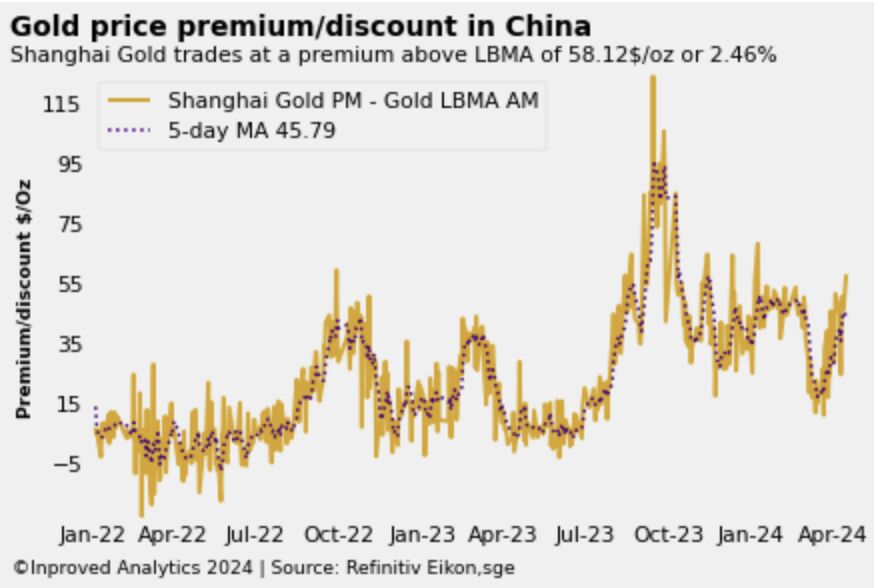

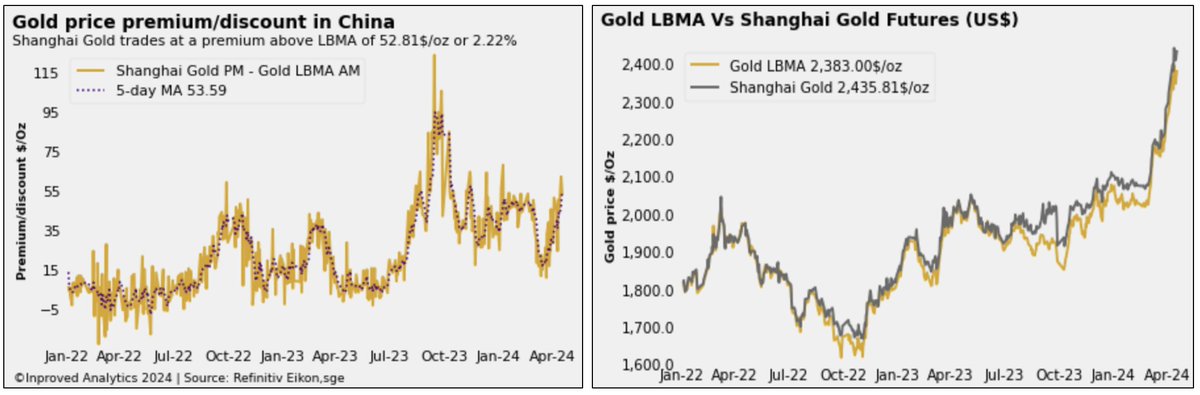

#Shanghai premiums remain elevated this morning, based on preliminary data ( SHAU AM fixing) at $52.8 per ounce or 2.2% above #LBMA , while the 5-day moving average is grinding higher at $ 53.6

#commodities #preciousmetals #china

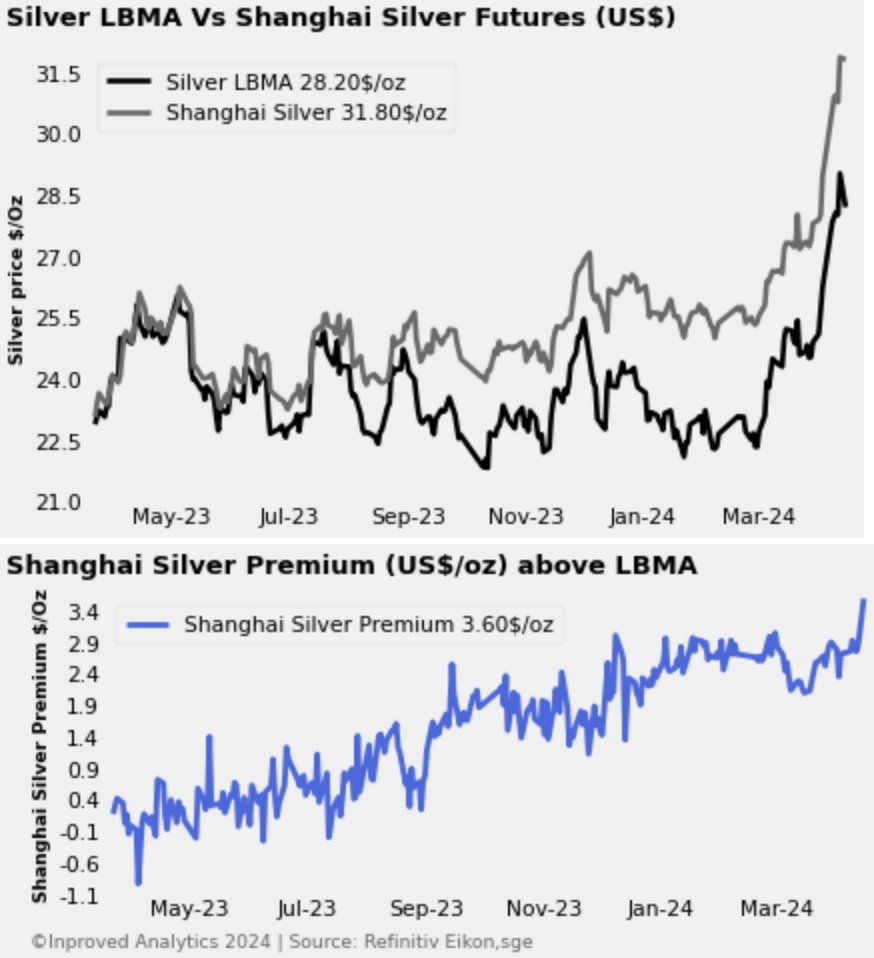

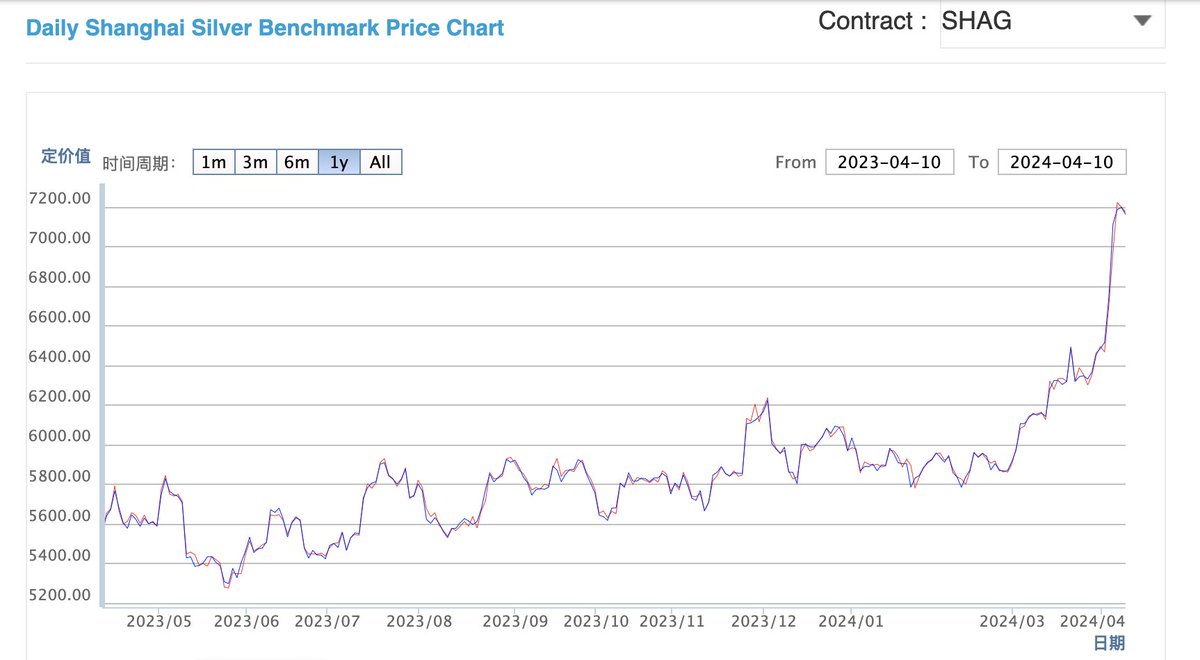

#silver premiums remain elevated in China based on preliminary data at $3.5 per ounce or 12.25% above

#LBMA at $31.94 per ounce on the Shanghai Gold Exchange

#commodities #preciousmetals #china

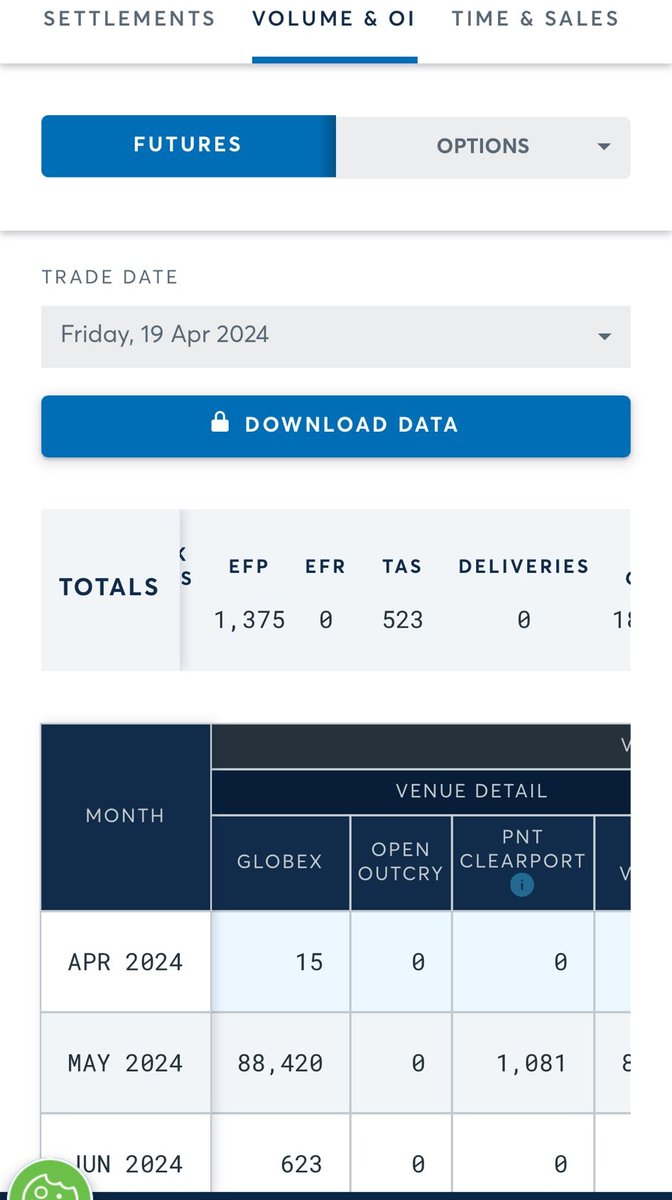

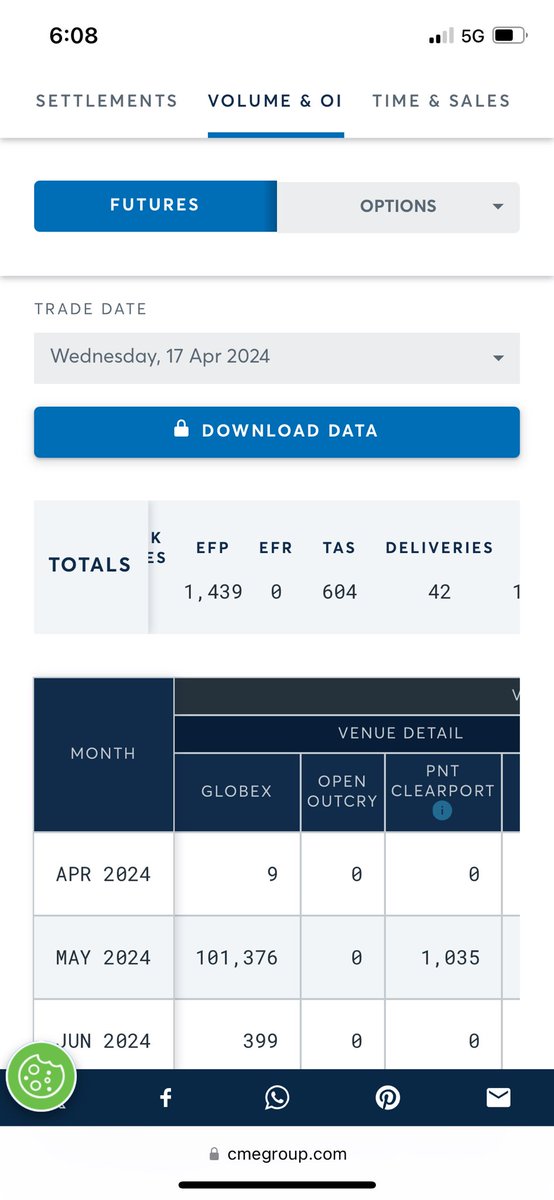

Friday's #COMEX sales in #silver lead to higher premiums in China this morning based on preliminary data ( SHAG AM fixing) at $3.6 per ounce or 12.7% above #LBMA at $31.8 per ounce on the SGE

#commodities #preciousmetals #china