Colby Smith

@colbyLsmith

US economics editor @FinancialTimes. Previously @FTAlphaville, @TheEconomist, @BloombergTV. [email protected]

ID:1176918506

https://www.ft.com/colby-smith 13-02-2013 21:43:32

6,0K Tweets

11,9K Followers

2,1K Following

Delighted to have Colby Smith, Steven Kelly, & Gerard DiPippo on the podcast to discuss 2023 and look forward to what may happen in 2024. Having a Fed beat reporter, a financial stability expert, and an international man means plenty of 🔥🔥🔥 takes! directory.libsyn.com/episode/index/… (1/4)

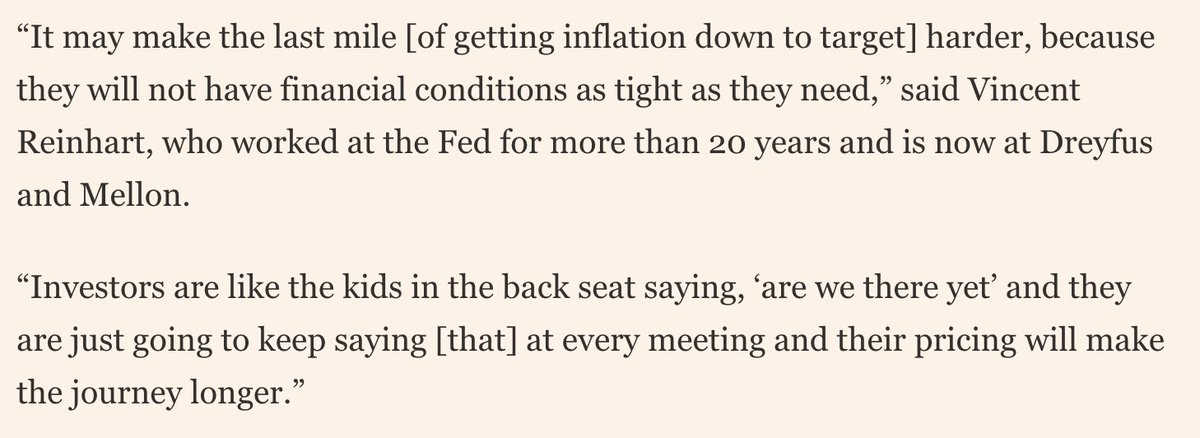

John Williams of New York Fed sought to push back on speculation that the US central bank is considering imminent rate cuts on Friday, telling Steve Liesman that talk of a March move was 'premature'

New Financial Times piece on the Fed pivot and how it is piling pressure on Europe's central banks to shift towards a more dovish stance Sam Fleming (FT) & Martin Arnold

ft.com/content/12a6a9…

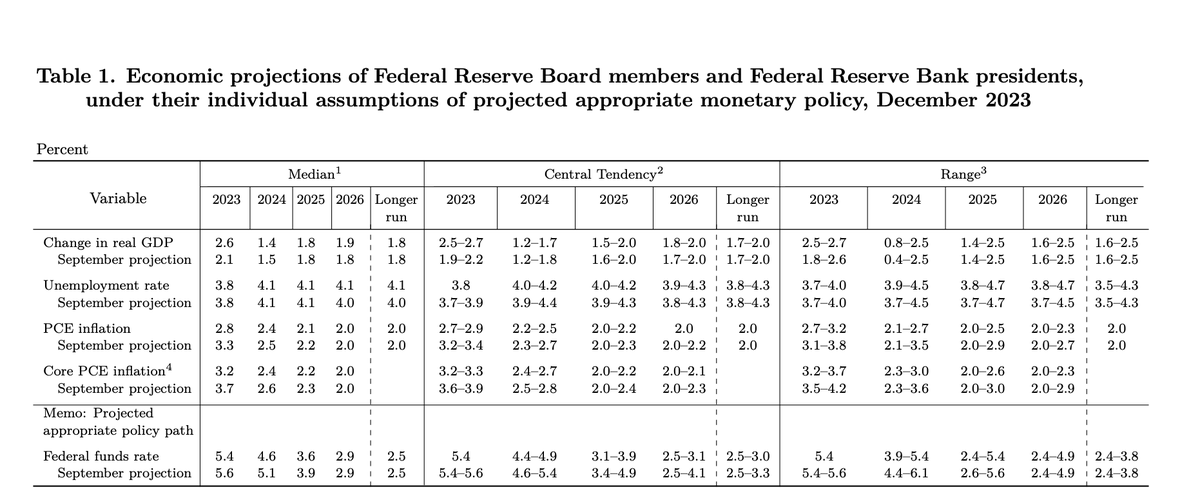

All eyes today will be on the Fed's updated SEP and how many cuts next year are pencilled in by officials.

Maintaining the same magnitude as September (50bps) would help to drive home the point that the Fed is not preparing anything imminent

ft.com/content/990024… Financial Times

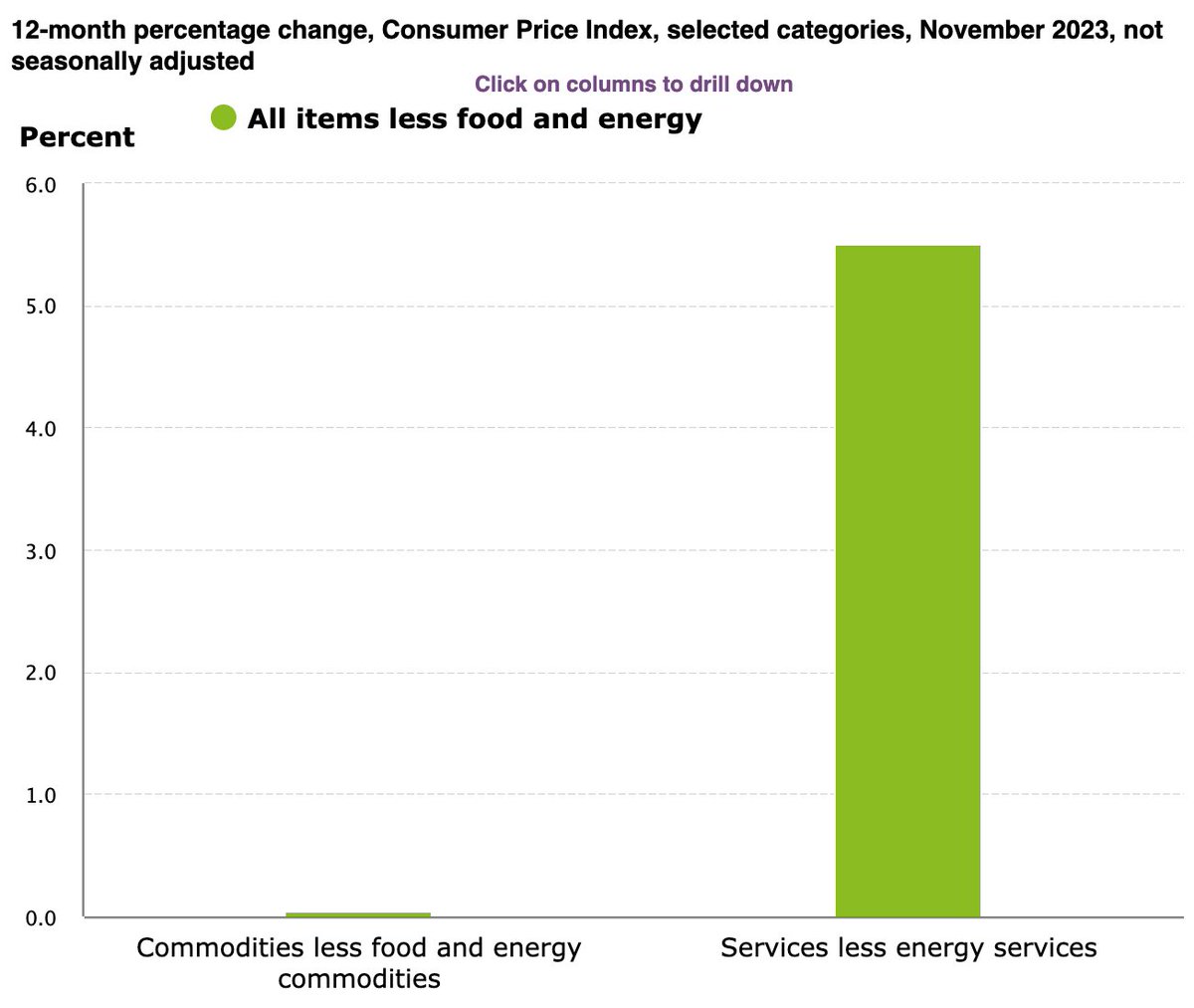

On the latest CPI report, Omair Sharif says the data does not yet suggest the Fed has the 'all clear' and can conclude with confidence that inflation is moving back down to the 2% target in a sustainable way. He sees June as a plausible start to cuts ft.com/content/51111d…

A 0.3% monthly rise in core CPI for November reinforces the idea that the Fed will keep its policy rate steady at a 22-year high well into 2024, defying market expectations of earlier cuts ft.com/content/51111d… Financial Times

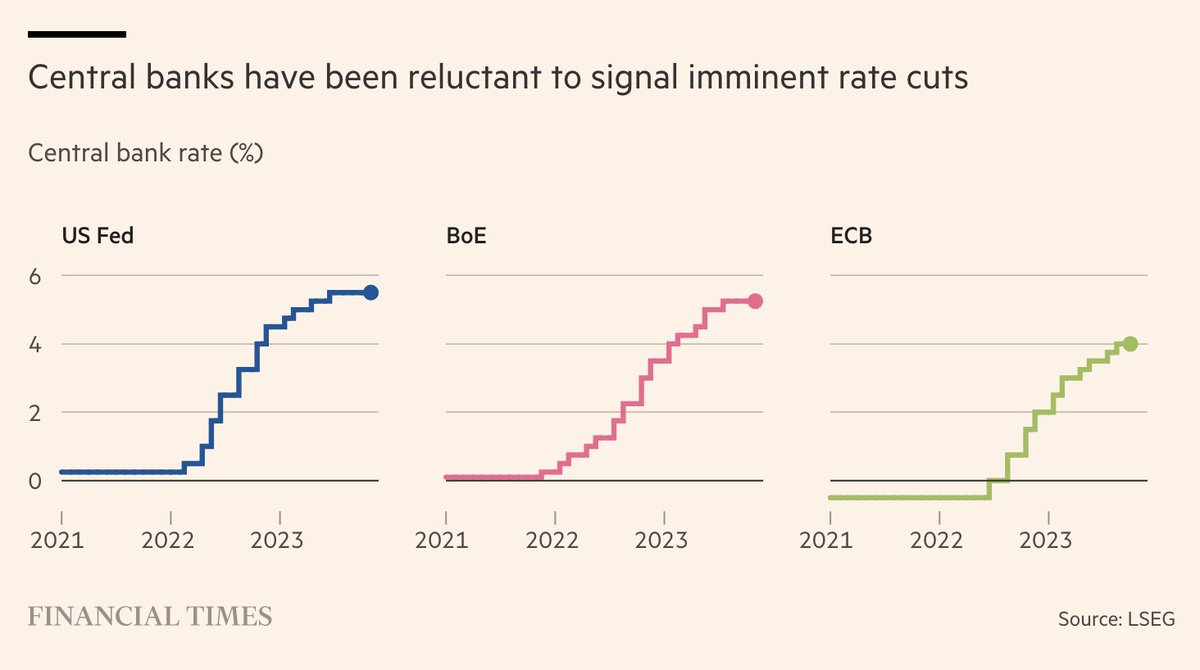

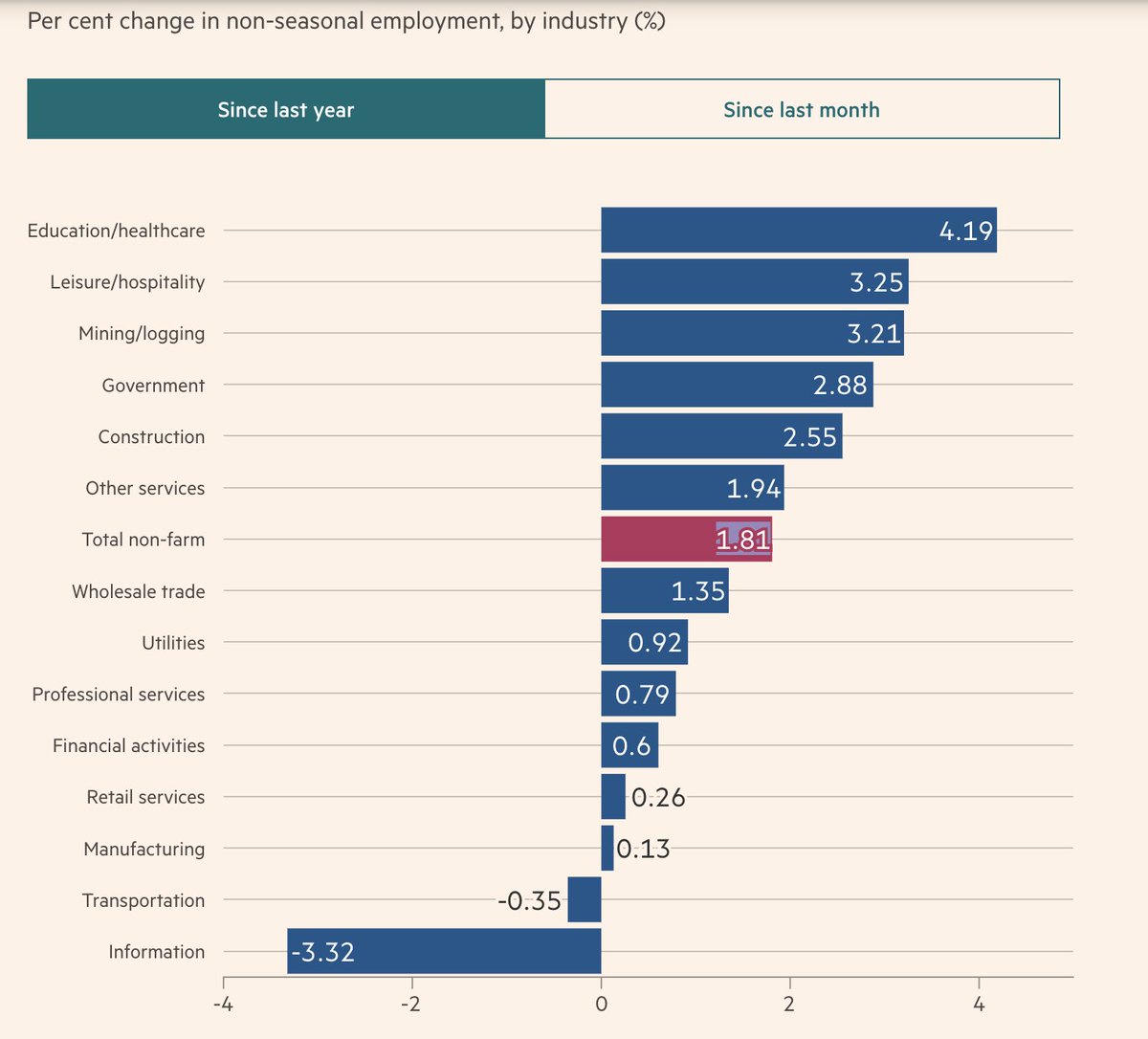

It’s pushback week for the world’s top rate-setters, but will markets listen? Central banks prepare to rebuff investors over path of interest rates by pointing to tight labour markets ft.com/content/1fea39… via @ft Sam Fleming (FT) Colby Smith

At the final FOMC meeting of the year this week, Jay Powell faces a tough balancing act to maintain flexibility in the Fed's policy plans in the face of intense pressure to reveal when and by how much it intends to cut interest rates next year

ft.com/content/990024… Financial Times

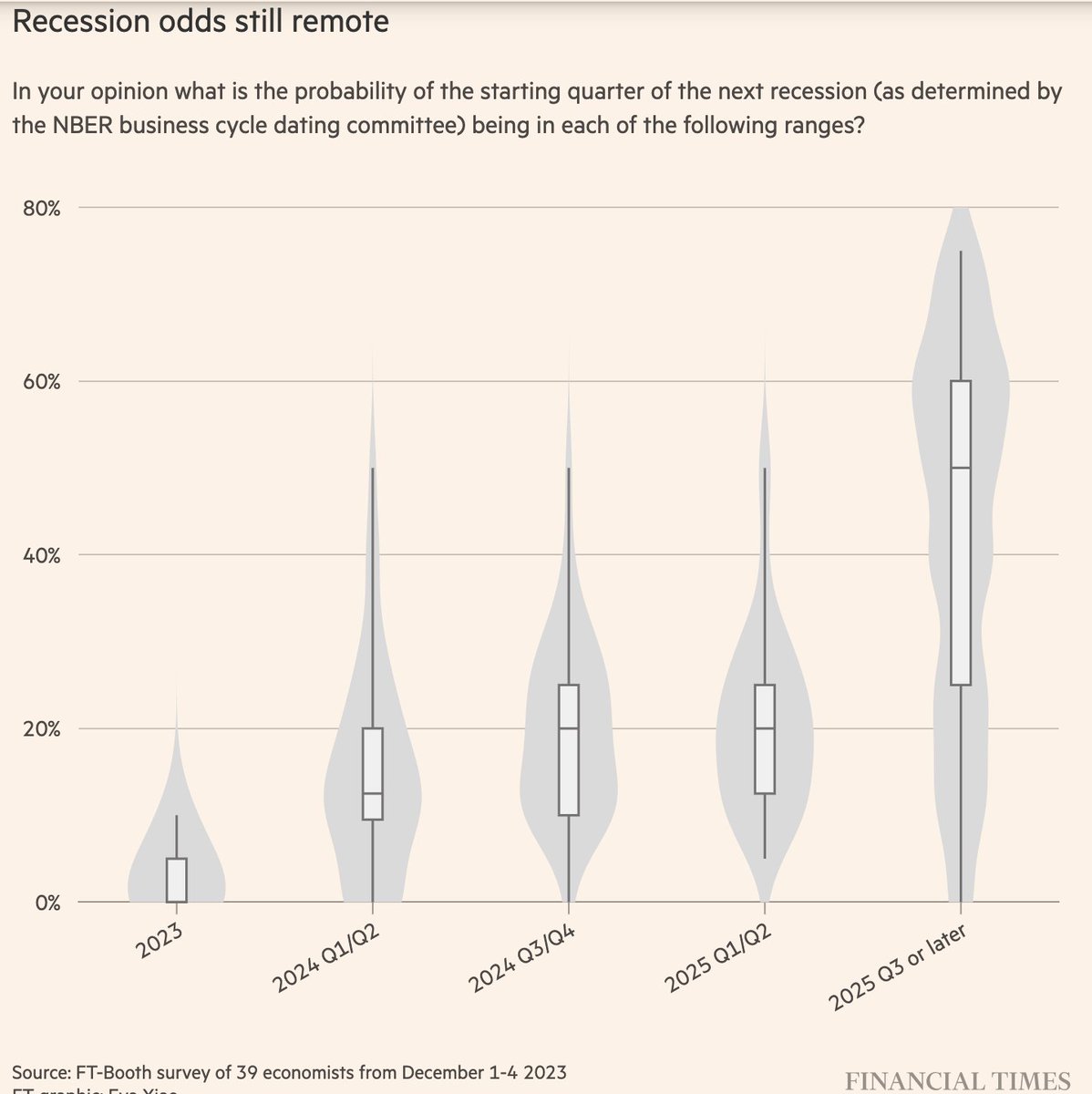

In the latest Financial Times survey w/ Chicago Booth, 63% of the economists polled think the Fed will only begin to cut rates in the third quarter of next year or later and in 2024 move by just 50bps -- a stark contrast to current market pricing ft.com/content/8c8fdc… Eva Xiao

Less than two years after they were criticised for being late in responding to the most brutal surge in prices for a generation, central banks face pressure to pivot as inflation slows

Latest Financial Times read with Sam Fleming (FT) & Martin Arnold

ft.com/content/5bf9e7…