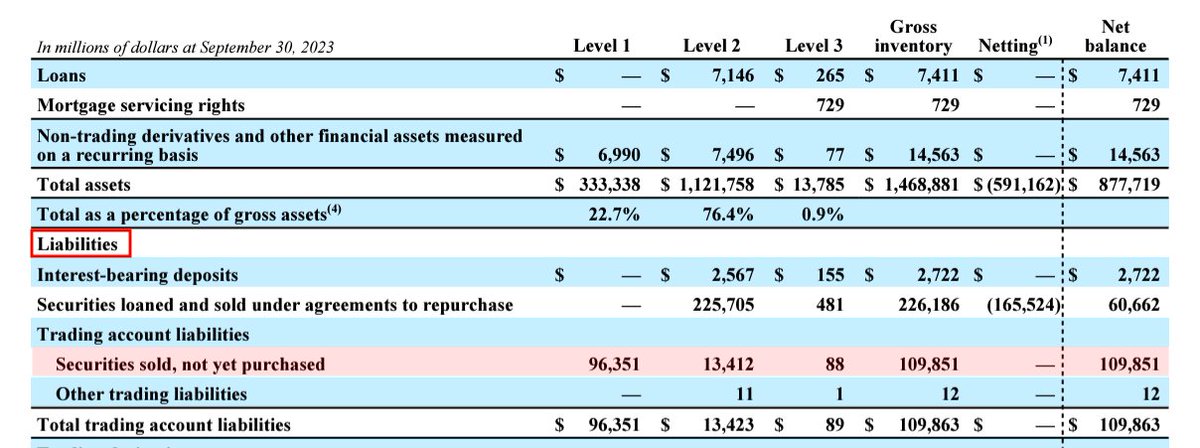

Citigroup, the parent company of Citibank, reported $109.851 billion in 'Securities sold, not yet purchased' in its most recent quarterly report, for the period ending September 30th.

#SystemicRisk #FinancialCrisis #LiquidityCrisis #BankingCrisis #MemeBank #Citi

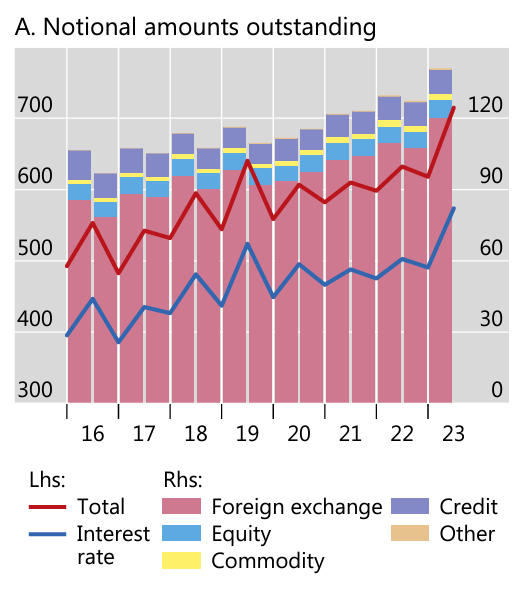

(Bank for International Settlements) --

'The notional value of outstanding OTC derivatives reached $715 trillion at end-June 2023'; a 16% year-over year increase; or $97 trillion.

#SystemicRisk #BankingCrisis #FinancialCrisis #Derivatives #Swaps #SoldNotYetPurchased #Leverage

“Global OTC derivatives notional outstanding totaled $714.7 trillion at the end of June 2023”.

#SystemicRisk #WallStreet #MemeBanks #LiquidityCrisis #OTC #Derivatives #GlobalFinancialCrisis

ISDA - Key Trends in the Size and Composition of the ORC Derivatives Market in the

Starting in January 2024, #JPMorgan CEO Jamie Dimon will sell 1,000,000 shares of his own JPMorgan stock for 'for financial diversification and tax-planning purposes”, according to Yahoo!

….“probably nothing”

#SystemicRisk #BankCrisis #MemeBanks #PonziScheme #Epstein

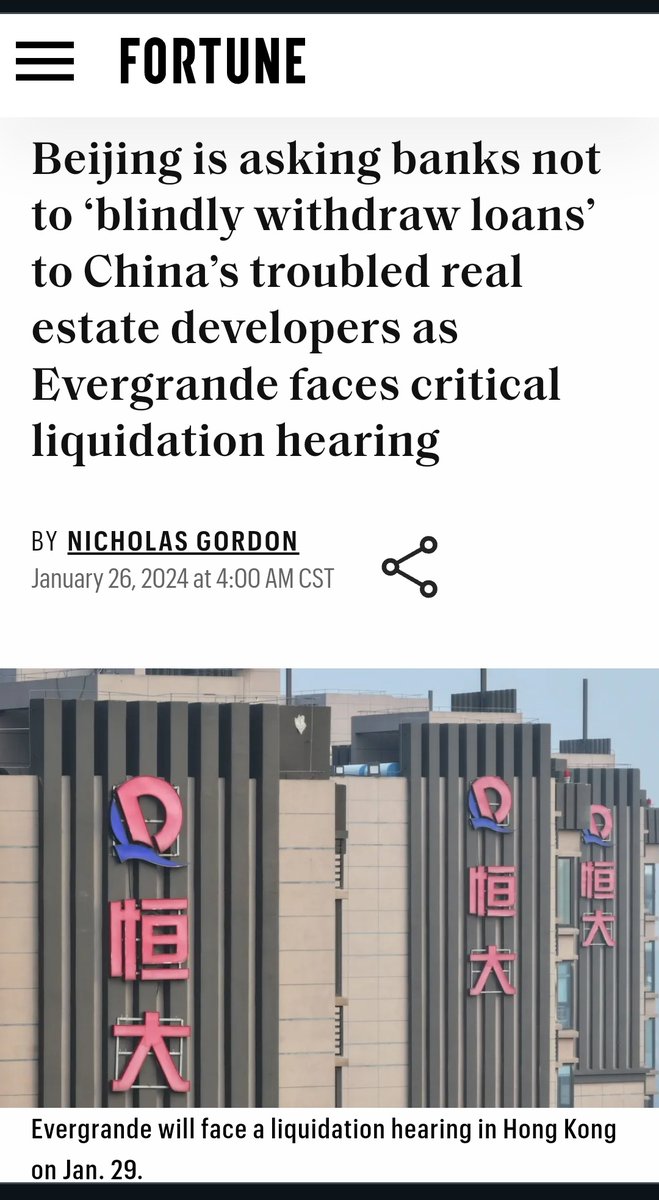

CHINA IS DESPERATELY PROPPING UP THEIR MARKETS AND BEGGING BANKS TO CONTINUE TO LEND TO OVERLEVERAGED REAL ESTATE DEVELOPERS.

EVERGRANDE FACES LIQUIDATION THIS MONDAY JAN 29TH IN BANKRUPTCY COURT.

#SYSTEMICRISK

Nice try, Wealthsimple,

I will not now, nor ever be engaging in #StockLending .

I will not provide ammunition to the very entities--SHFs--that have set out to short, distort, and destroy companies that I love and see value in.

#SystemicRisk #StockMarket #HedgeFunds #MemeStocks

Wrap up day one by graphic recorder Lorna Schütte! Amazing 🤩 #coronaandbeyond #coronacrisis #systemicrisk

Thank you so much for taking care of our guests! 🫶👍 After two days of ☀️ the last day starts with rain. #coronaandbeyond #systemicrisk

BoF Economics Review 3/2024 by Heidi Koponen: Constructing a composite indicator to assess cyclical systemic risks: An early warning approach.

#FinancialCycles #SystemicRisk #BankingCrises #EarlyWarningSystems

publications.bof.fi/handle/10024/5…

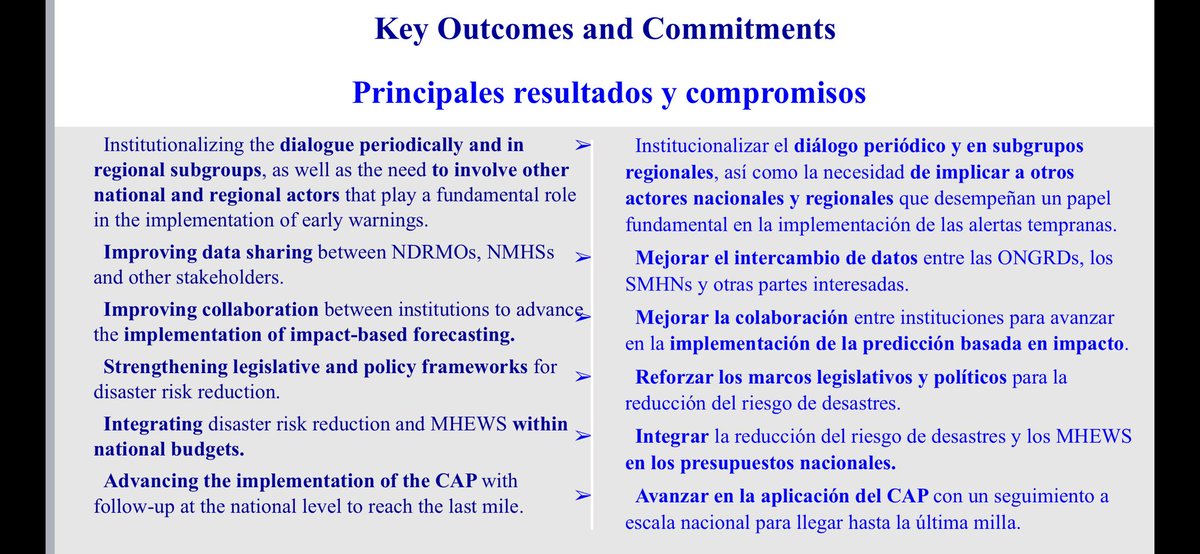

Among others, NMHSs & NDRMOs, understand & agree on the need to involve other actors that play an important role in the implementation of #MHEWS : geological observatories, epidemiological centers, academia, private sector & civil society org. #BreakingSilos #SystemicRisk #EW4ALL

#Macropru tends to be aimed at the banking sector-but; the future of #Macropru is likely to extend to non-banking sectors, such as #systemicrisk arising in MMFs or liquidity and leverage risks in the investment fund sector ✂️🪴

#throwbackart #PhDcartoon MacroPru😷 Macroprudential Policy

'Reserve requirements can be used as a #macroprudential tool to manage credit and systemic risks. They can reduce the build-up of #SystemicRisk and the frequency of financial distress episodes.' Bank for International Settlements bis.org/publ/work1182.…

Our conference with Cascades at Potsdam Institute for Climate Impact Research PIK brought together a diverse and interdisciplinary community of researchers on cross-border #ClimateChangeImpacts and #SystemicRisk . 🌎🌡🔍

Curious about their insights?

Watch this video! 🎥⤵

Learn more 🔗 bit.ly/3Mv7fhC

Probably more of what #CreditSuisse wants locked away for 50 years are its ties to #Citadel .

Credit Suisse serves as prime broker Citadel Equity Fund, which was organized in the #CaymanIslands .

...probably nothing!

#SystemicRisk #CrimeSpree #HideAndSeek #Derivatives #Broker

![McSqueezyTheCow (@McSqueezyTheCow) on Twitter photo 2023-04-25 21:01:06 Did you know that

During the March 2020 'dash for cash'

• Total IM req't for CCPs increased by $300B

• Collateral prepositioned at CCPs increased $415B

• Jan-Feb prior, Daily CCP VM [margin] calls increased from $25B to $140B

#SystemicRisk #FunFacts

tinyurl.com/3d8syj3m Did you know that

During the March 2020 'dash for cash'

• Total IM req't for CCPs increased by $300B

• Collateral prepositioned at CCPs increased $415B

• Jan-Feb prior, Daily CCP VM [margin] calls increased from $25B to $140B

#SystemicRisk #FunFacts

tinyurl.com/3d8syj3m](https://pbs.twimg.com/media/FulqtMPaYAA1eW4.png)