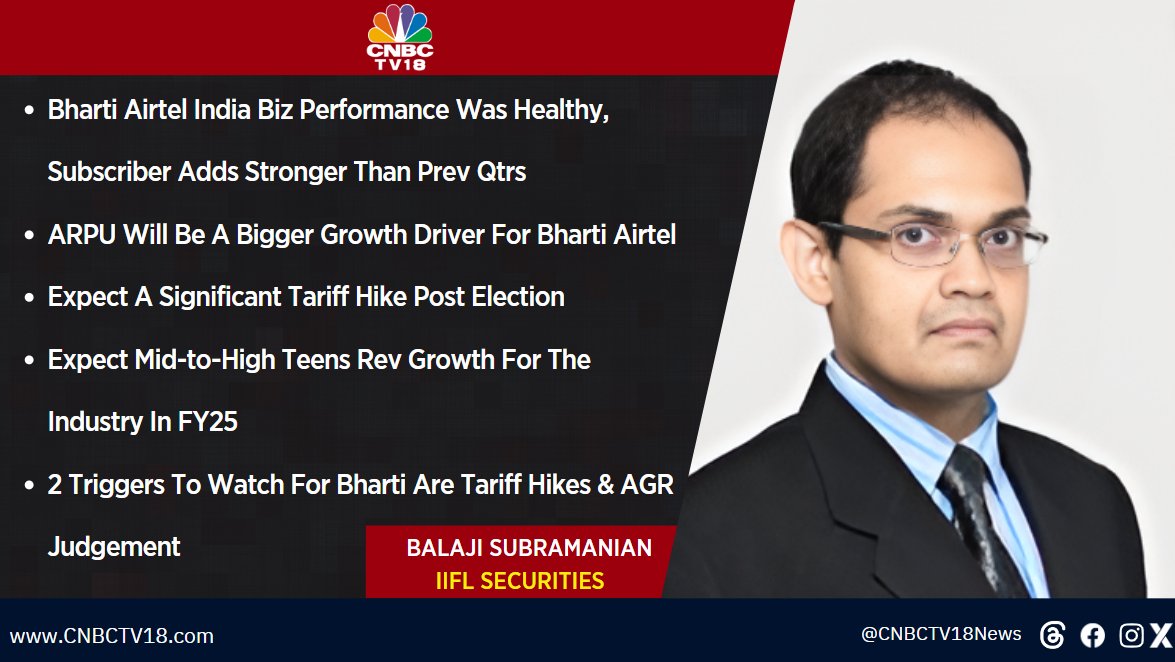

#OnCNBCTV18 | ARPU will be a bigger growth driver for Bharti Airtel. Expect a significant tariff hike post election. 2 triggers to watch for Bharti Airtel are tariff hikes & AGR judgement, says Balaji Subramanian of IIFL Securities

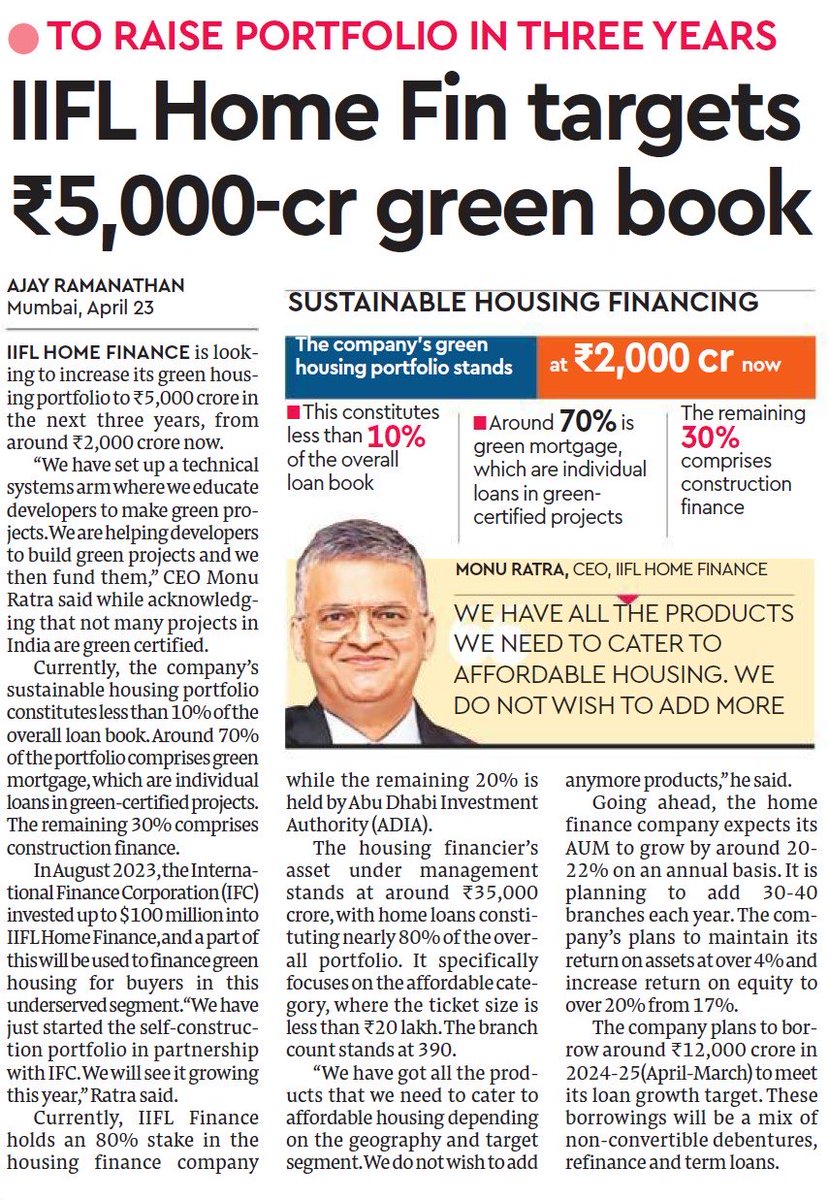

🌿 IIFL Home Finance aims to expand its green housing portfolio to ₹5,000 crore over the next three years, up from ₹22,000 crore. Focused on sustainable housing, we’re set to grow by 20-22% annually and add 30-40 new branches each year. #GreenHousing 🏡💚

IIFL Securities appoints capital markets veteran Mr Nemkumar as Managing Director of IIFL Securities

Mr R Venkataraman, co-promoter of IIFL Group will continue as the Chairman of the board at IIFL Securities. #IIFLSecurities

livemint.com/brand-stories/…

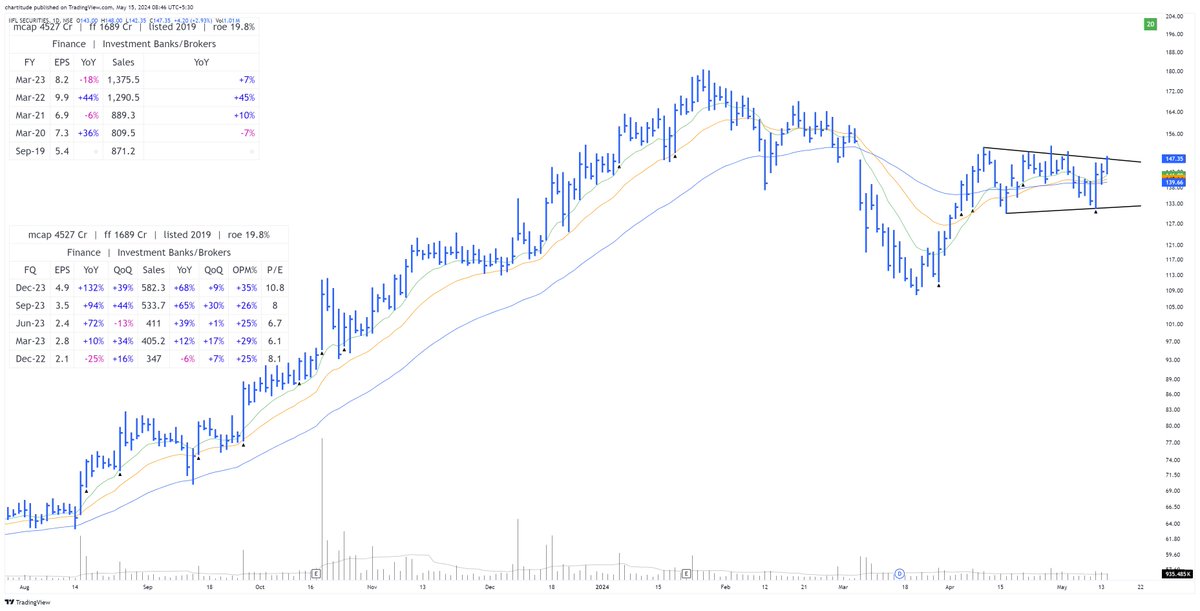

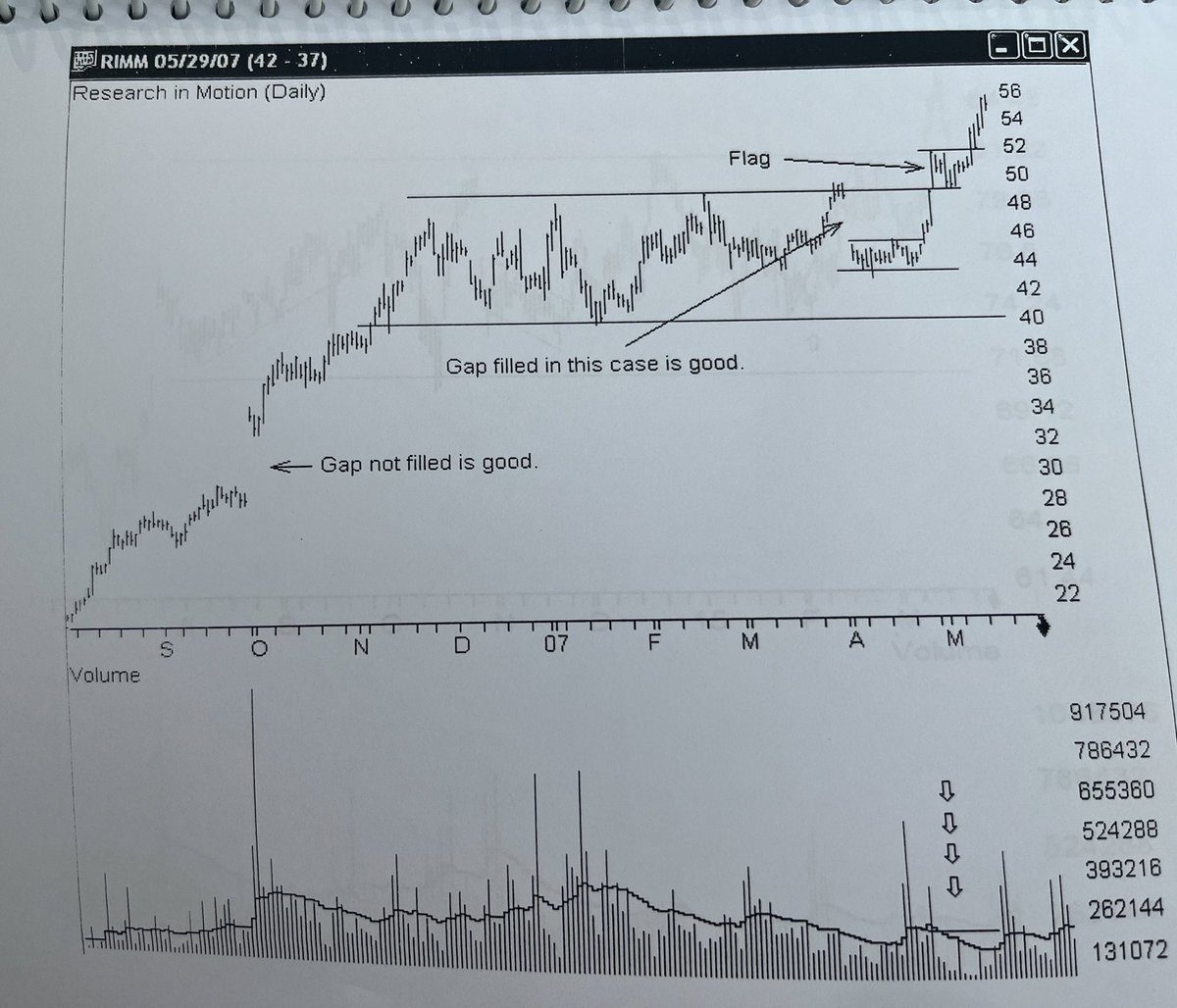

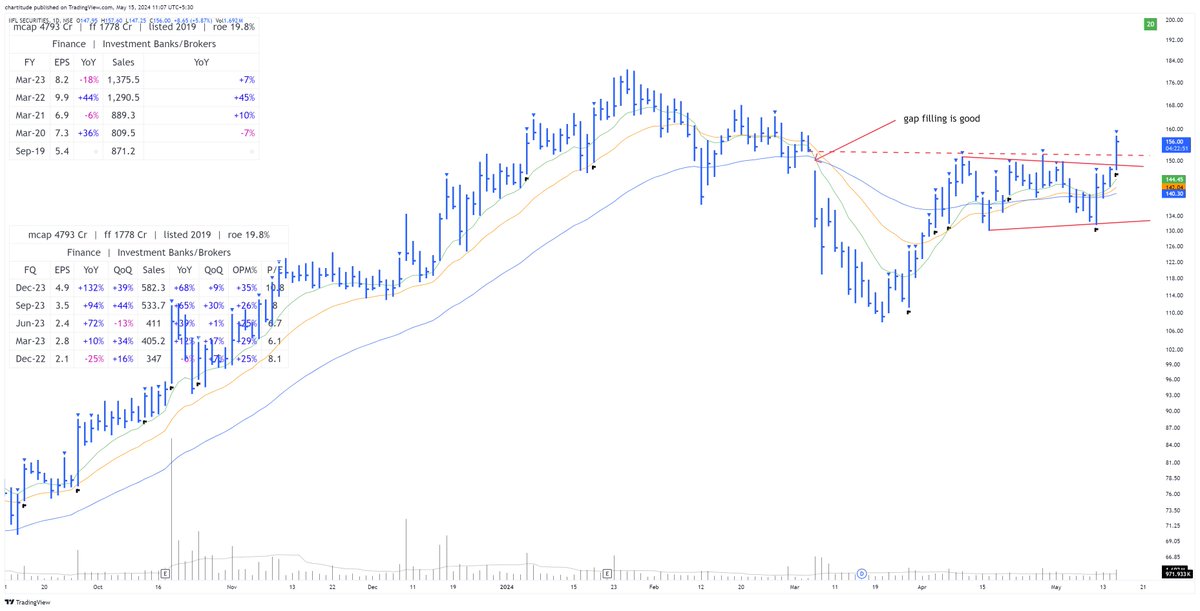

One of my best buying strategy. #Insidecandle formation at bottom. two stocks already shared .

Today's stock is #IIFL finance. I am taking position in stallement.

#StocksToBuy #AdaniEnterprises #polycab #IIFL

Achieve your long and short-term goals by investing a minimum amount of Rs.500 with SIPs every month! #IIFLSecurities #SIP #stockmarket #trading #invest