Rushabh Desai

@rooshabh11

Founder: Rupee With Rushabh Investment Services | AMFI Registered | Family Office 1943 | Differently Abled ♿️ | Contributor: CNBC (IND), NDTV Profit, ET, TV 9

ID:321993460

http://www.rupeewithrushabh.com 22-06-2011 13:31:46

2,3K Tweets

4,0K Followers

370 Following

India is a land of good savers not good investors. It is very important to channalise savings towards equity investments

भारत अच्छे बचतकर्ताओं का देश है, अच्छे निवेशकों का नहीं। बचत को इक्विटी निवेश की ओर मोड़ना बहुत महत्वपूर्ण है

Nisha Pandya

बचत के साथ सही निवेश भी ज़रूरी।FD Vs Equity || #money #financialadvisor ... youtube.com/shorts/1ijEts8… via YouTube Rushabh Desai #FinancialLiteracy #money #equityinvestment #FridayMotivation #advice #SavingsGoals #investmentthatpays

Take advantage of the fall in the stock market, don't panic

शेयर मार्केट की गिरावट का फायदा उठाओ घबराओ मत

Nisha Pandya

This was indeed very special Rushabh Desai !

Very big fan of your work and commitment. Loved every bit of this one with you & Niraj Shah: )

#mutualfunds

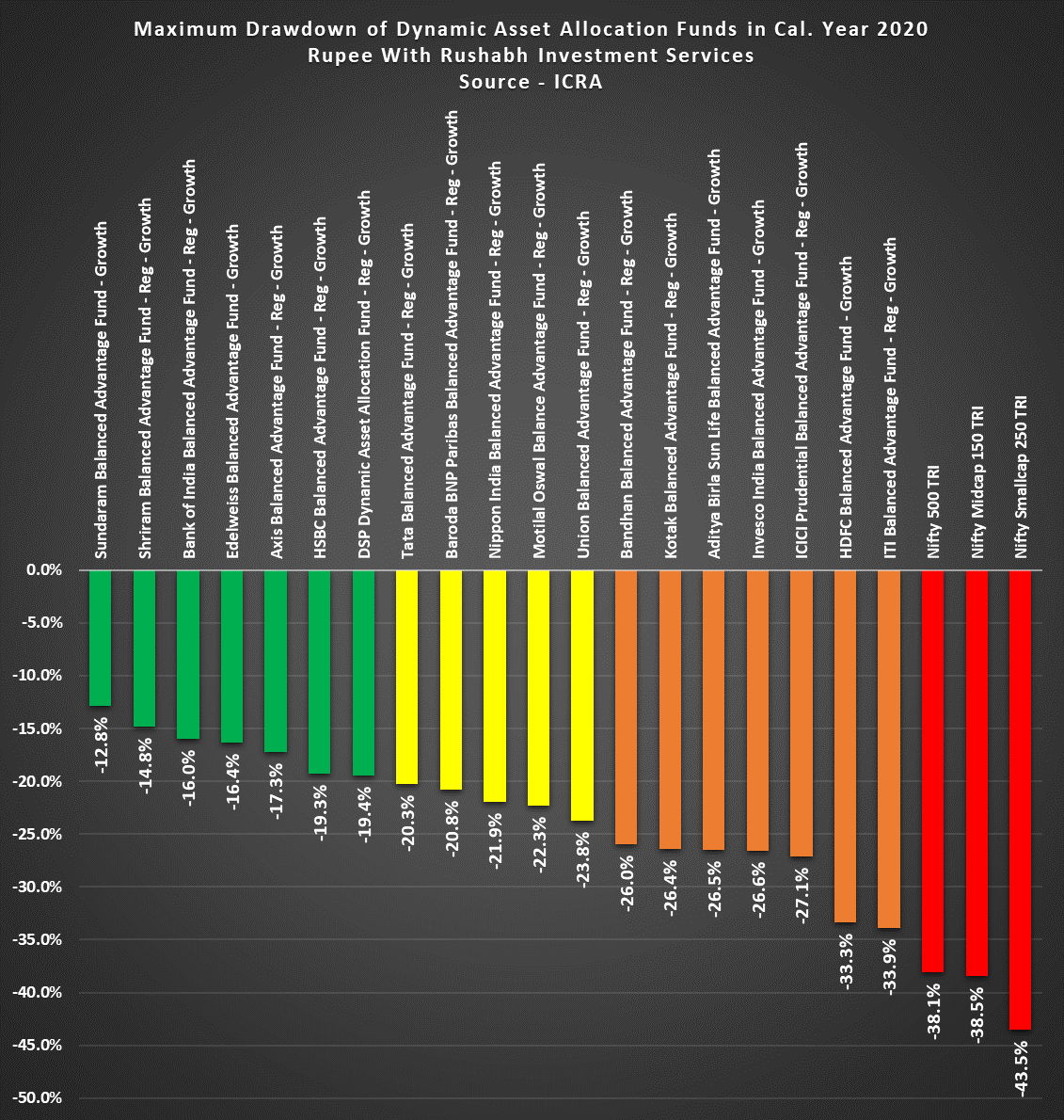

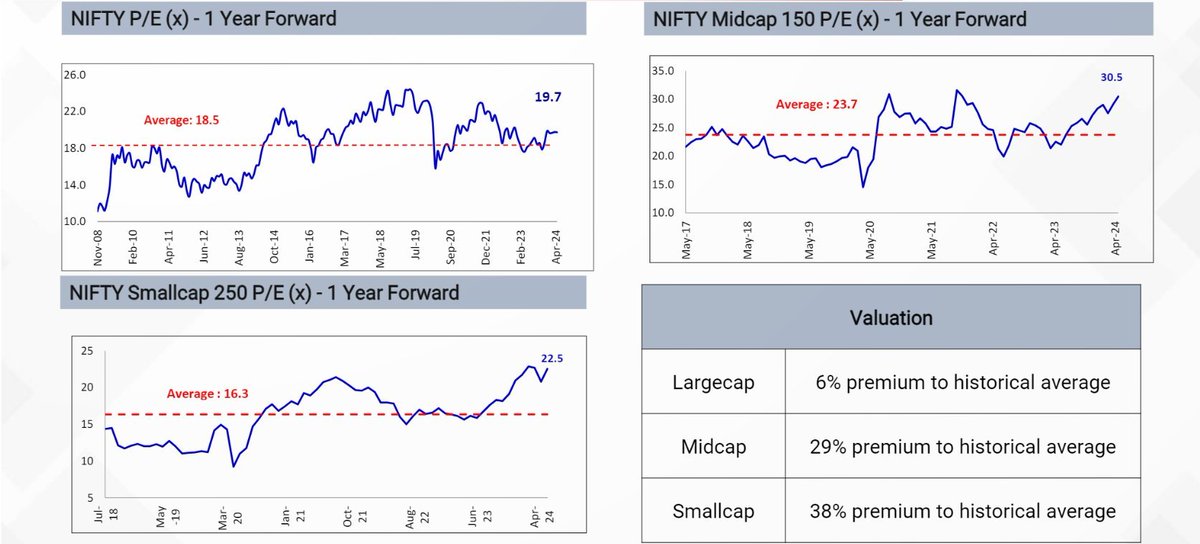

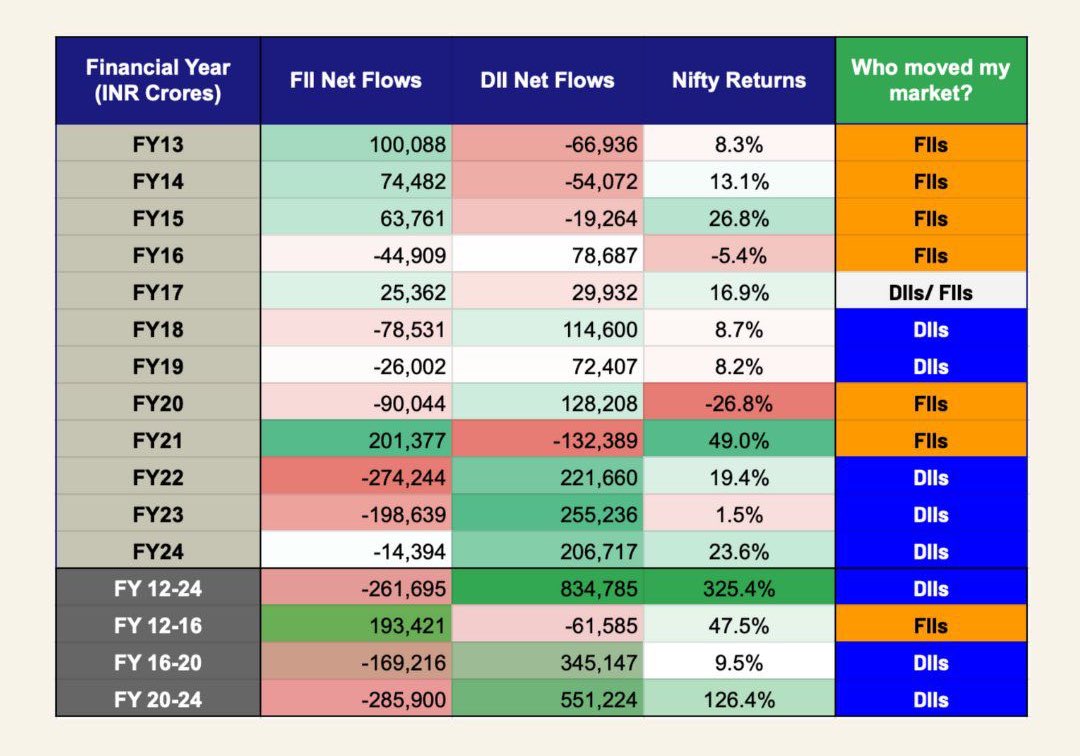

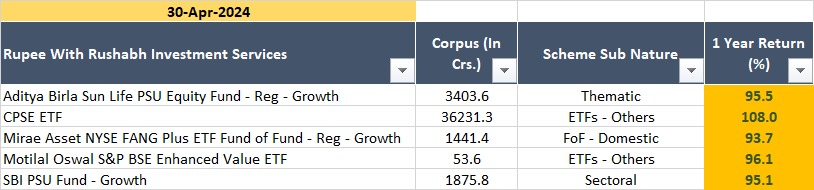

Today on NDTV Profit channel Mohit Gang, Niraj Shah & I discussed various parameters of Dynamic Asset Allocation / Balanced Advantage Funds & why these products are in a sweet spot today

Doing this show with my dear friend Mohit was special

Link - youtu.be/FOV-GFUyqjQ?si…

शेयर मार्केट की गिरावट का फ़ायदा उठाइए , घबराइए मत Rushabh Desai Rushabh Desai #nishasniche #financialliteracy youtube.com/shorts/Mh2J4I1… via YouTube #sharemarket #MutualFund #sip #profitbooking #panic

Contributed my views in Economic Times, ET Mutual Funds

Smallcap index hit record high but why did 93% smallcap MFs underperformed?

Link - economictimes.indiatimes.com/mf/analysis/sm…

Canara Robeco MF (Canara Robeco Mutual Fund), your relationship/distributor management SUCK big time. Your services towards your distributors & investors have been absolutely very poor. You really need to be hands on or else you will start losing business. I hope someone will contact me soon

Contributed my views in Moneycontrol

US-focused IT mutual funds lead Indian sectoral peers, but investors have few options

Link - moneycontrol.com/news/business/…

Many thanks Abhinav Kaul

Contributed my views in Moneycontrol

Will a new scheme that bets on non-cyclical consumer sectors pay off? A Moneycontrol review

Link - moneycontrol.com/news/business/…

Many thanks Abhinav Kaul

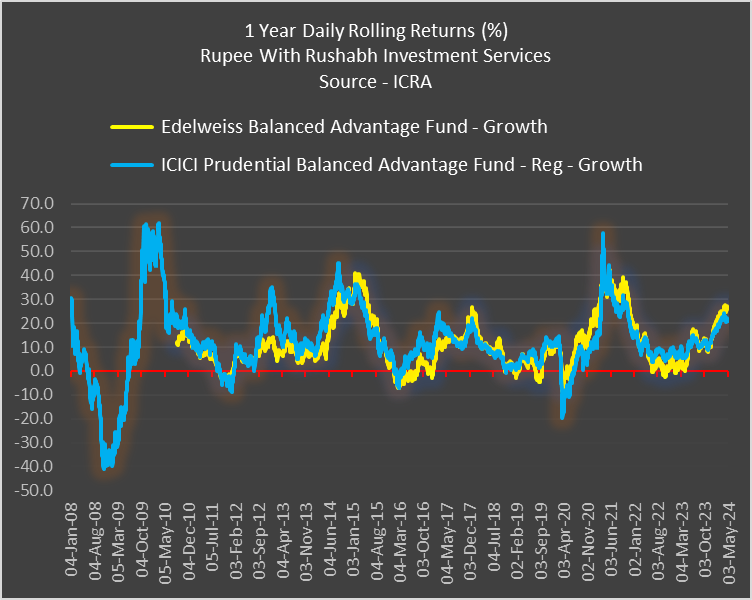

On a 1 year daily rolling returns Edelweiss Mutual Fund & ICICIPruMF Balanced Advantage Funds have generated negative returns only around 11% of the time since their respective inception dates with average 1 year returns of both at around 11%

Radhika Gupta Niranjan Avasthi Adil M Bakhshi

Thank you so much, Rushabh Desai , for your valuable time and sharing such insightful knowledge about investing.

#investing #Savings #moneypower

To watch more content on #financialliteracy follow youtube.com/@nishappandya

New Investor? Let’s Learn “How To Invest?” With Rushabh Desai,Rupee With Rushabh Investment Services

Wonderful to do this interview with Nisha Pandya (Senior Journalist and Ex-CNBC)

Click the link to watch my full interview - youtu.be/--Lj8uYH0vw?si…