pasturerealtygroup.myagent.site/8-strategies-t…

#RealEstate #realestatemarket #lowermortgagerates

#dfwrealestate #inflation #homebuyers #hotrealestatemarket #homesellers #creditscore #strategiestolowermortgagerates #debttoincomeratio #realestatetips

Boosting Your Person themortgageblog.info/how-to-get-pre… #debtpayments #debttoincomeratio

Learn Effective Pers themortgageblog.info/how-to-get-pre… #debtpayments #debttoincomeratio

We're often asked what #DebtToIncomeRatio is about.

Your ratio of debt to income is a formula that lenders use to determine how much of your income can be used for your monthly mortgage payment after all your other monthly debt obligations have been met. bit.ly/ReenTeamDtoIra…

It’s About to Become Easier to Qualify for a… dlvr.it/PNpK53 #RealEstateNews #debt #debt toincomeratio #fanniemae #mortgage

Got queries like:

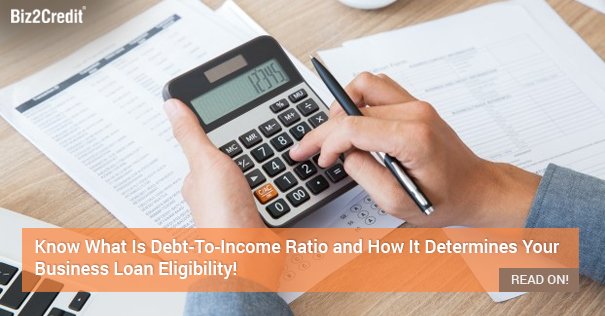

What Is #DebtToIncomeRatio and How It Determines Your #BusinessLoan Eligibility?

Read on: goo.gl/jlRC8j

Does marriage make both spouses responsible for one's student loans? #studentloans #debttoincomeratio #dti #loans #mortgage #affordability #liability

Link: ow.ly/Q09p30jIexl

Get Out Of Debt With themortgageblog.info/how-to-get-pre… #debtpayments #debttoincomeratio

Calculating Debt-to-Income confusing? Yup, we agree! bit.ly/282NKla #Mortgage #Debttoincomeratio #loanapproval #firsttimehomebuyer

On average, an American will spend $906 on holiday gifts this year. That's up 20% from last year. Keep working! #SaturdayMotivation #DebtToIncomeRatio #ConsumerConfidence #MoreOvertimePlease @MakeAmericaGreat

I’ve never had a car or home in my name. My #DebtToIncomeRatio is too “risky” per lenders #CancelStudentDebt

#DebttoIncomeRatio is one of the things that lenders look for when you’re applying for a #homemortgage Are you ready to see where you stand? Contact us & let’s get to work.🔑🏠 #buyahome #homesearch #homebuyer #loanapproval

#realestate #debttoincome #getpreapproved #housingmarket

#frugalfinancetip : While you're being approved for your home loan, keeping your credit and #debttoincomeratio the same is imperative. This means putting off any large purchases (new car, maxing out a credit card) to prevent your financing from falling through.

New American Funding