#IREDA

If the gap doesn't fill and bounce back it would be a great setup to trade.

Formed a good base post 100% rally.

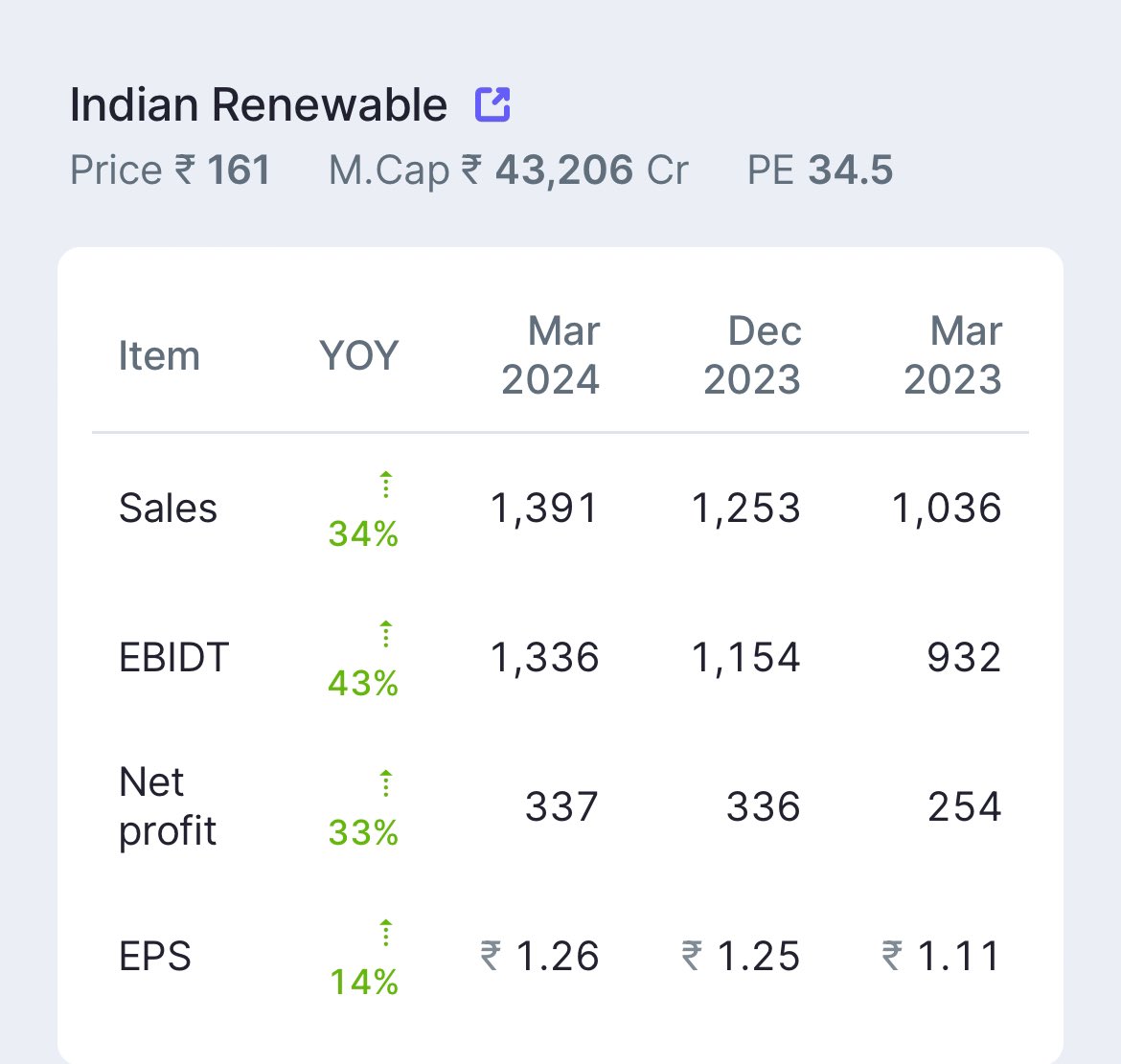

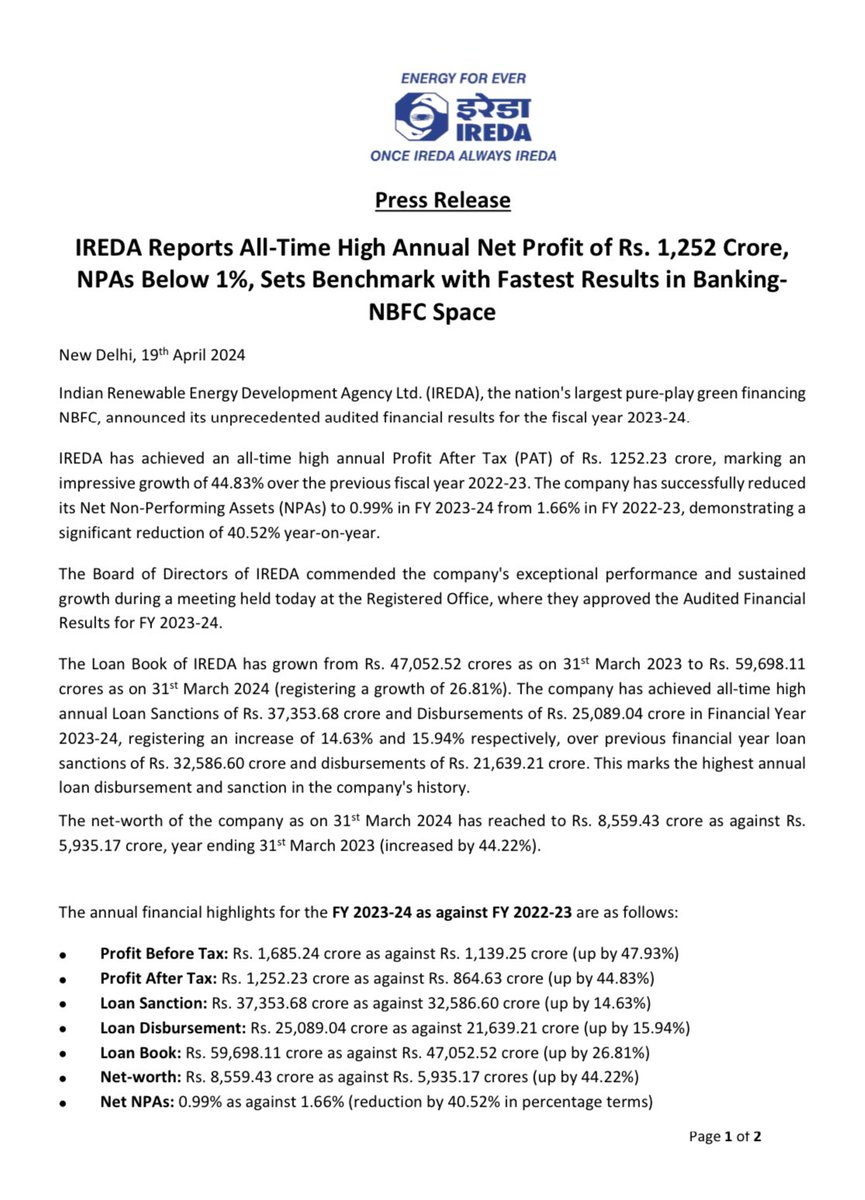

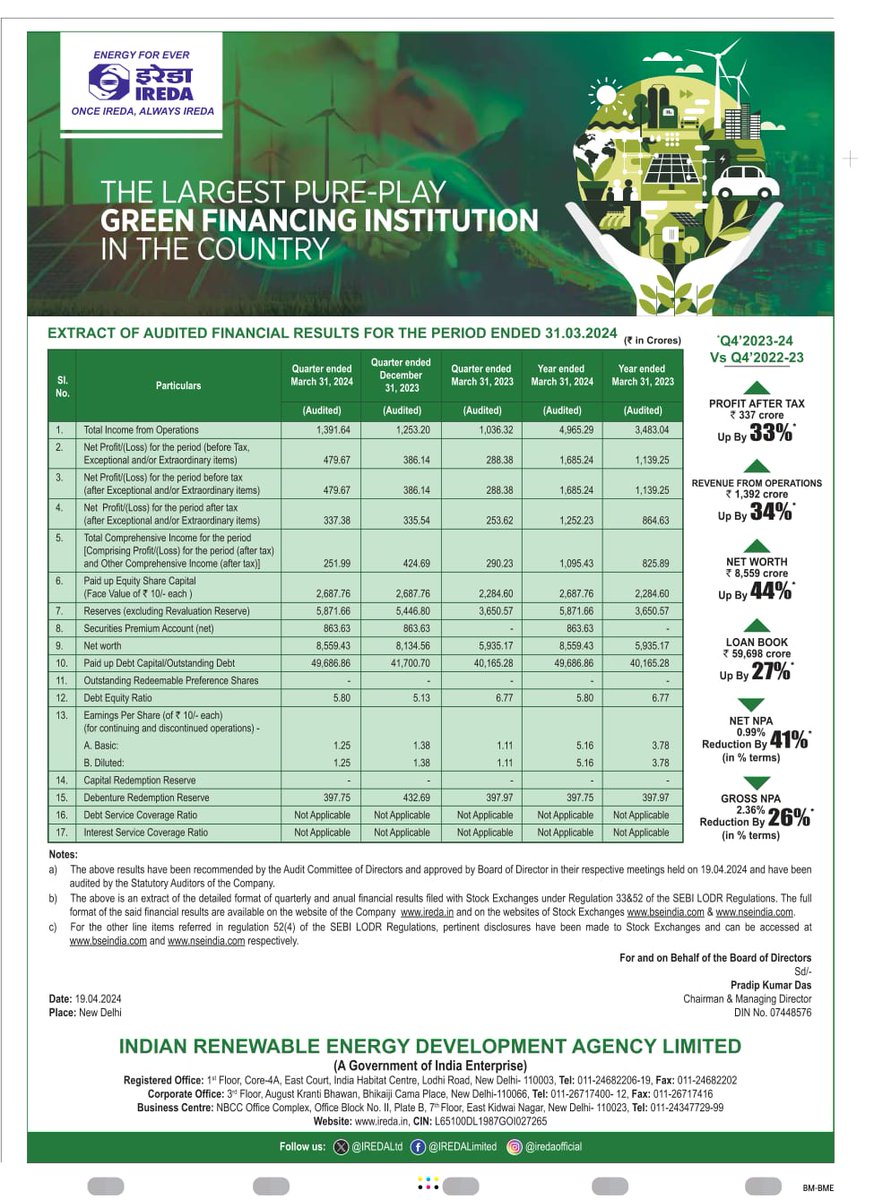

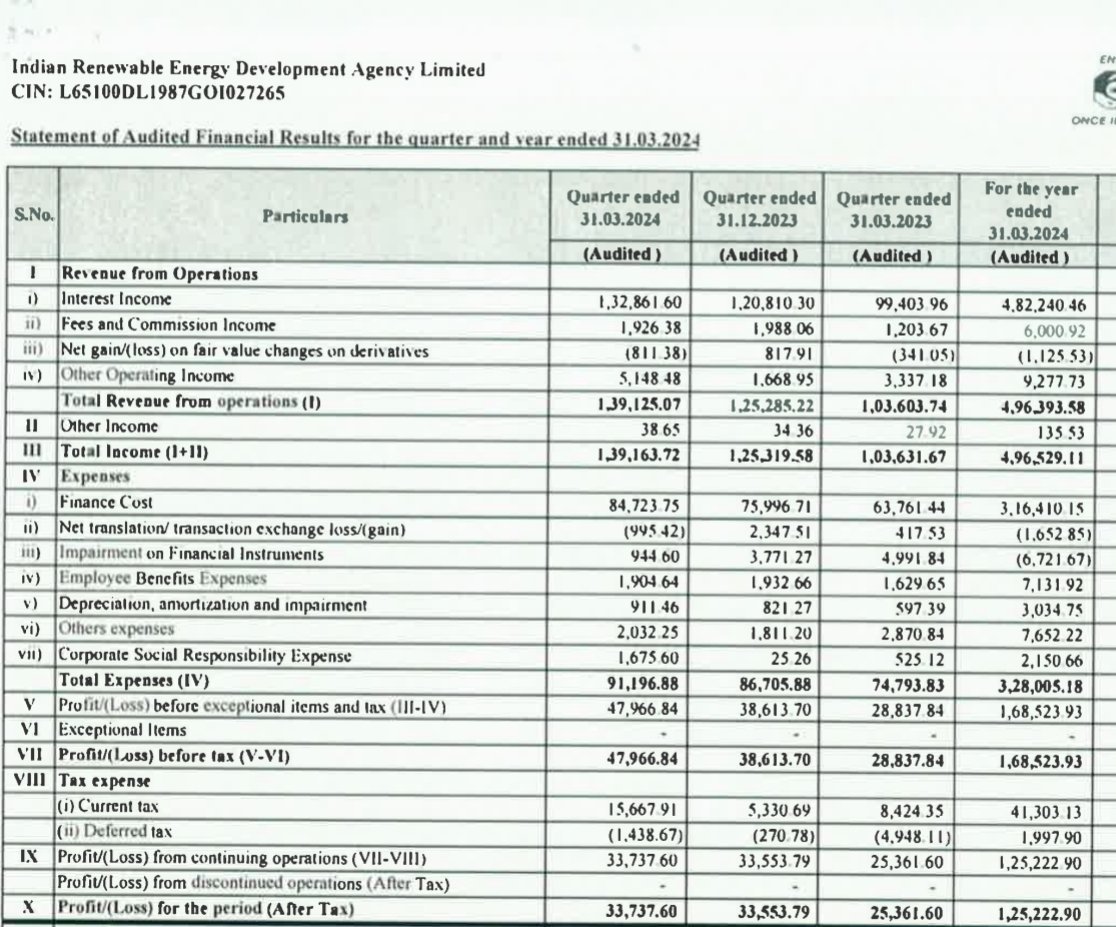

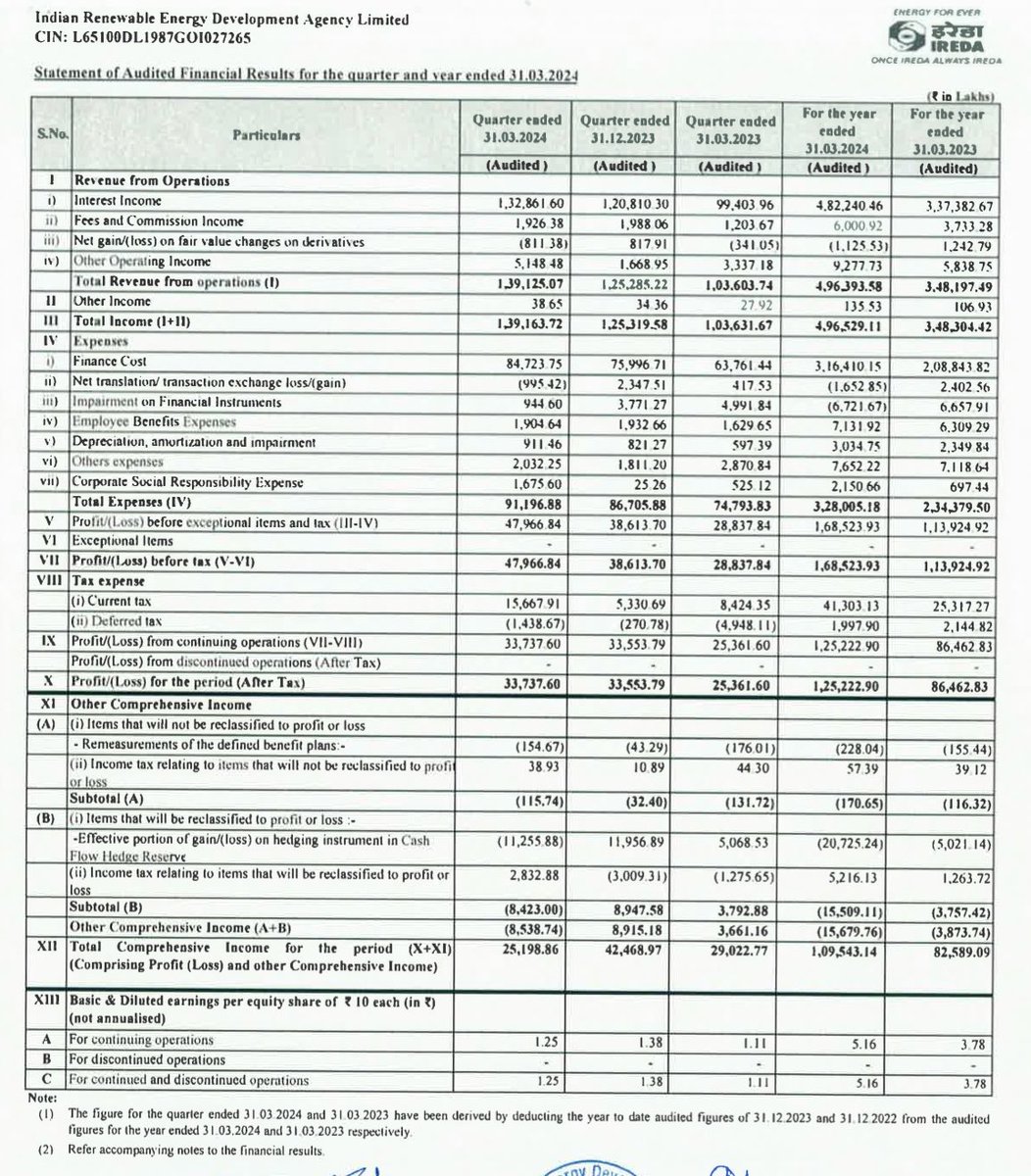

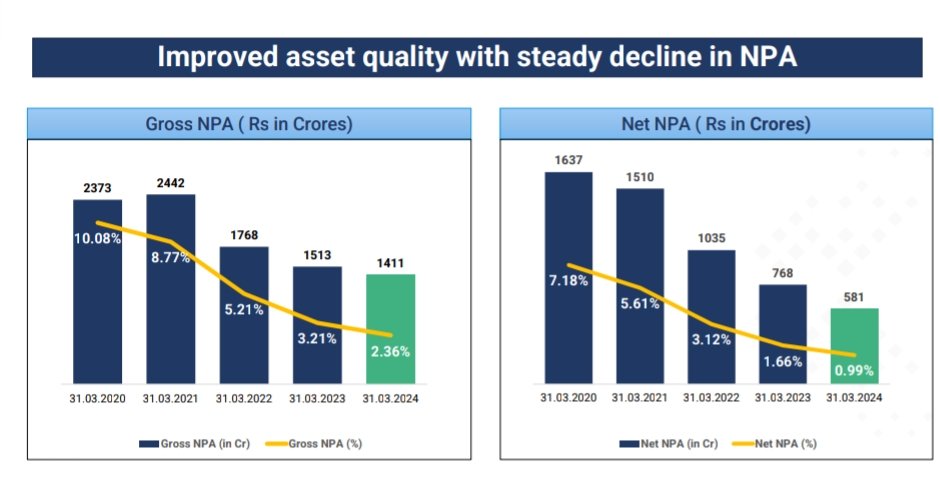

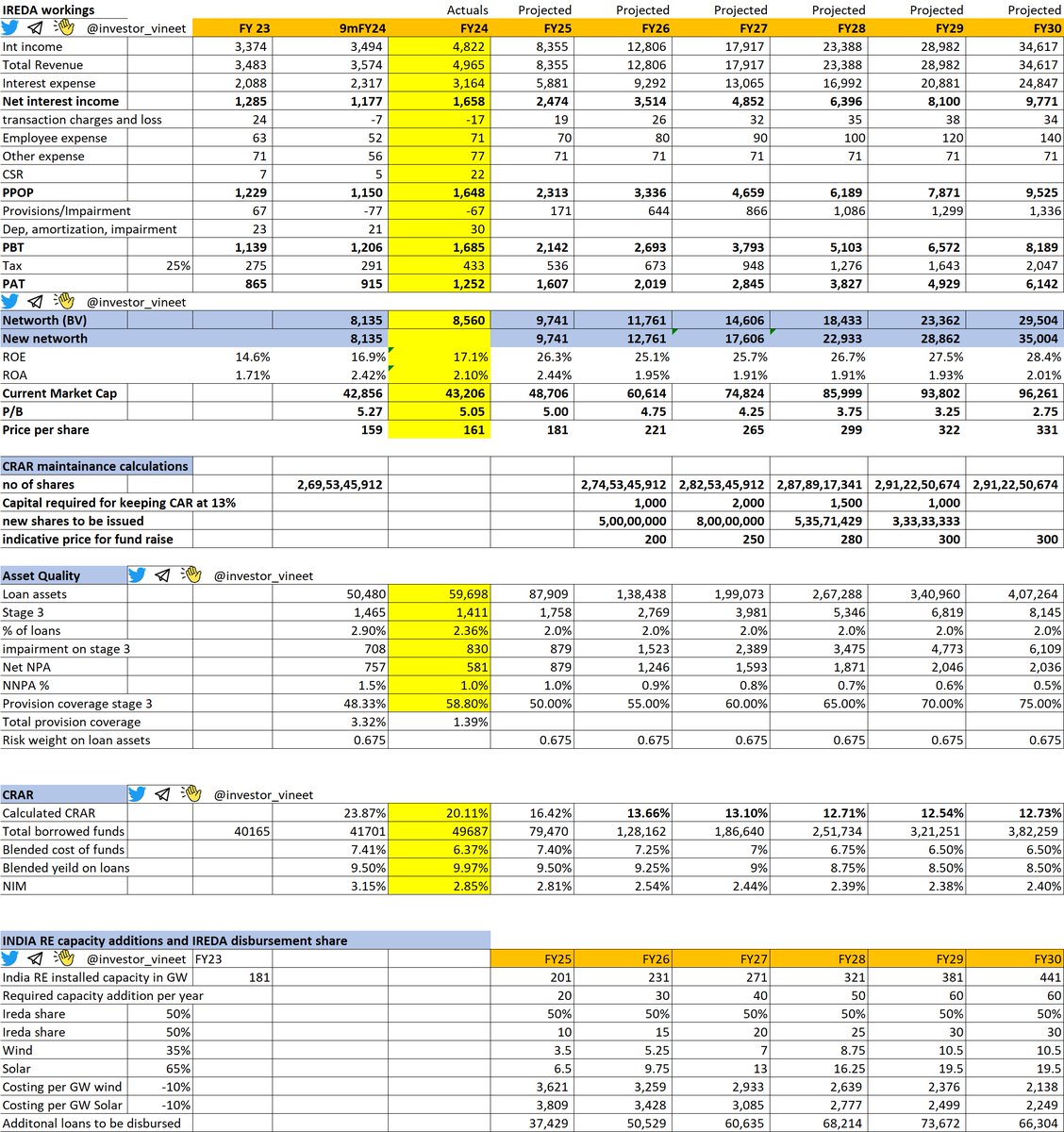

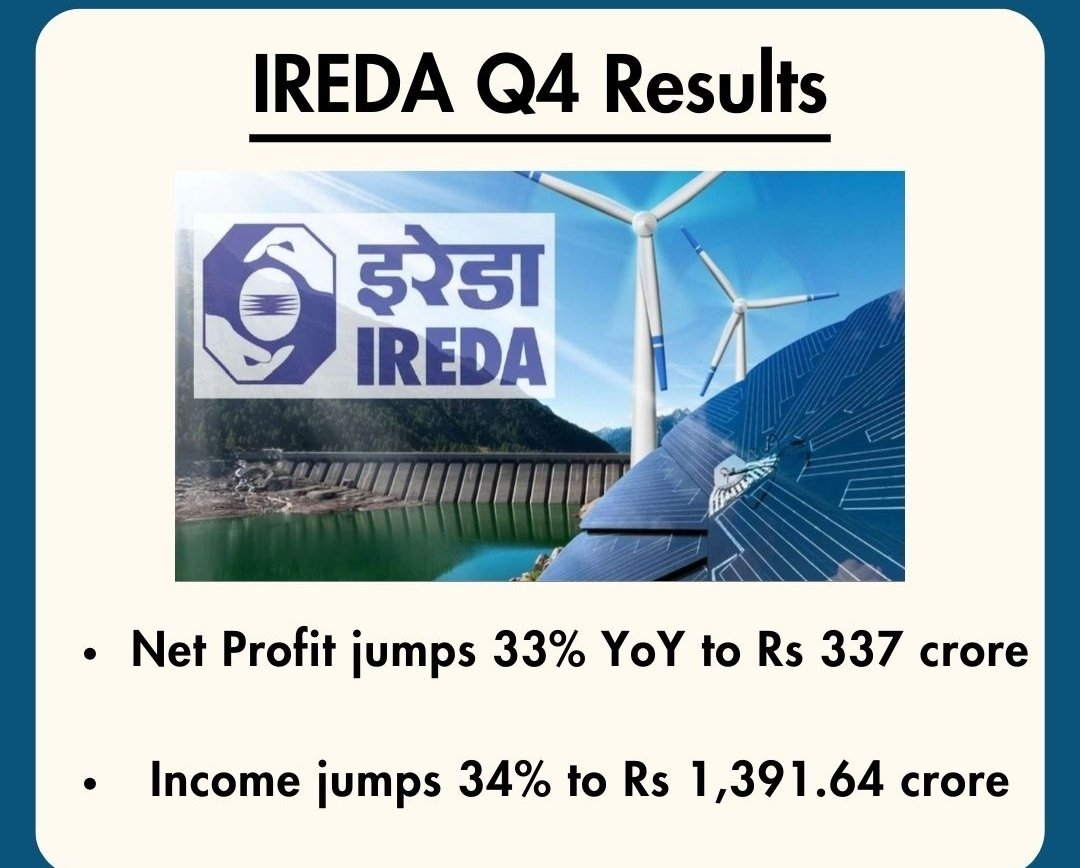

Good quarterly results also.

And circuit limit revised to 20% from 5% also.

Time for it to show a move?

#StocksInFocus #tradingsetup

#IREDA

-Inverted Head & Shoulders pattern

-Earnings gap up

-Circuit limit revised to 20% from 5% (FINALLY)

#StockMarket #StocksToBuy #stocks #StockMarket india