IMFS

@IMFS_Frankfurt

The Institute for Monetary and Financial Stability at Goethe University has a focus on central banks and monetary policy. It is headed by @WielandVolker.

ID:2382148802

http://www.imfs-frankfurt.de 10-03-2014 13:30:12

4,4K Tweets

1,4K Followers

282 Following

Later today: watch live as ECB President Christine Christine Lagarde explains the latest monetary policy decisions.

Shedding new light on why people dislike inflation, leveraging two new surveys in the US, from Stefanie Stantcheva nber.org/papers/w32300

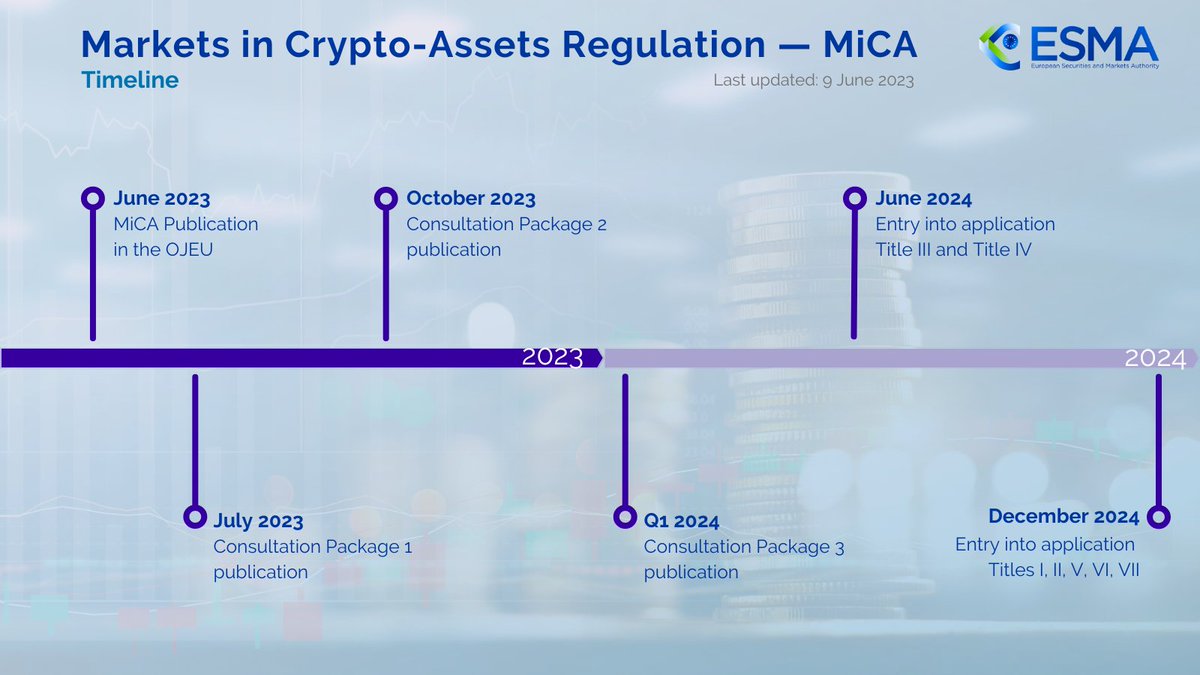

Differences in regulatory requirements may result in inconsistent/uncoordinated oversight of #Stablecoins across jurisdictions. International cooperation will be critical to shape an effective regulatory environment #FinancialStabilityInstitute bis.org/fsi/publ/insig…

Ahead of the ECB monetary policy meeting, according to Volker Wieland, 'it's not guaranteed that more cuts will follow right away'. After a first cut in June, 'one might question whether it's really so urgent to ease more soon.' #inflation #wages

marketnews.com/mni-interview-…

It’s #FinancialLiteracy Month ! We are sharing our #FinancialLiteracy resources all month long. Today we are featuring the second video in our #Inflation101 series, check out the others: clefed.org/Inflation101

Euro area #inflation expected to be 2.4% in March 2024, down from 2.6% in February. Components: services +4.0%, food, alcohol & tobacco +2.7%, other goods +1.1%, energy ‑1.8% - flash estimate ec.europa.eu/eurostat/en/we…

Die #Inflationsrate in Deutschland wird im März 2024 voraussichtlich +2,2 % betragen. Das ist der niedrigste Wert seit April 2021 (+2,0 %). Gegenüber Februar 2024 steigen die #Verbraucherpreise voraussichtlich um 0,4 %. Mehr dazu: destatis.de/DE/Presse/Pres…

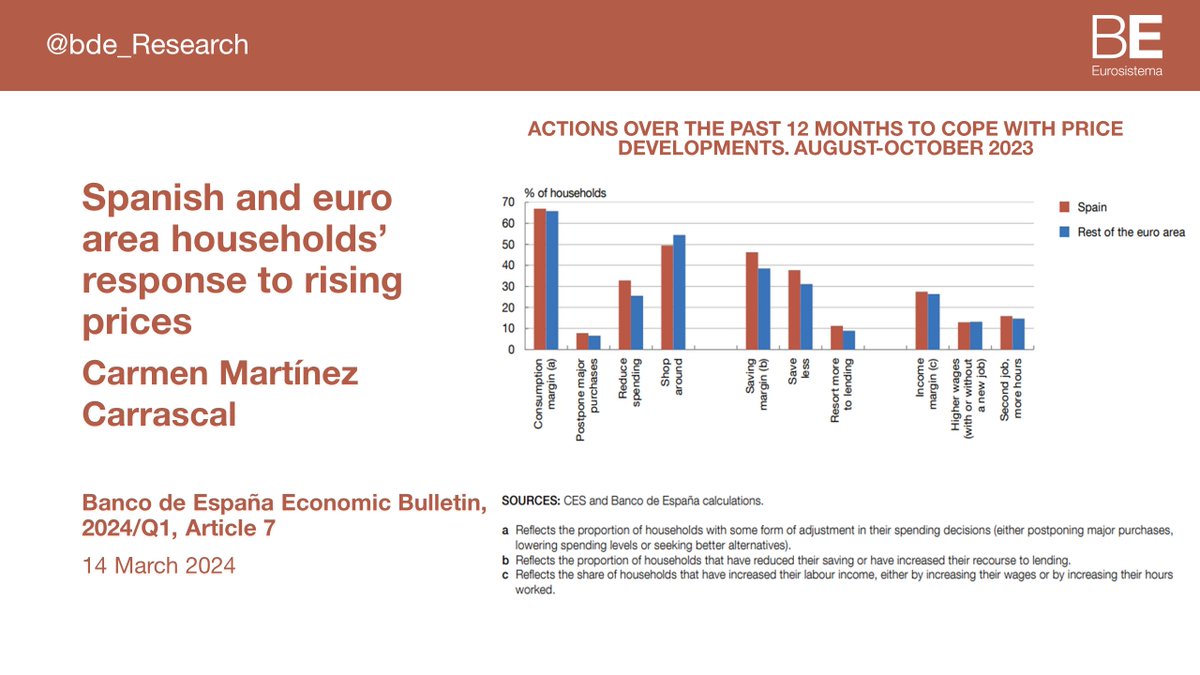

Spanish households have resorted to credit and increased their labour supply (by taking a second job or working longer hours) to cushion the impact of rising prices on #consumption more than their euro area countgerpart #bdeResearch #inflation 1/3 bde.es/f/webbe/SES/Se…