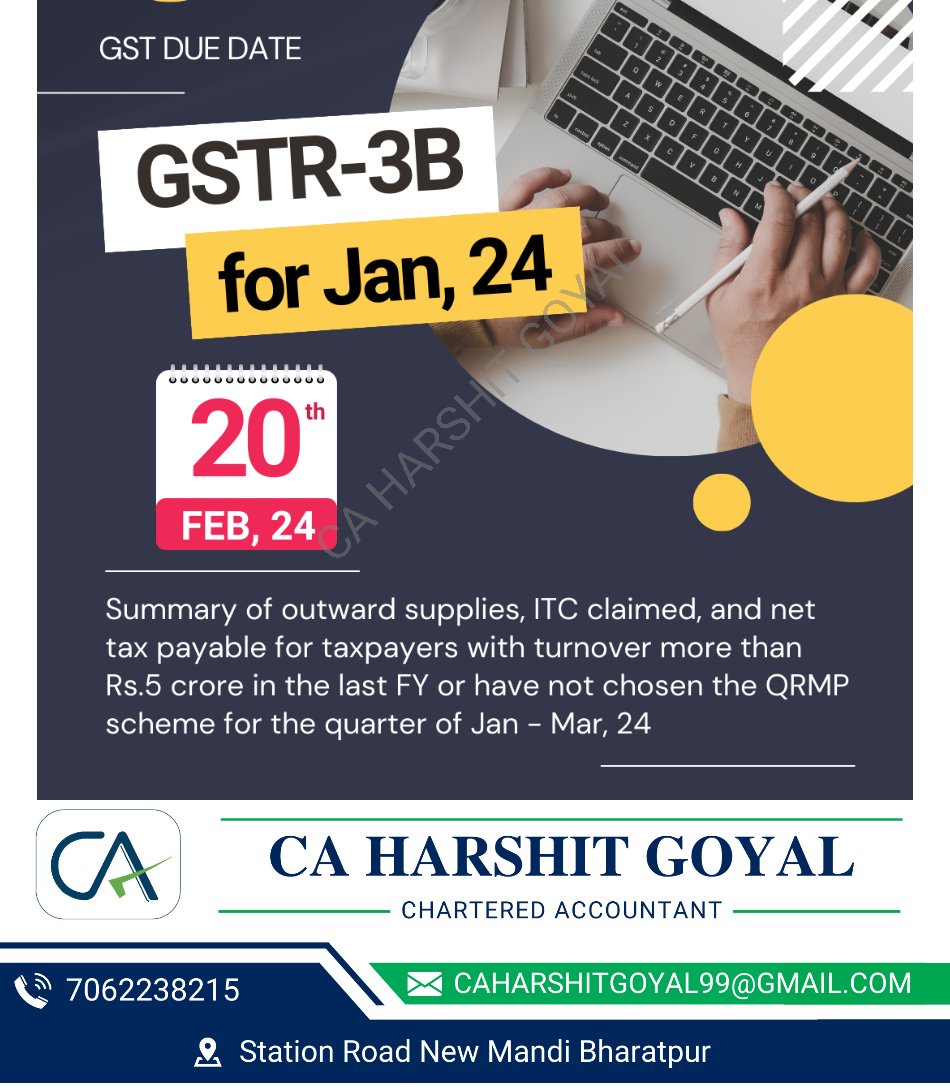

Don't miss this due date and file it on time to save late fees.

.

.

.

.

#GSTR3B

#GSTFiling

#TaxCompliance

#GSTReturns

#IndianTaxation

#GSTUpdate

#TaxationIndia

#BusinessCompliance

#TaxationMatters

#GSTPortal

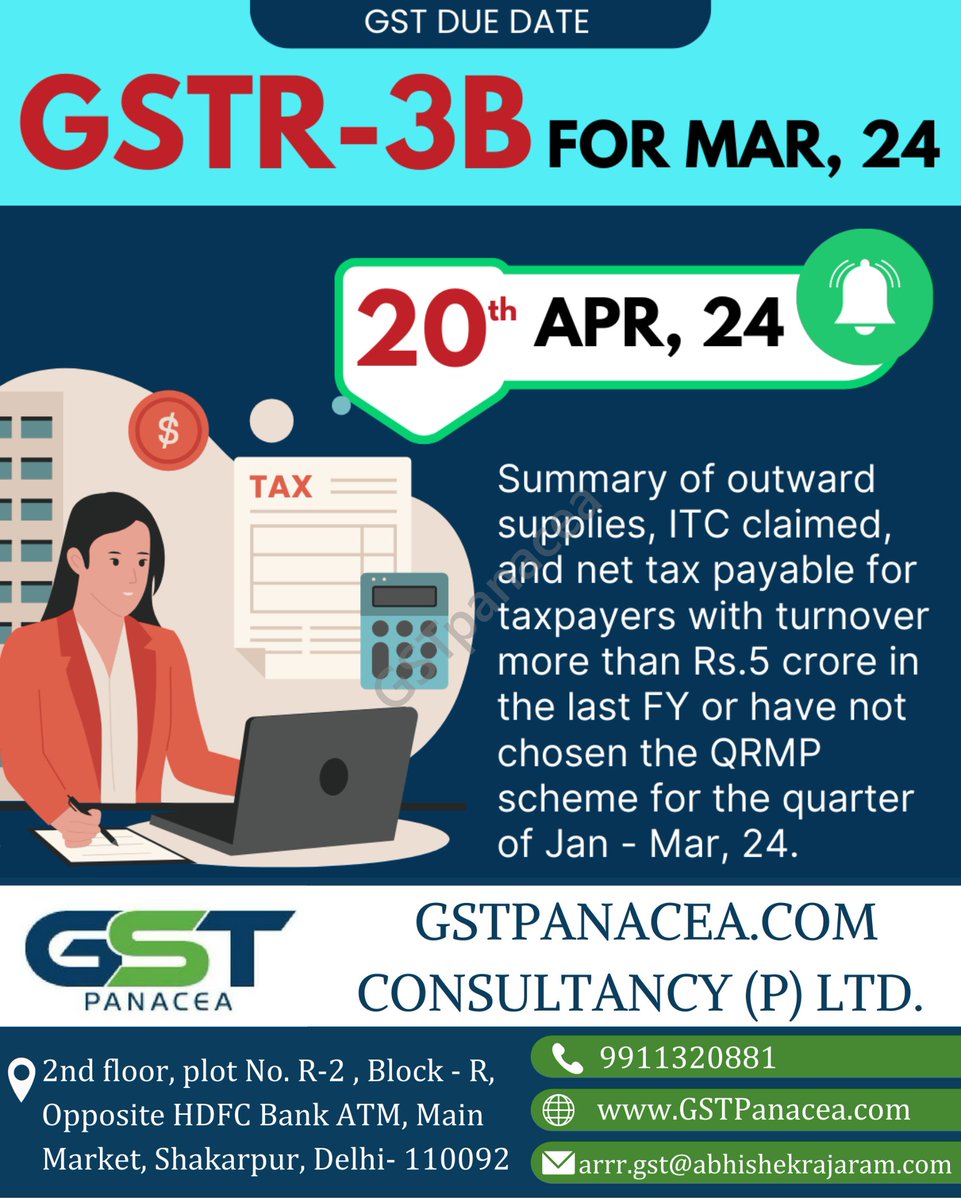

Don't miss this due date

File your GSTR-3B now to avoid last moment rush

#GSTR3B

#GSTFiling

#TaxCompliance

#BusinessTax

#GSTReturns

#GSTUpdate

#Taxation

#FinancialReporting

#BusinessFinance

#TaxMatters

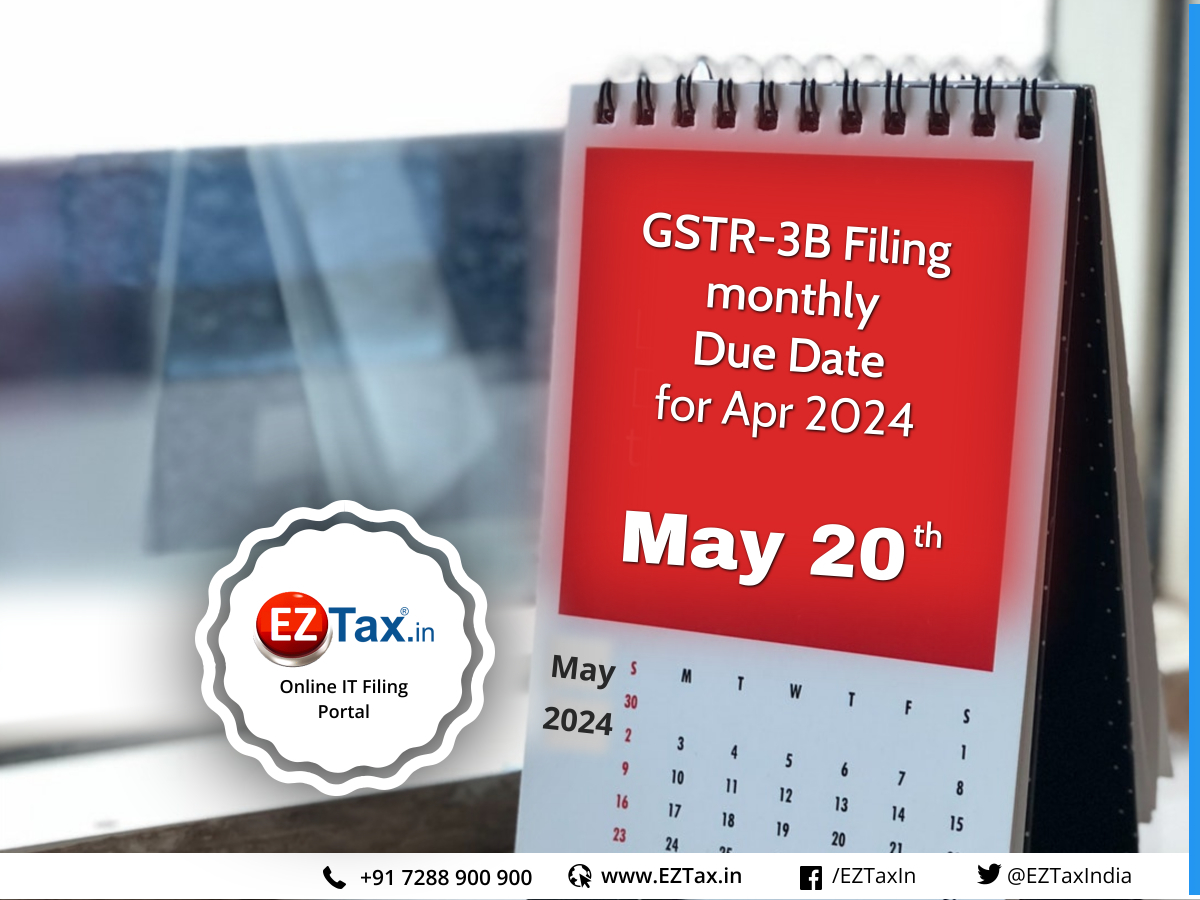

Taxpayers not under QRMP scheme, 20th May,2024 is the last date to file GSTR-3B for April 2024. File now to avoid Late Fees.

#GSTR3B #GSTIndia #TaxFiling #GSTReturn #GSTCompliance #IndianEconomy #FinancialCompliance #TaxUpdates #BusinessTax #CorporateFinance

Due Date Reminder

GST Due Date

GSTR- 3B

For MAR,24

#GSTReminder #GSTR3B #TaxFiling #BusinessCompliance

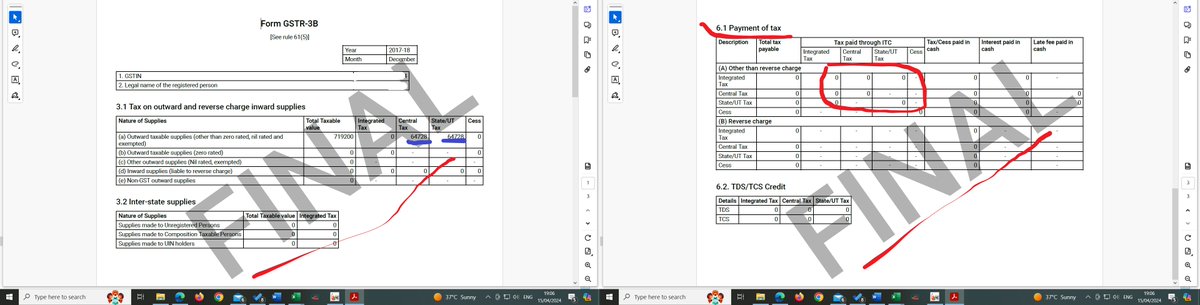

Good news for businesses! Filing GSTR-3B just got easier with enhancements and the introduction of Electronic Credit and Re-claimed statement. #GSTR3B #TaxFiling #BusinessUpdate

Due Date Reminder

GST Due Date

GSTR- 3B

For MAR,24

#GSTReminder #GSTR3B #TaxFiling #BusinessCompliance

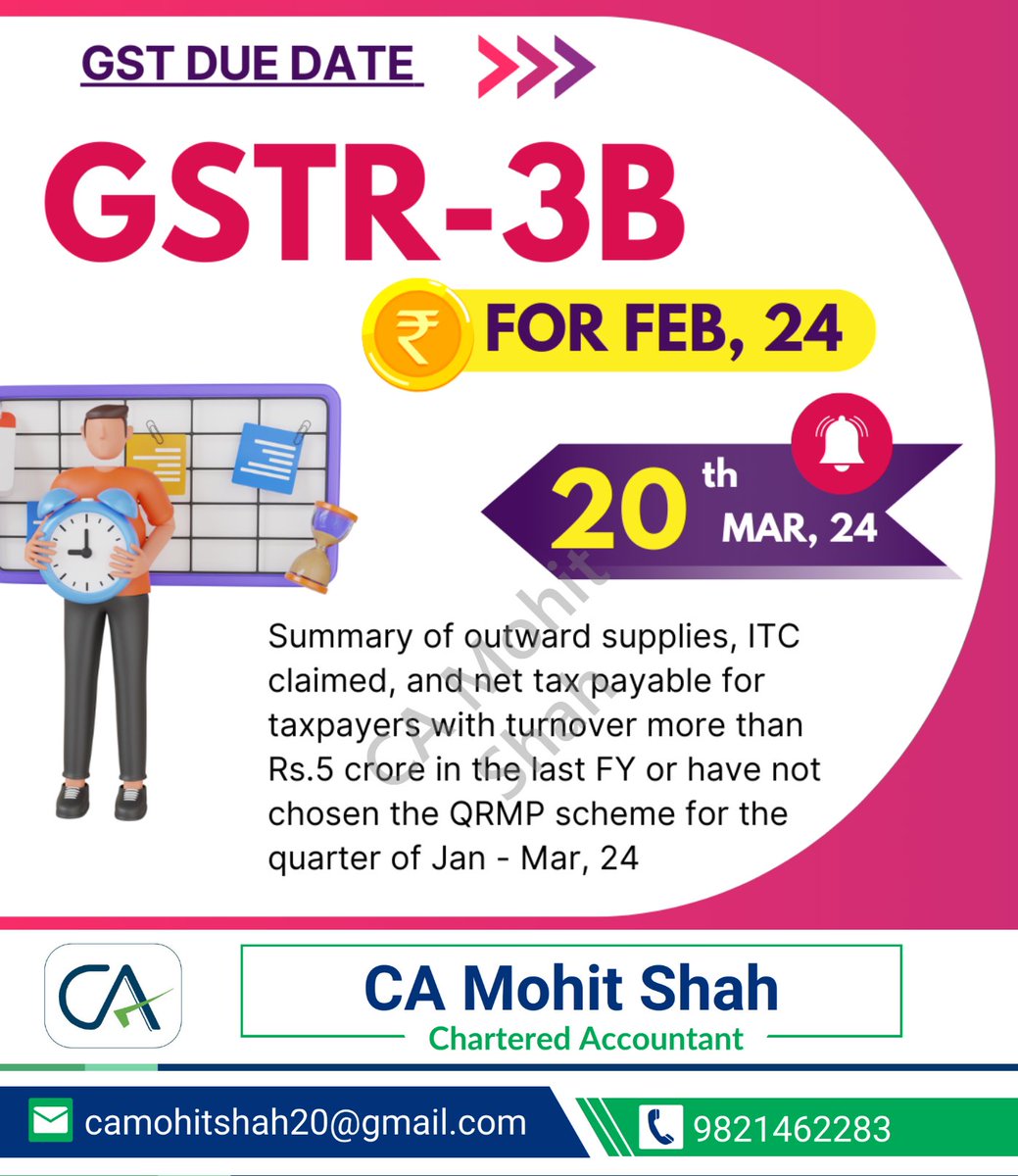

Reminder: Submit your GSTR-3B for Feb, 2024 by 20th March 2024 if your turnover exceeds Rs.5 crore or if you have not chosen the QRMP scheme for the current quarter.

#GSTR3B #GSTFiling #GSTReturns #TaxCompliance #GSTIndia #DigitalTaxation #BusinessInIndia #IndirectTax #TaxReform