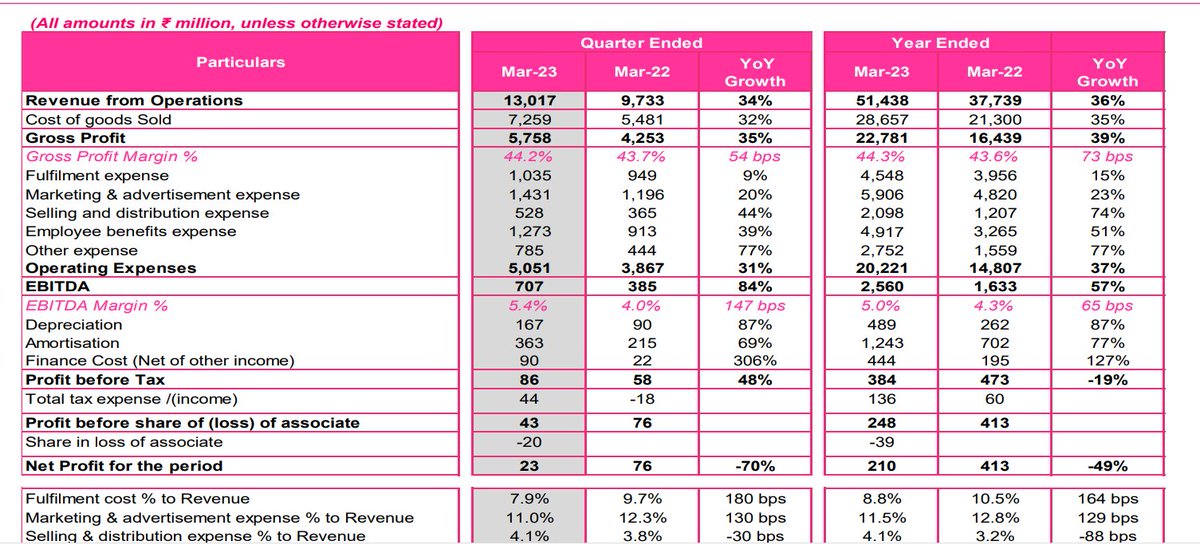

#4QWithCNBCTV18 | Nykaa reports Q4 earnings.

◼️Net profit down 71.8% at Rs 2.4 cr Vs Rs 9 cr (YoY)

◼️Revenue up 33.7% at Rs 1,301.7 cr Vs Rs 973.3 cr (YoY)

◼️EBITDA up 84% at Rs 70.6 cr Vs Rs 38.4 cr (YoY)

◼️EBITDA margin at 5.4% Vs 4% (YoY)

Zee Business brings to you 5 stocks recommended by brokerage firms to keep an eye out for under Rs 500.

#brokeragereport #brokeragecalls #Nykaa #stocksunder500 #bharatelectronics #powergrid #bandhanbank #BPCL

some boys really need this kind of treatment

#ManojBajpayee #IPLFinals #Nykaa #MouniRoy Om Shanti #KaranJohar #NiteshPandey #Asur2 #TejRan

Capital used 10,000 only

profit Rs.3000+

#StockMarketindia #PresidentofIndia #recession #karnataka #SunnyLeone #RanveerSingh #Nykaa #VandeBharatExpress #Fighter #oval #DowJones #amul #RahulGandhi #modi #tamil #Cricket24 #IPL2023Final #ahmedabad #AsiaCup2023 #Ukraine