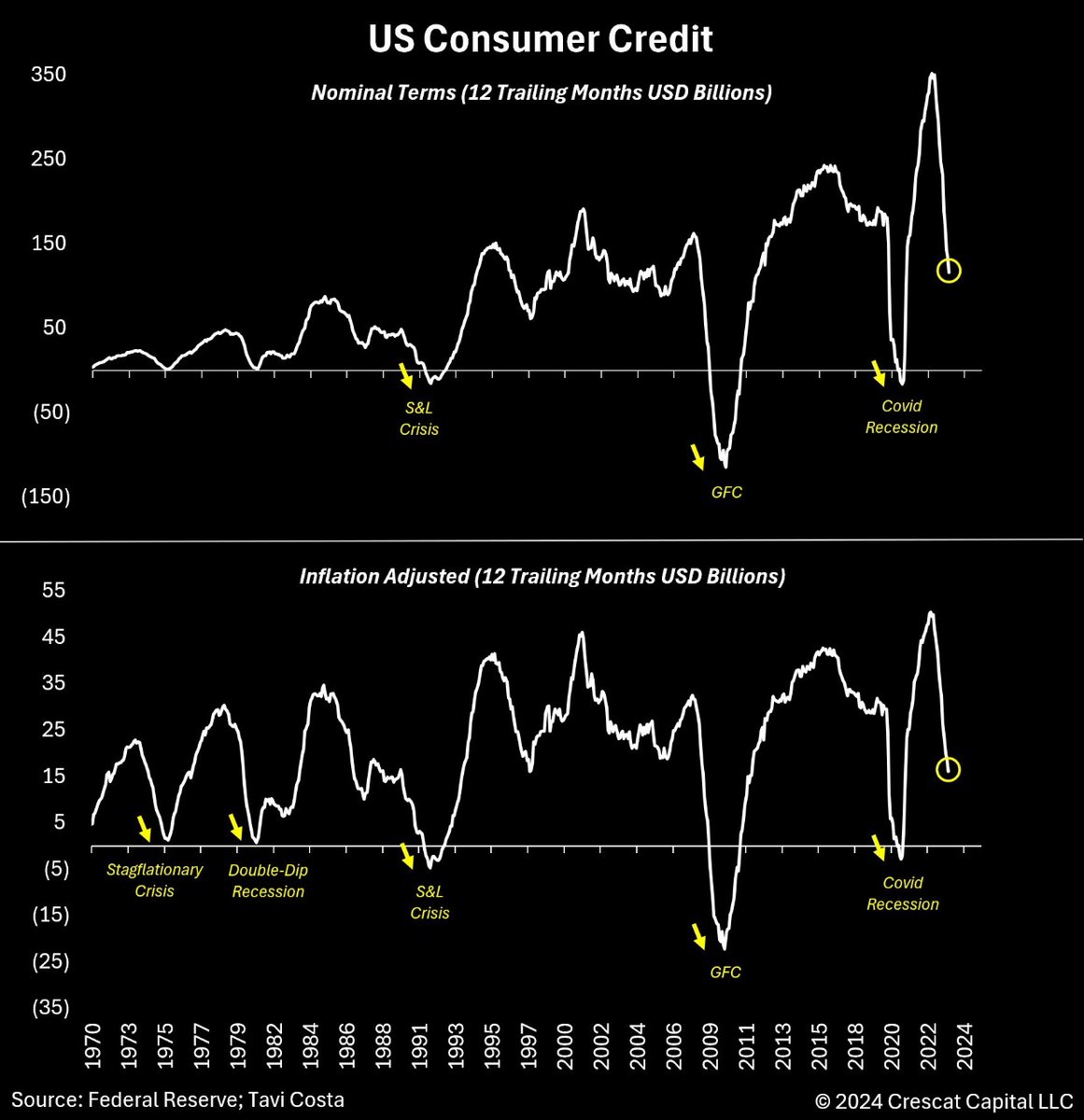

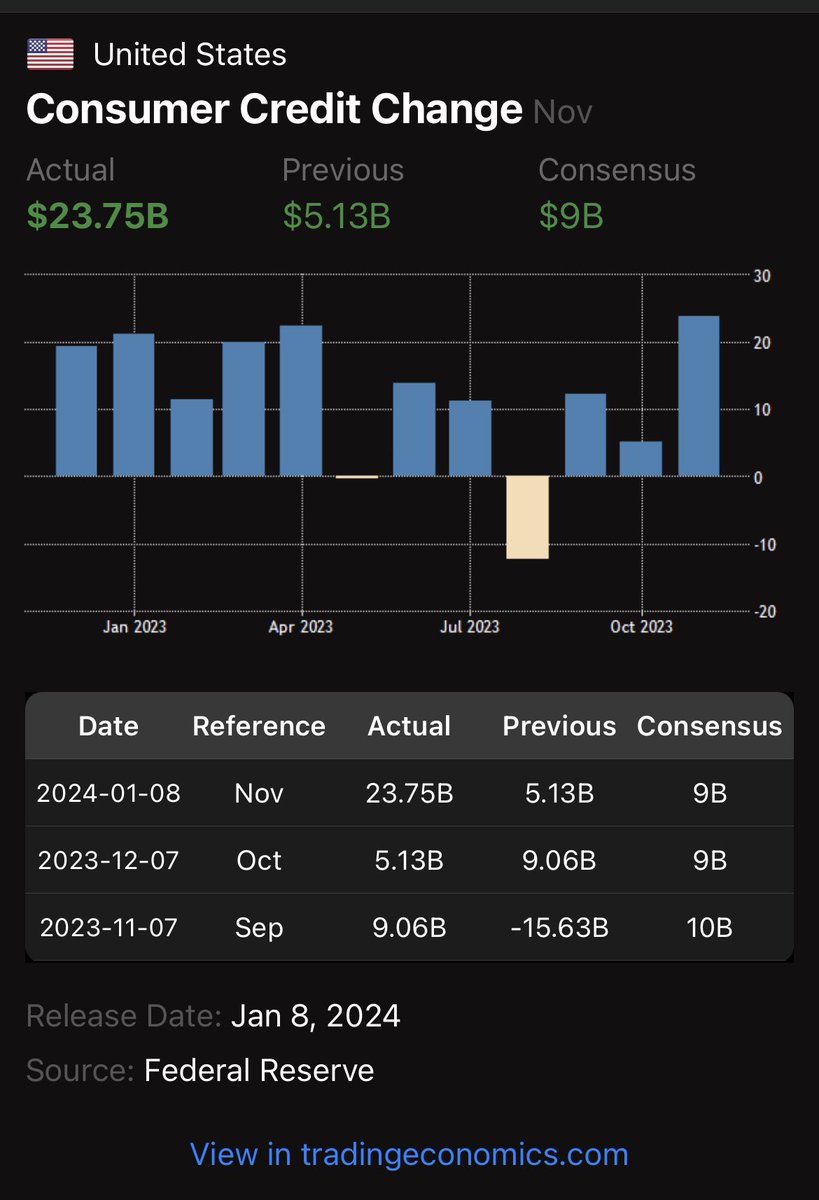

This has got to be a fuckin typo right!?

#ConsumerCredit

Increased to 23Billion vs. expected $9B!

What the actual f*ck!?

$SPY $DIA $IWM

#RBI raises risk weight on consumer credit & banks’ exposure to #NBFC s :

Higher Impact on #BajajFinance and #ltfh : ~200bps

Ltd impact on Capital Adequacy for most banks with RWA likely to rise by 5-7%

#RBI News #ConsumerCredit #MarketImpact #finance #Banking #NBFC #creditcard

#Consumercredit 🇺🇸 Stock de crédito al consumo en circulación se expandió U$7,200 millones en mayo, muy por debajo de las expectativas de U$20,500 millones.

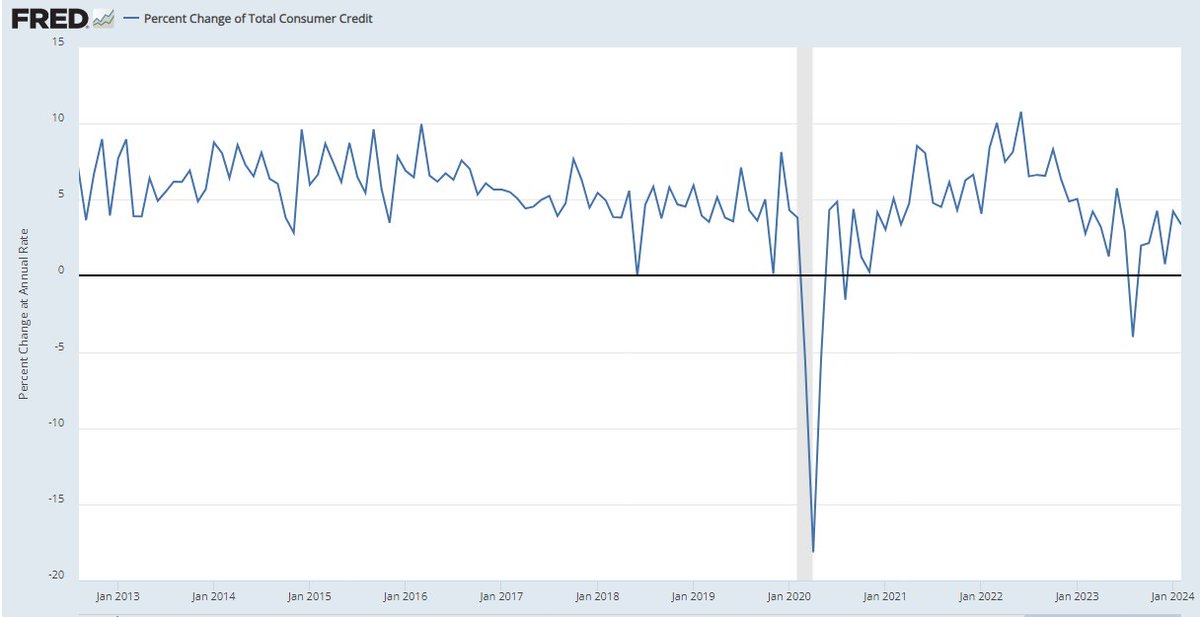

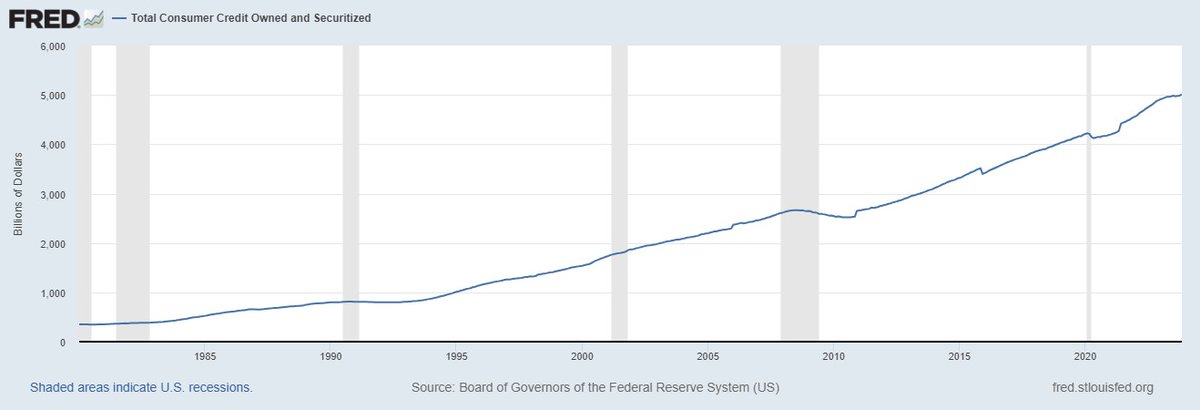

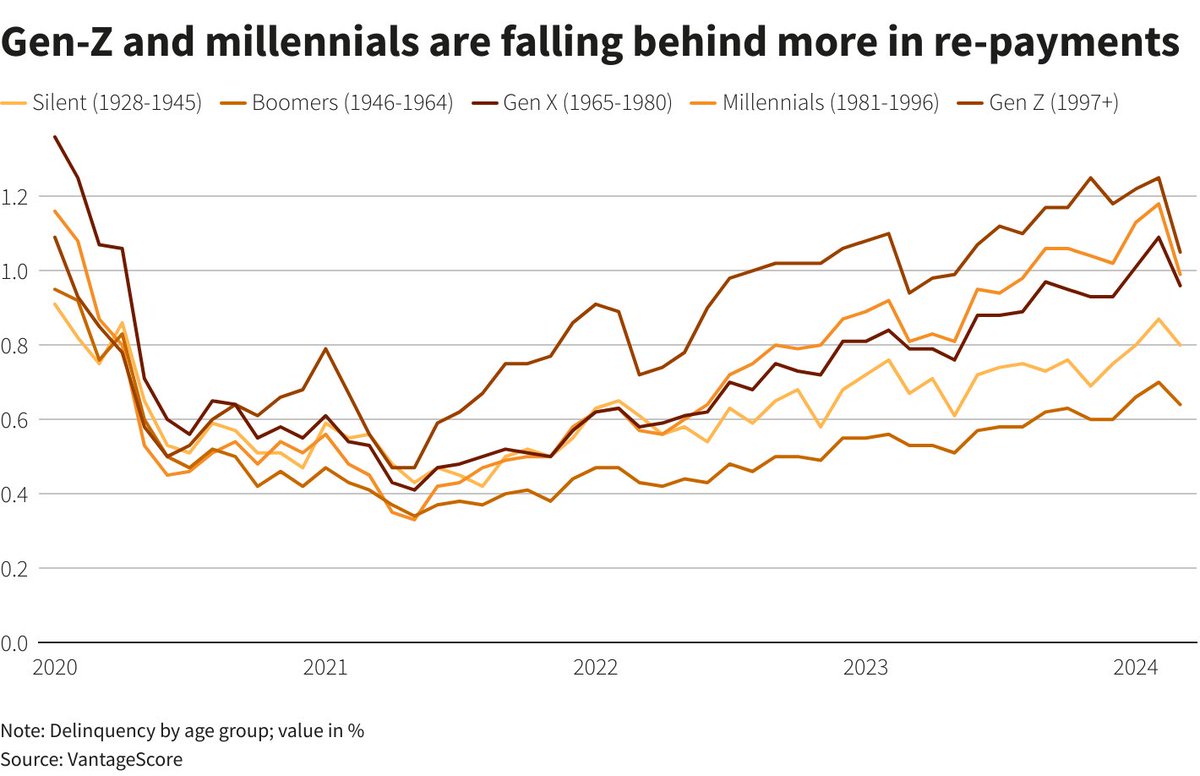

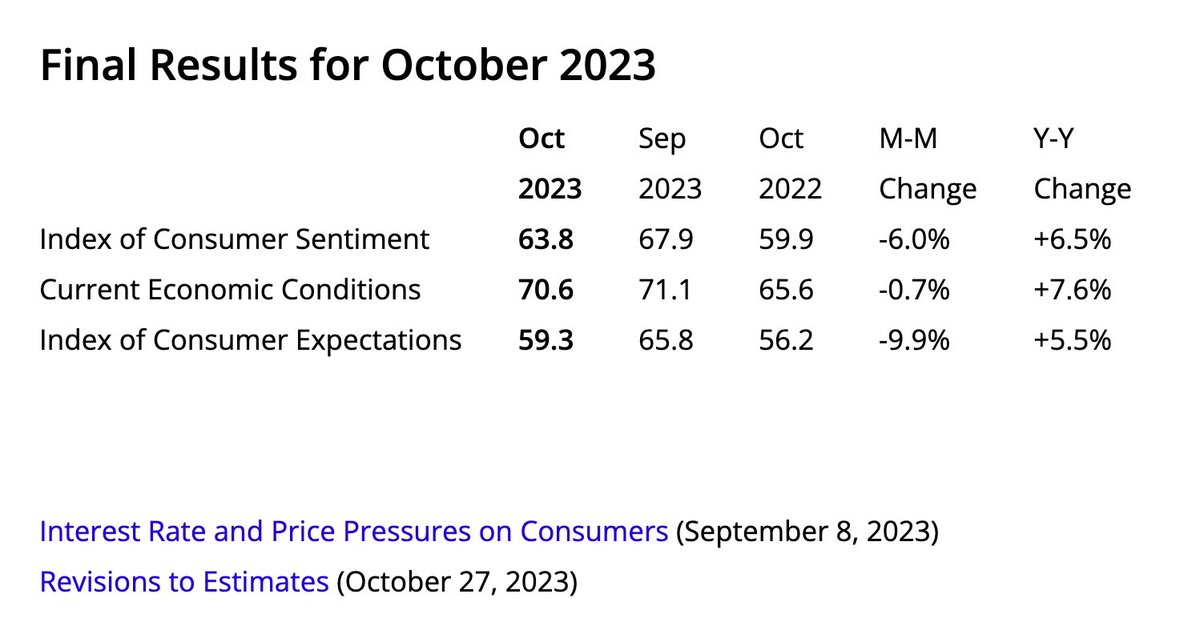

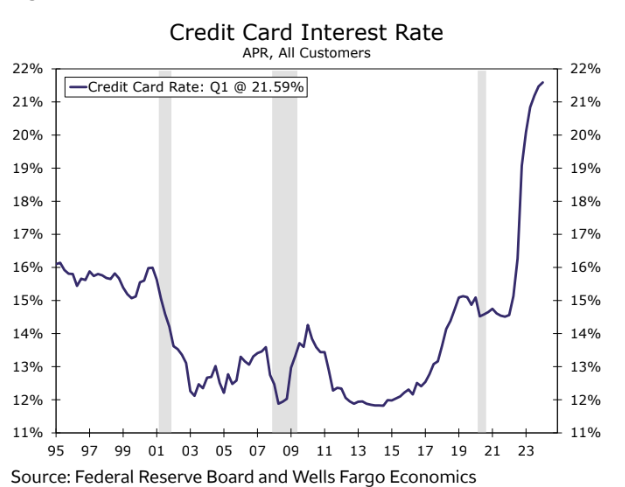

Despite reaching all-time highs #consumercredit growth is slowing as higher interest #rates curb spending. KPMG US economist Meagan Martin-Schoenberger noted, “We have decreased our expectations for interest rate cuts from three to two, starting in September.” #Fed bit.ly/44aFzGo

Consumer credit access has tightened significantly compared to last year. Banks have increased lending standards on credit cards, with current conditions tougher than during early 90s and 2000s recessions. #ConsumerCredit #EconomicTrends

“The student loan is the only way to bring a push-up, it also being focused education.” - Prince Dapo Adelegan Former President Nigerian-British Chamber of Commerce

#theconversation

#consumercredit

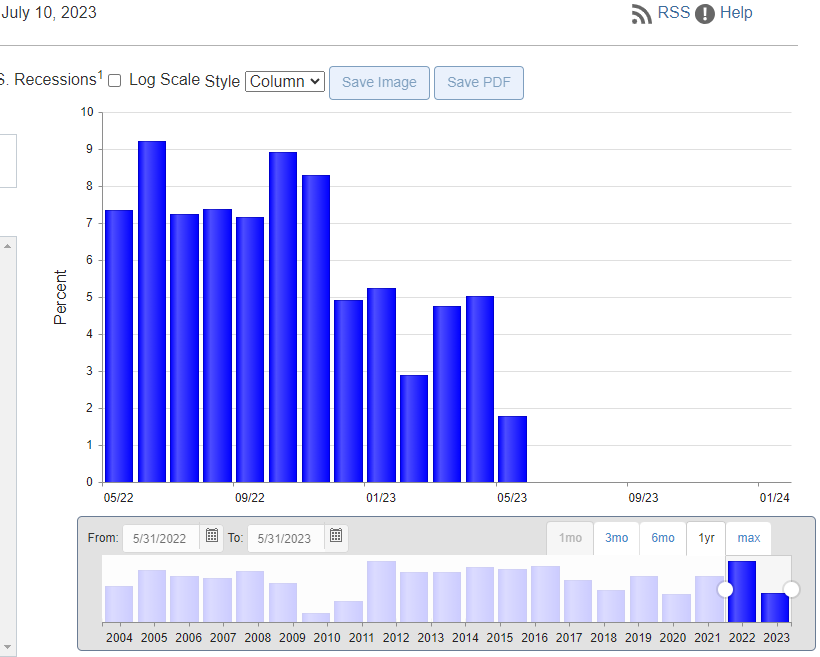

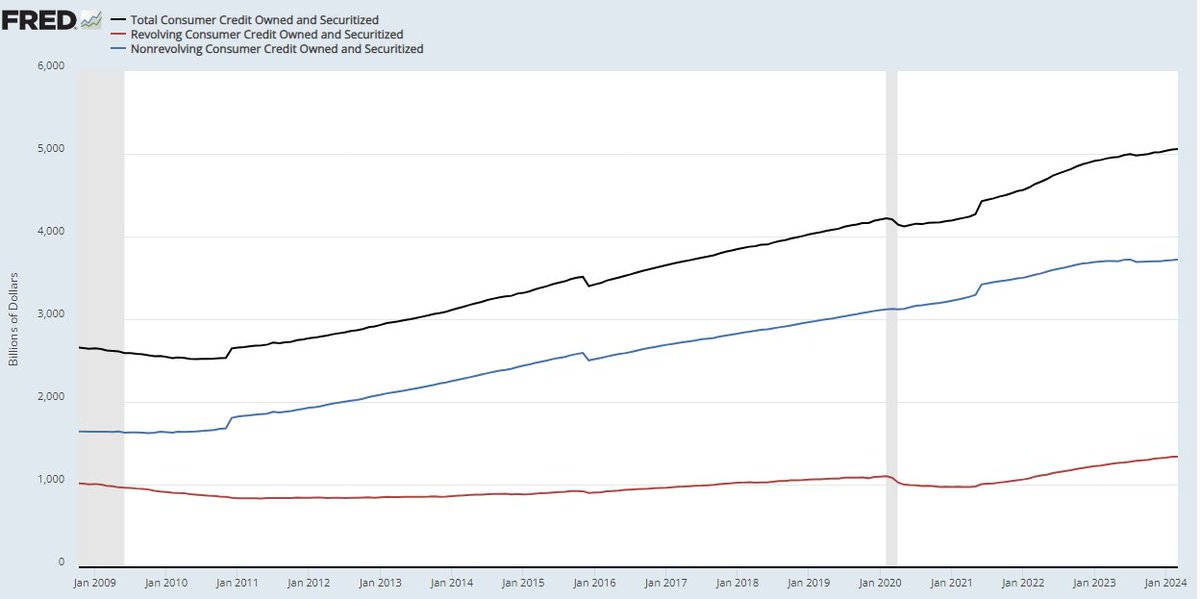

#voiceoflagos

Mar #consumercredit comes in well below exp's at +1.5% SAAR or $6.27bn, the least this yr, vs exp’s for $15.0bn & decelerating from +3.6% in Jan or $15.0bn (rev’d from $14.13bn), now up just 2.6% y/y.

Revolving (mostly #creditcard ) debt was up just +0.1% SAAR ($0.15bn), the

Do join us at 5pm today as we discuss understanding your Credit Score and its importance in improving your financial health. Talk soon!

#CreditScore #CreditReport #ConsumerCredit

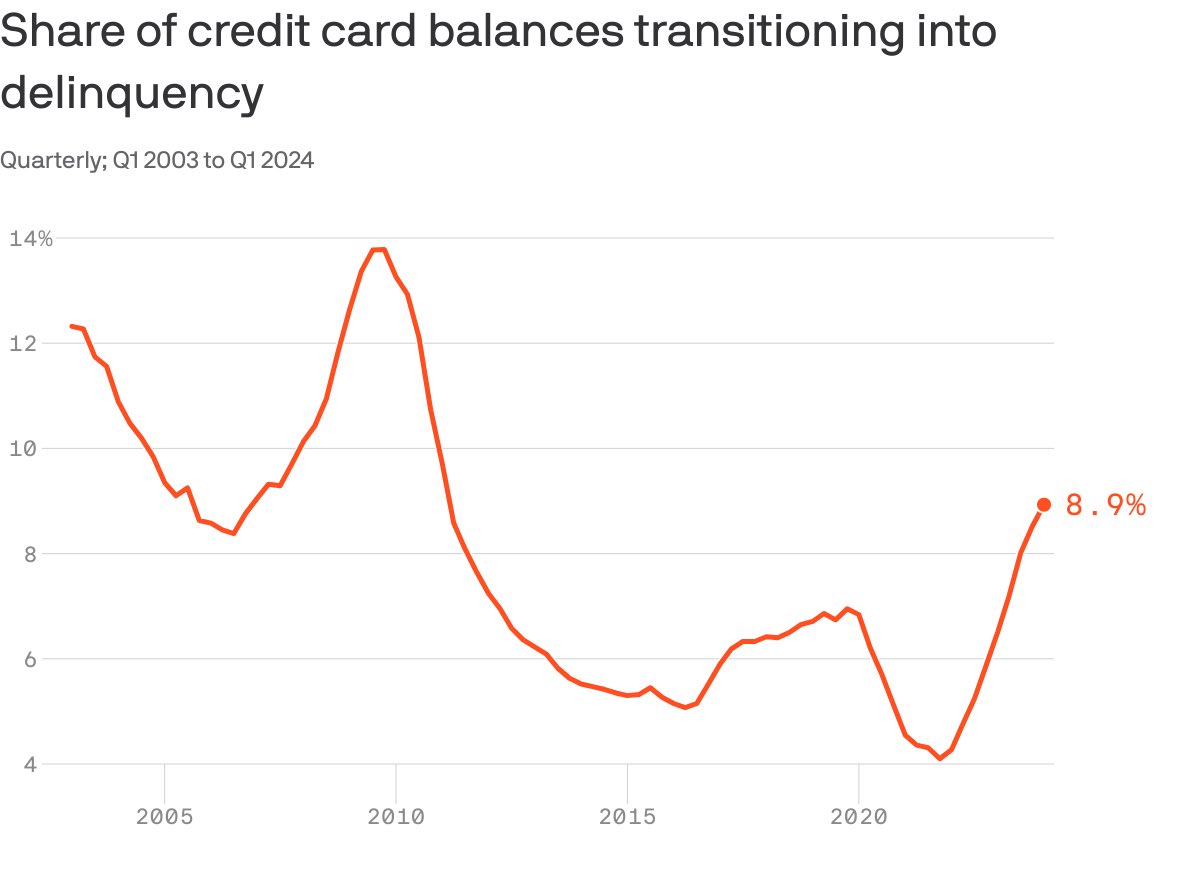

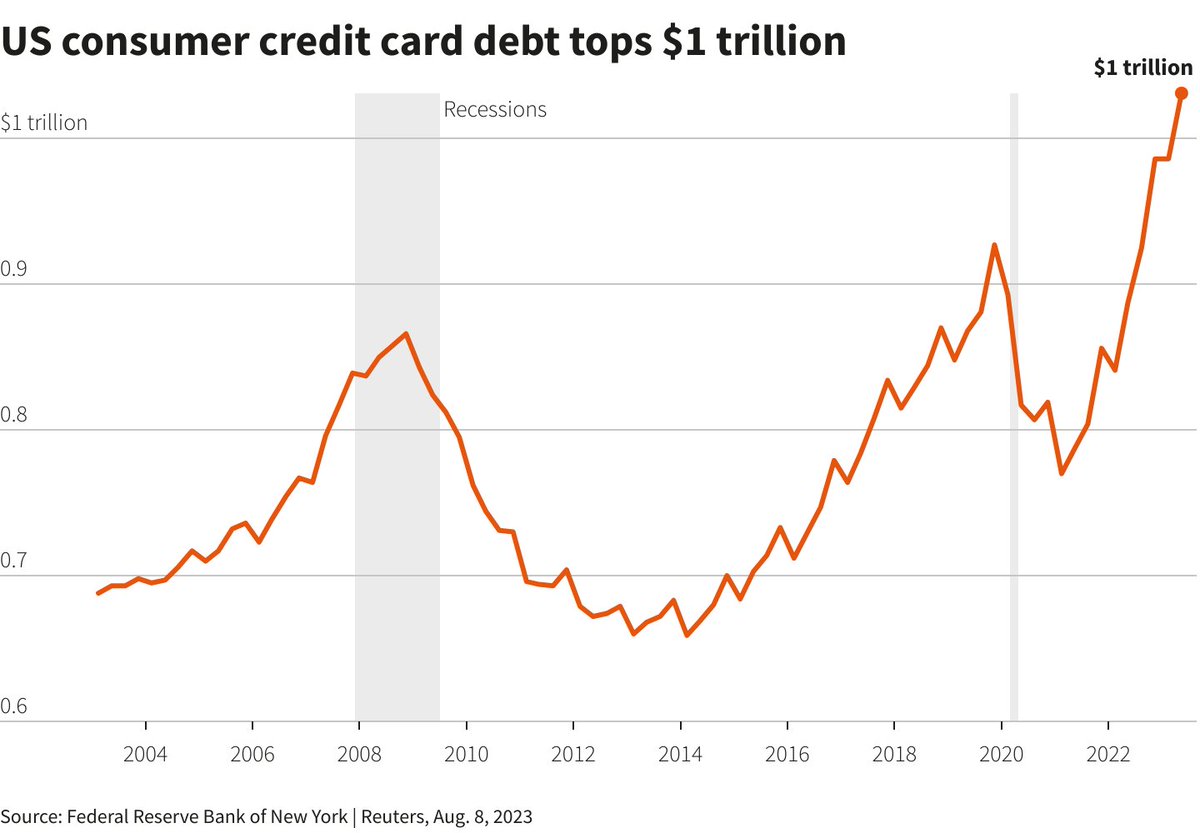

US consumers credit card debt (August 2023).

Passed the 1 Trillion mark a while ago.

Quite a concerning development.

But reflects the current state of the country pretty accurately.

(Image by Reuters)

#USDebt #ConsumerCredit #EconomicUpdate

#FinancialNews

Feb #consumercredit comes in slightly below exp's at +3.4% SAAR or $14.125bn vs exp’s for $15bn, decelerating from +4.2% in Jan or $17.68bn rev’d from $19.60bn) up 2.6% y/y.

Increase led by revolving debt (mostly #creditcard ) +10.9% SAAR ($11.27bn), most since Nov and up +9.0%