S&P Global Commodity Insights

@SPGCI

The leading independent provider of information & benchmark prices for energy & commodity markets. S&P Global Commodity Insights is a division of @SPGlobal

ID:19795822

https://www.spglobal.com/commodity-insights 30-01-2009 23:43:43

13,4K Tweets

24,7K Followers

491 Following

#PlattsGEA - Nominate for Platts Global Energy Awards' Energy Transition Award - Downstream. Stand out in the #refining , #petrochemicals , LPG, fuels marketing, or retail by showcasing how you address the energy transition & decarbonization. Nominate now okt.to/UlZdK4

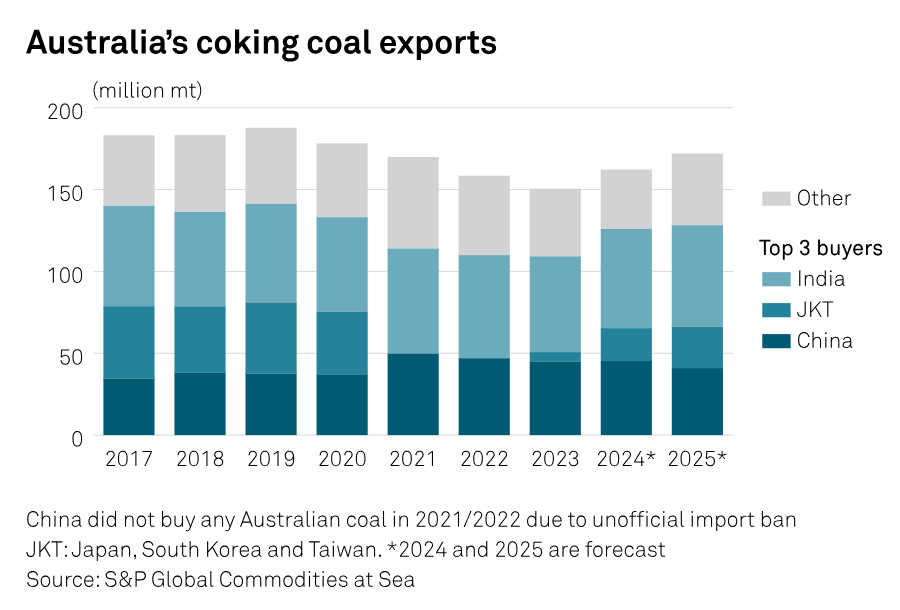

MET COAL SERIES: #Australia is poised to expand its reign as the leading exporter of #cokingcoal , fueled by #India 's growing consumption and China's increasing #imports .

Read more for an in-depth analysis ⬇️

okt.to/IKsqlV

#MetCoal

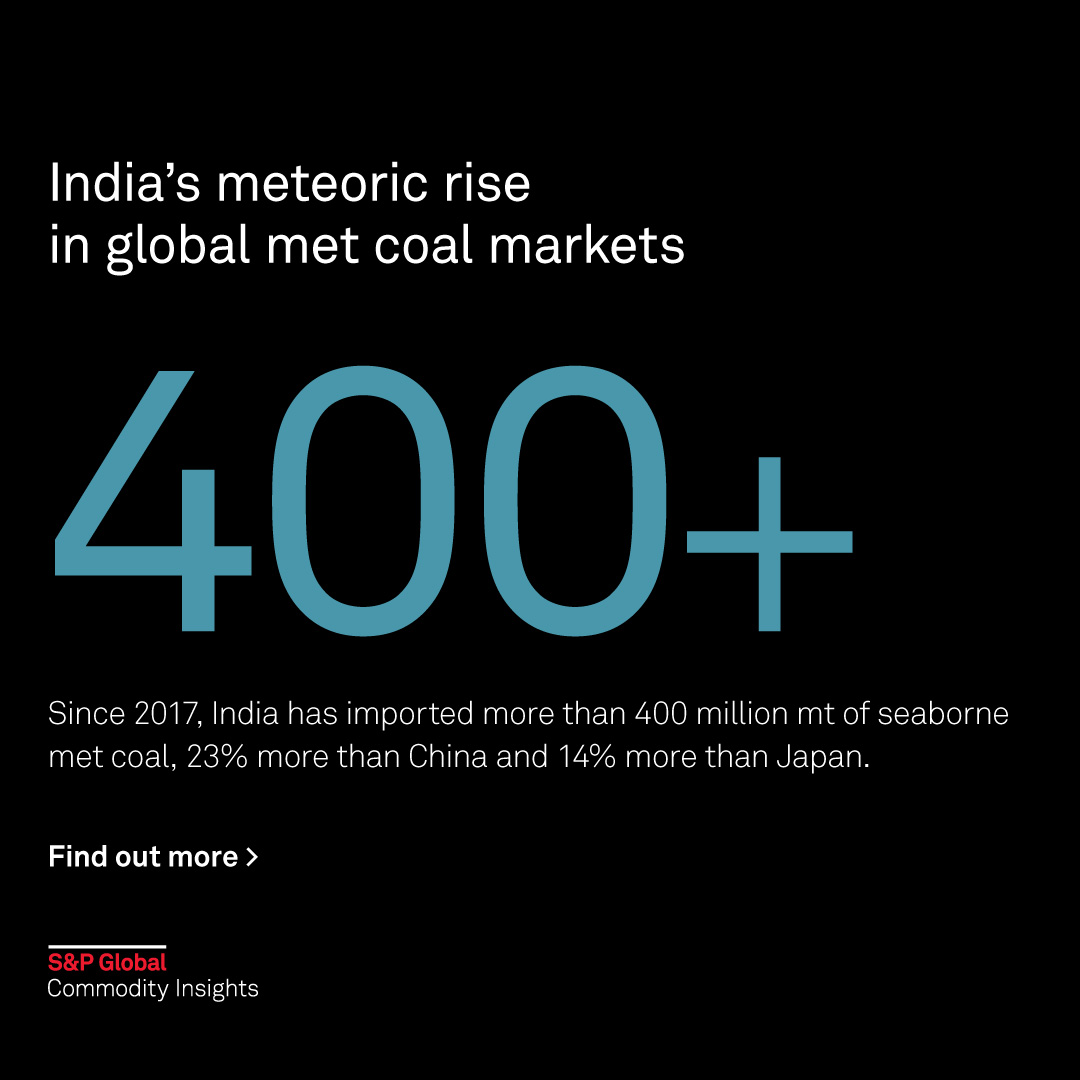

📊 Our latest #infographic explores #India 's infrastructure boom and its impact on #steel and #cokingcoal demand. Despite efforts to enhance local production, imports are set to rise as steel aims for 300M metric tons by 2030.

More Insights⬇️

okt.to/3Szt76

🏆 Nominations Now Open for the Platts Global Energy Awards! 🏆⚡️

If you know an exceptional individual, team, or organization making waves in the #EnergyIndustry , Please submit a nomination. This is a career-making opportunity! okt.to/BPoOiR

Latest #EnergyTransition news highlights from S&P Global Commodity Insights:

'Time to reorganize': Tesla reboots after EV sales, profits sputter in Q1 linkedin.com/pulse/time-reo…

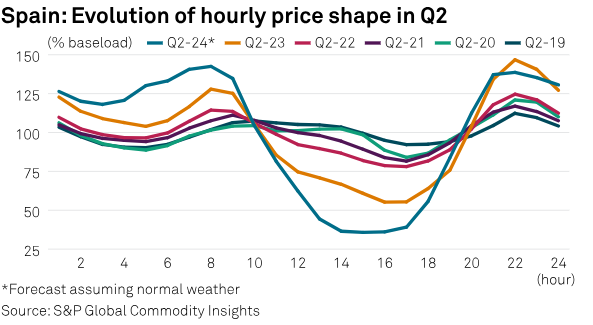

#ChartsToWatch on #CommodityTracker

➡️ Low-carbon #hydrogen prices while ammonia deals are being secured in Asia-Pacific

➡️ Growing fleet of ‘shadow’ #tankers

➡️ Global #LNG prices while sellers await bids from emerging demand hubs

… and more okt.to/9fTJDd

Our Team Lead, Daryna Kotenko, is discussing this topic with industry experts Sai Vijay Kaki, Market Design Specialist, New York ISO, Guillermo Bautista Alderete, Director, Market Analysis, Forecasting, California ISO, & Seth Mayfield, Manager, Market Design, Southwest Power Pool.

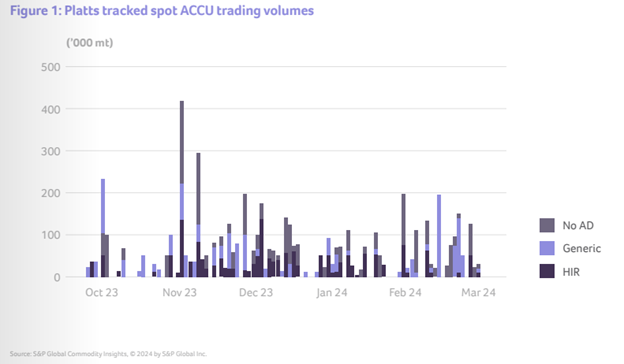

In the Carbon Market Institute’s inaugural Market Report, our chapter delivers crucial insights into Australian #CarbonCredits price dynamics, offering a deep dive into compliance demand trends shaping the #CarbonMarket landscape. okt.to/fF7AVa

#Australiacarbonmarket

S&P Global Commodity Insights is pleased to have contributed a chapter to the Carbon Market Institute’s inaugural Market Report in partnership with Westpac Bank. Our chapter provides insights into #SupplyDemand and pricing trends. okt.to/qtyCQI

#carbonmarkets #carboncredits

Day 3 of #CERAWeek by S&P Global: Talks about growing demand for energy commodities, #infrastructure , & #rawmaterials to facilitate #energytransition

🔹 #Hydrogen could play role in decarbonizing power despite challenges

🔹No limit to global #copper demand: Trafigura's Saad Rahim

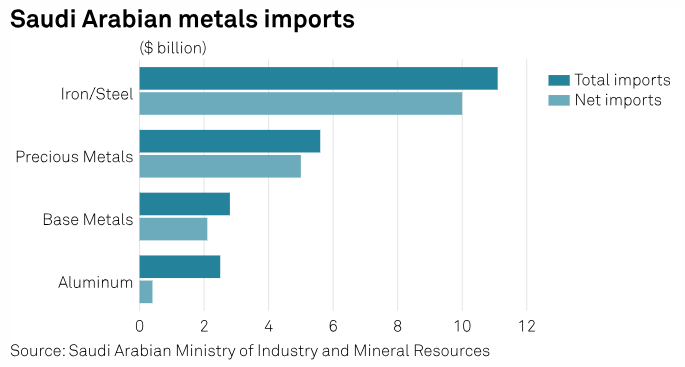

#SaudiArabia 's economy an #oil export-dependent country, is eager to diversify. Mining valuable minerals hidden under its vast deserts could help to reduce its reliance on oil and grow its share in the #energytransition .

okt.to/fMDsJ2