#Assetallocation

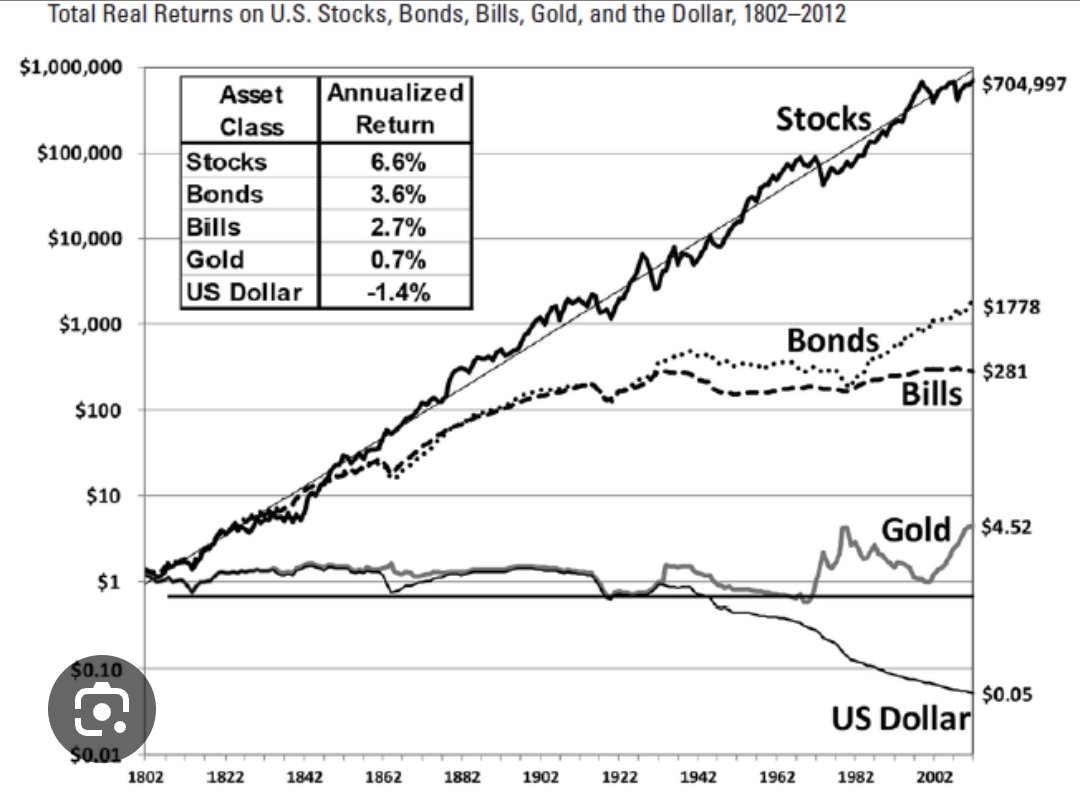

Look at this chart from 200years of study in the US. Stocks outperform all asset classes handsomely. If ever you need any optimism to remain invested in stocks, this should strengthen it. Same is the story in all markets including India. Equity will always beat…

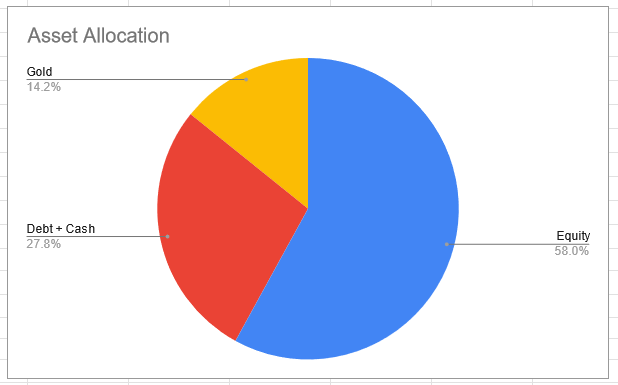

A nice way to think about your post-retirement asset allocation.

#Retirement #Investing #AssetAllocation

Sharing my current asset allocation! What's yours and what's your rationale behind it? Let's discuss it!

#AssetAllocation

#assetallocation

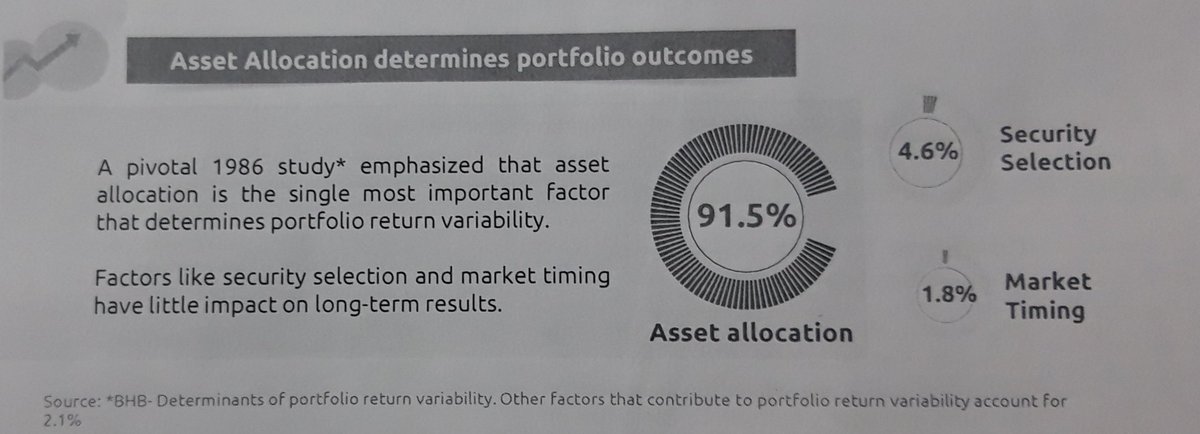

If you can't do it then stay invested in equities till you retire, no point in chasing 9% contributing factor for portfolio returns.

Switch between sectors or market caps but stay put !

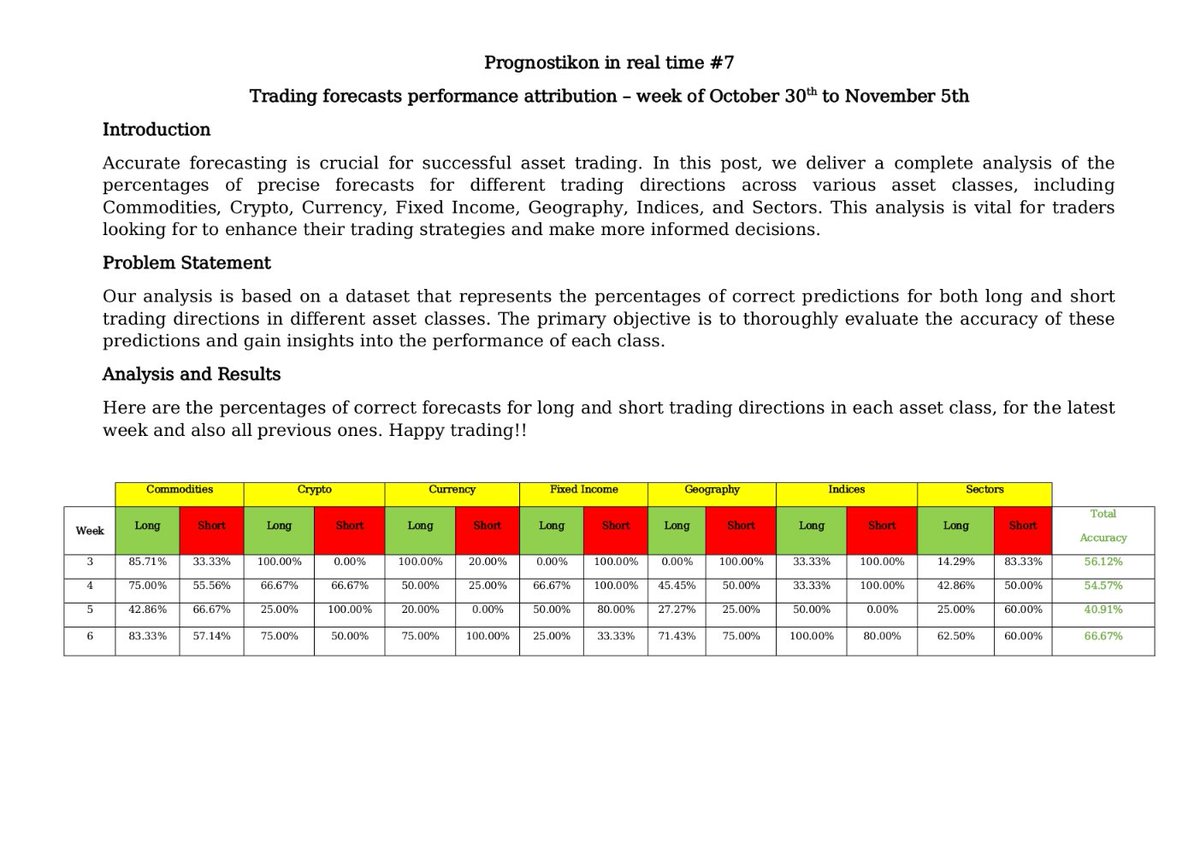

Trading forecasts performance attribution – week of October 30th to November 5th

#trading #forecasts #performance #attribution #assetclasses #long #short #accuracy #informeddecisions #assetallocation #riskmanagement #trading strategy #marketanalysis

Bitcoin Drop: Where Are Investors Moving Their Money?

#BitcoinDrop #InvestorBehavior #RiskAssets #BondMarket #AssetAllocation #MarketAnalysis #FinancialMarkets #InvestmentStrategy #CryptocurrencyNews #MarketTrends

#MYTHVSFACTS JRG is on the way to clear all myths coming in the way of investing. #JRG #JRG financial #mutualfunds #financialwisdom #money #finance #inflation #personalfinance #assetallocation #money management #financialplanning #sip #mutualfunds #wealthbuilding #wealthmanager

Discover the importance of asset allocation in achieving your long-term financial goals and building wealth. #AssetAllocation #WealthBuilding

The Power of Diversification: How to Safeguard Your Investments

#DiversifyYourInvestments #InvestmentStrategy #ReduceRisk #FinancialSecurity #PortfolioDiversification #AssetAllocation #InvestmentTips #WealthManagement #FinancialPlanning #RiskManagement

Financial Behaviour of a person describe his/her future. Get your financial insight with JRG Financial. #JRG #JRG financial #mutualfunds #financialwisdom #money #finance #inflation #personalfinance #assetallocation #sip #mutualfunds #wealthbuilding #wealthmanager #India

Before investing in SGB, you should be very clear of your purpose of investment and as a rule you should not be having more than 10% of your total portfolio in gold!

Women Talk Money #goldbonds #SovereignGoldBond #assetallocation #DiversifyYourPortfolio

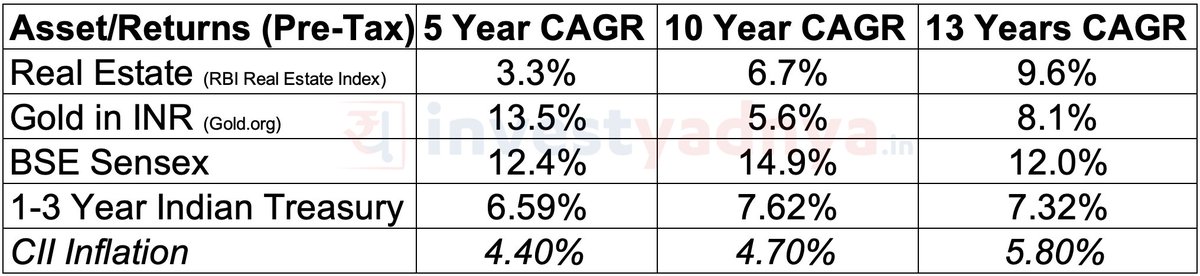

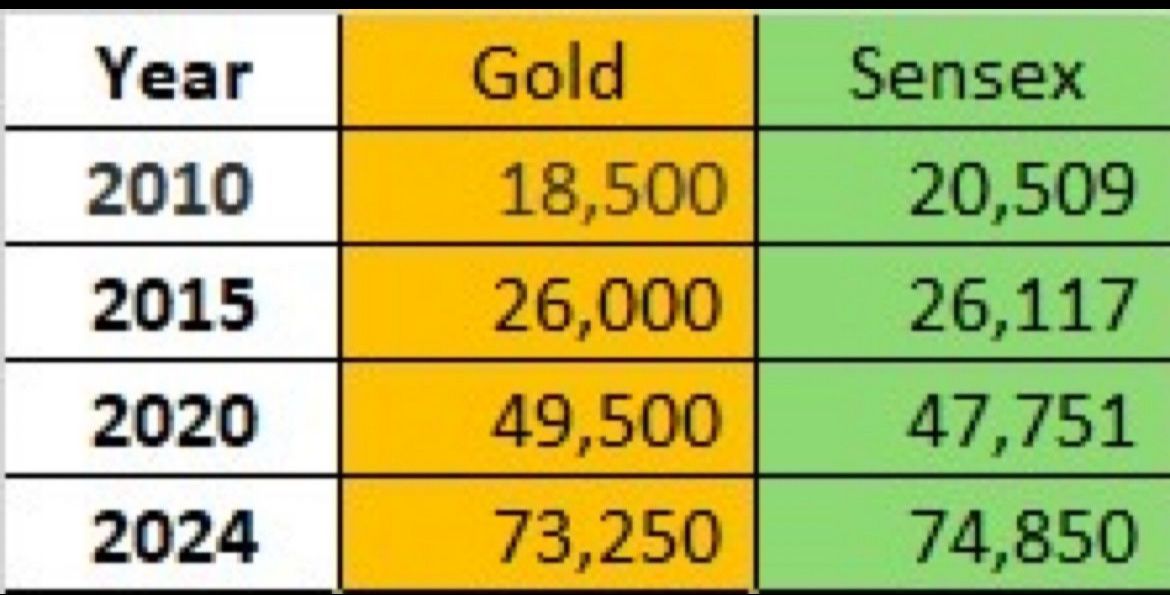

So many myths busted by data:

1. In the long term, equity is the best asset class

2. Gold can only be a hedge

3. If you are young, invest only in Equity....

Can continue adding!

I must say, this has also been a huge unlearning for me too!

Hence... #assetallocation

Can a ₹5000/- SIP make you 5.6 Crore?

Watch the video to know entire crux behind it.

Kirtan A Shah 🇮🇳

#SIP #Investment #PersonalFinance #WealthBuilding #FinancialPlanning #MutualFunds #MoneyManagement #Investing #SmartInvesting #SIP Investing #AssetAllocation #LongTermInvesting

Is FD more Risky than Stock?

Watch the video to know entire crux behind it.

Kirtan A Shah 🇮🇳

#RiskAssessment #InvestmentRisk #FinanceDebate #StockVsFD #FinancialSecurity #RiskManagement #InvestmentStrategy #WealthManagement #FinancialPlanning #MarketVolatility #AssetAllocation

The landscape for commodities may be variable due to the green transition, but bonds and REITs are showing upward trends. Discover more by downloading these key takeaways from our annual Long Run Asset Allocation Outlook report.

shorturl.at/iOSY5

#assetallocation

NEW YEAR🌟NEW FAT PITCH! Clint S CFA, CMT WealthShield Advisor & Paul Barausky w/the Nicholas Fusco of ApeVue w/insight on #privatemarkets Ep covers #assetallocation #measuringvolatility #valuation #transparency #fintech #Microsoft #SpaceX #EpicGames #Bytedance & more. LISTEN/WATCH👇

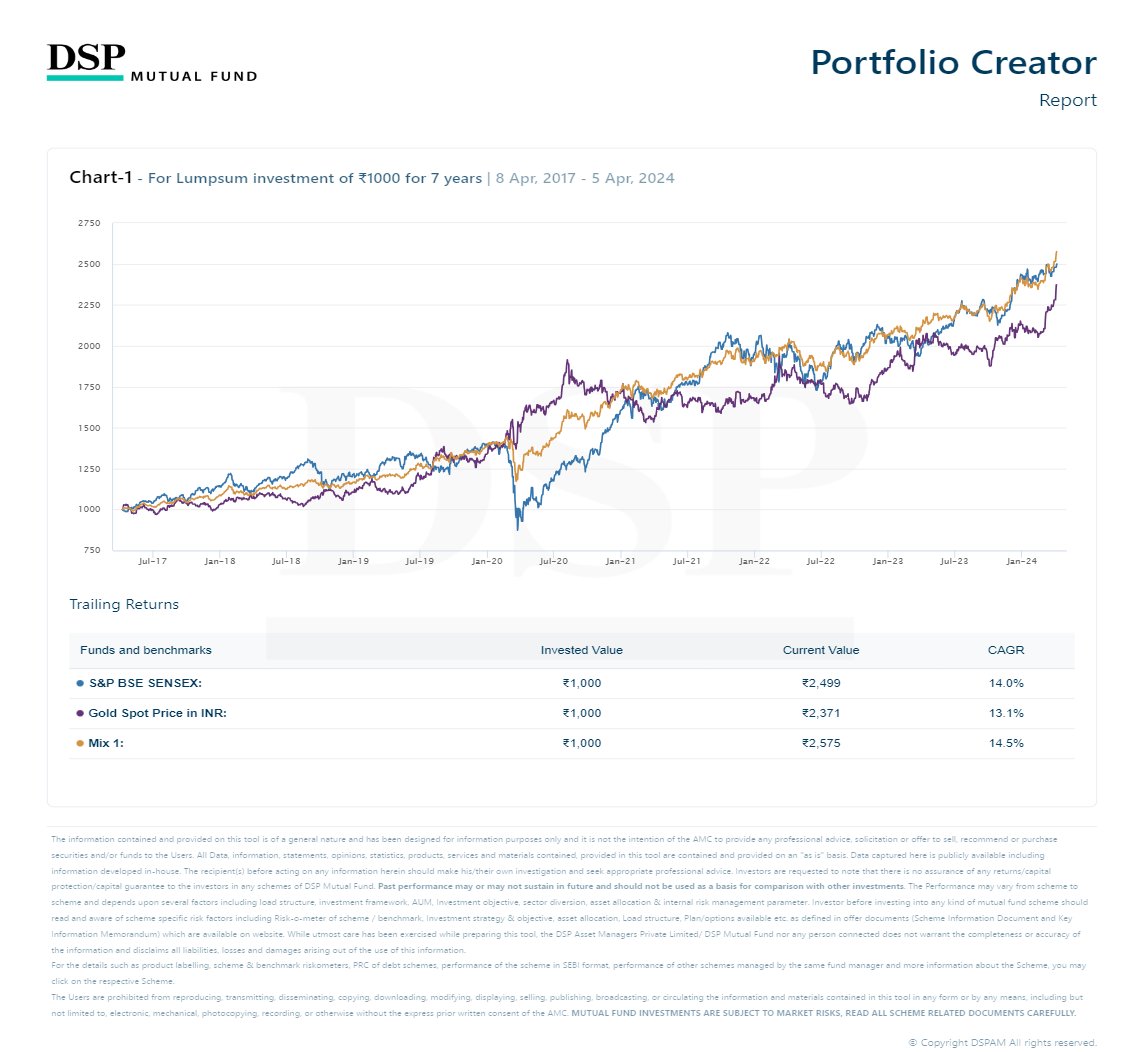

Over the last 7 years

Sensex Index CAGR 14%

Gold (INR) CAGR 13.1%

Mix of these two 50:50 (annualy rebalanced) CAGR 14.5%

#AssetAllocation