Ana Beatriz Galvao

@AnaGalvao24816

Senior Economist at Bloomberg Economics. Opinions are my own.

ID:1552664335285190656

28-07-2022 14:38:14

16 Tweets

84 Followers

32 Following

Follow People

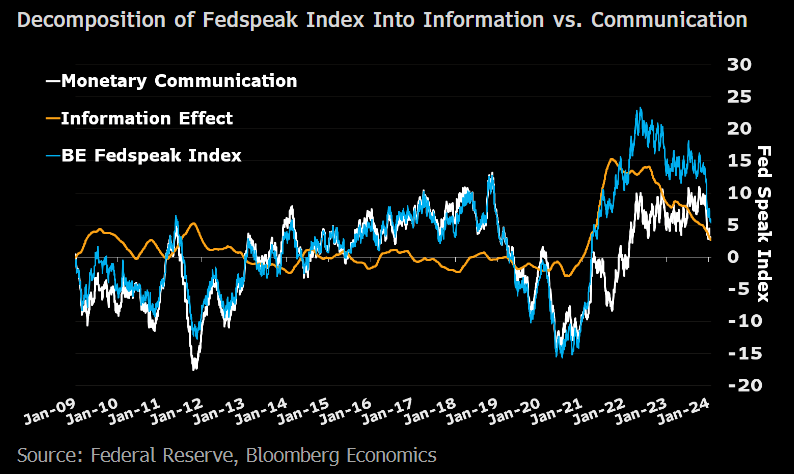

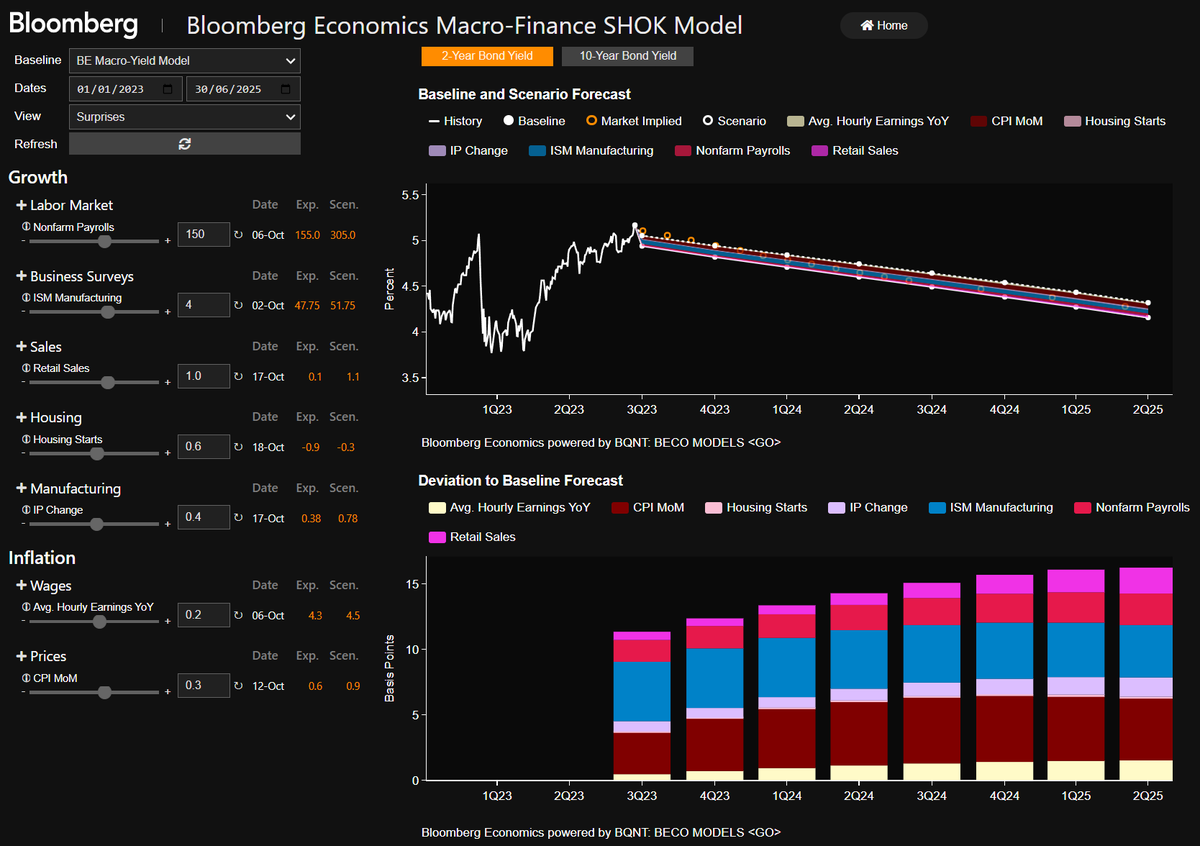

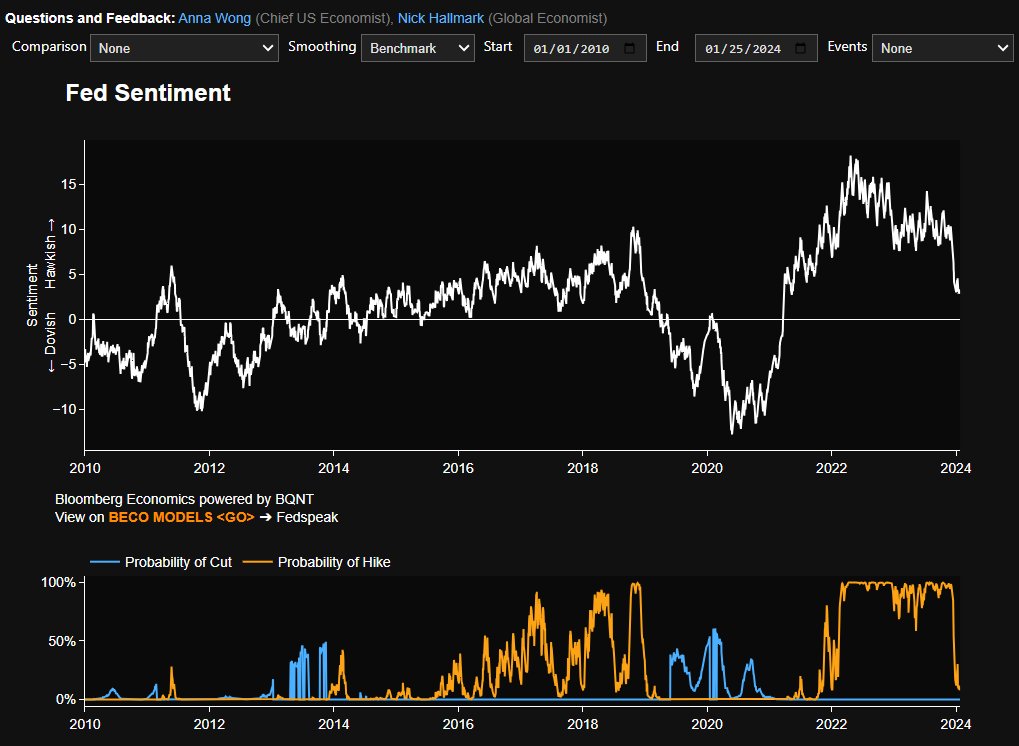

Just launched our NLP Fedspeak Index on Bloomberg Terminal today. Our Fedspeak Index combines Bloomberg's timely Fed reporting+labels trained on my read of Fedspeak. It flagged for us Powell's Dec Dovish pivot. Right now its readings is similar to March 2019-4 months before rate cuts.

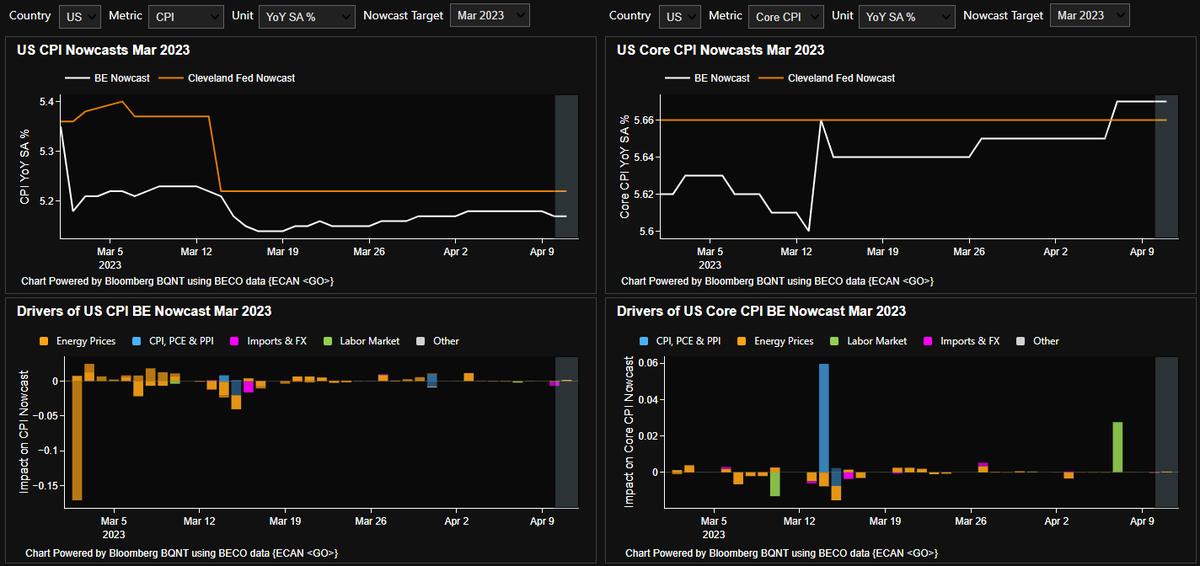

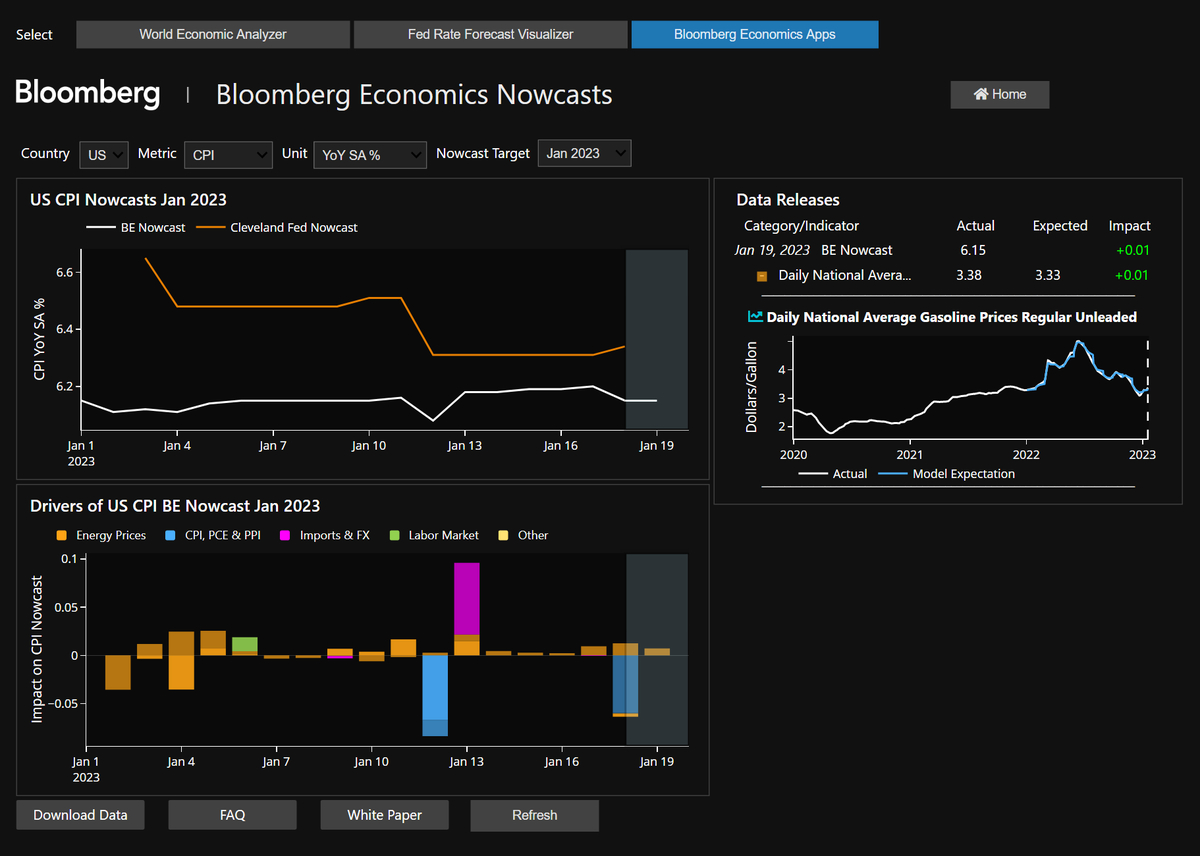

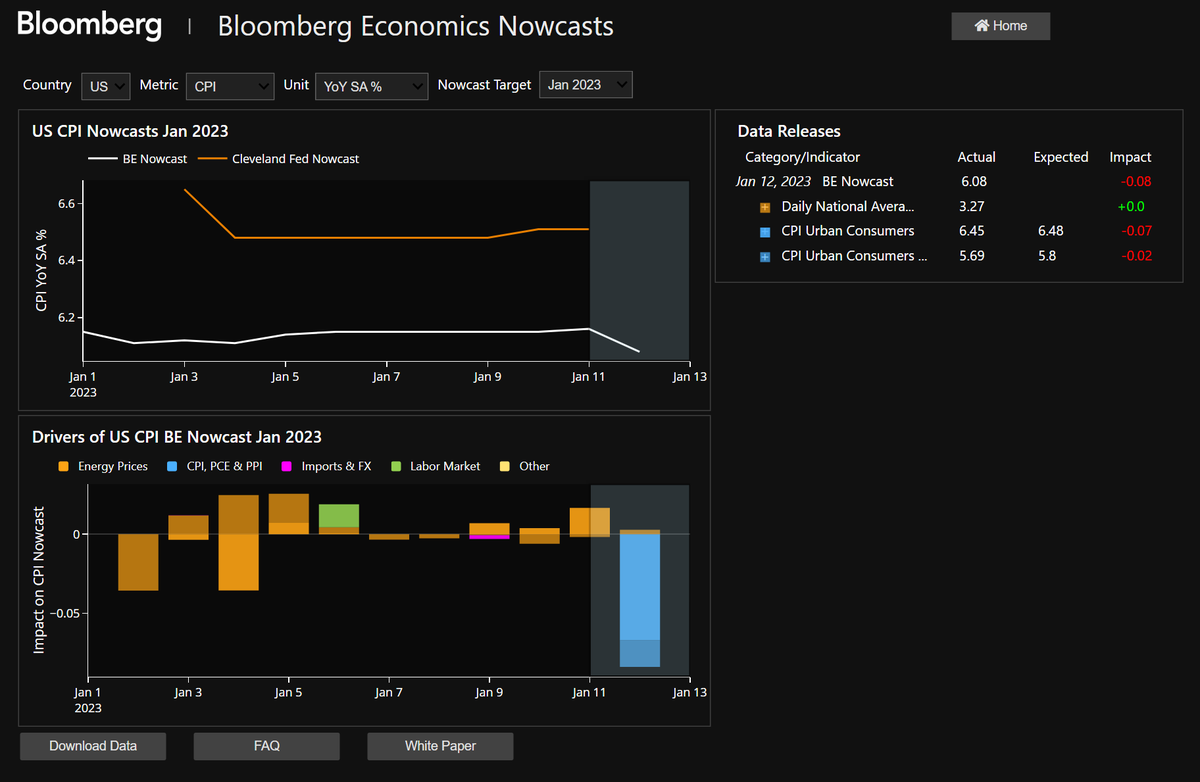

Our nowcasts are updated daily and accessible to Clients via the #bloombergterminal under ECAN<GO>. Andrej Sokol Scott Johnson Bhargavi Sakthivel Ana Beatriz Galvao Ana Luís Andrade Michael McDonough Michael Denicola #inflation #spain #economics #ecb Zoe Schneeweiss Alonso Soto Joya Bloomberg Economics

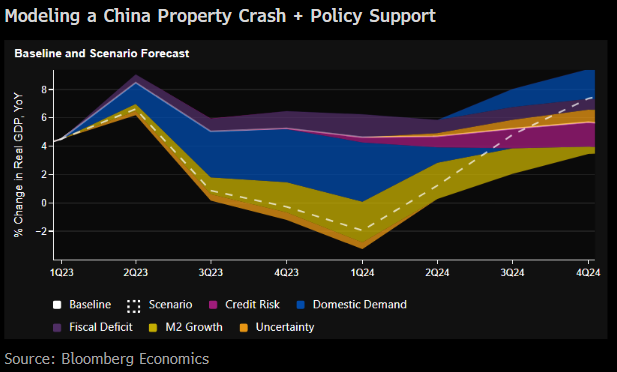

A property crash in China remains a risk, though it's not our team's base case. Our new scenario modeling tool for China shows how a collapse might play out, with a ~6-ppt drag on growth, taking into account the likely policy response. {ECAN<GO>} Via Ana Beatriz Galvao, et al

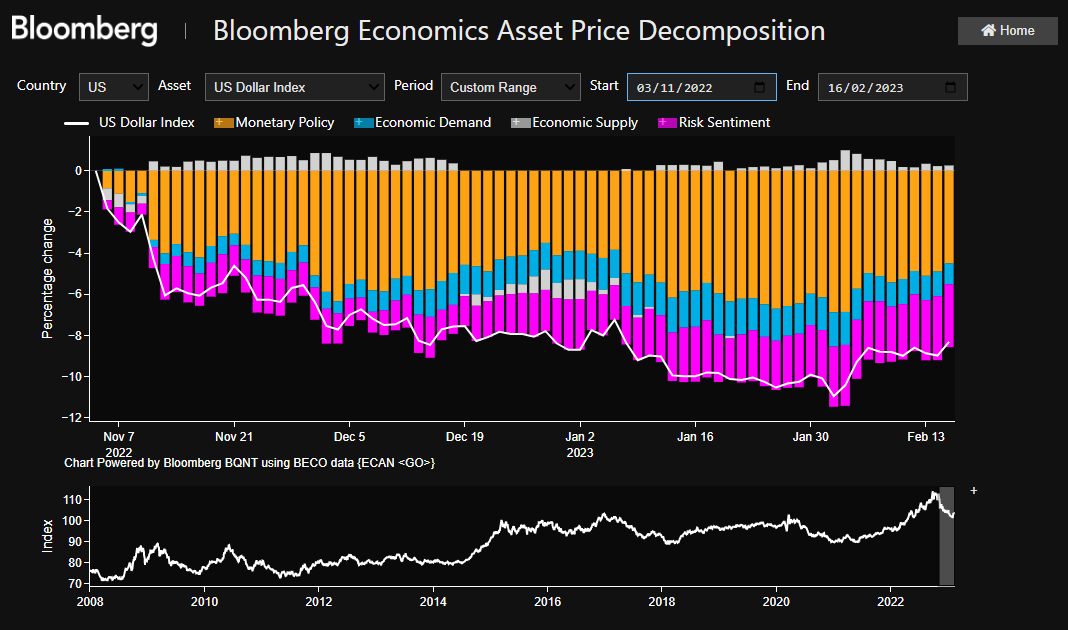

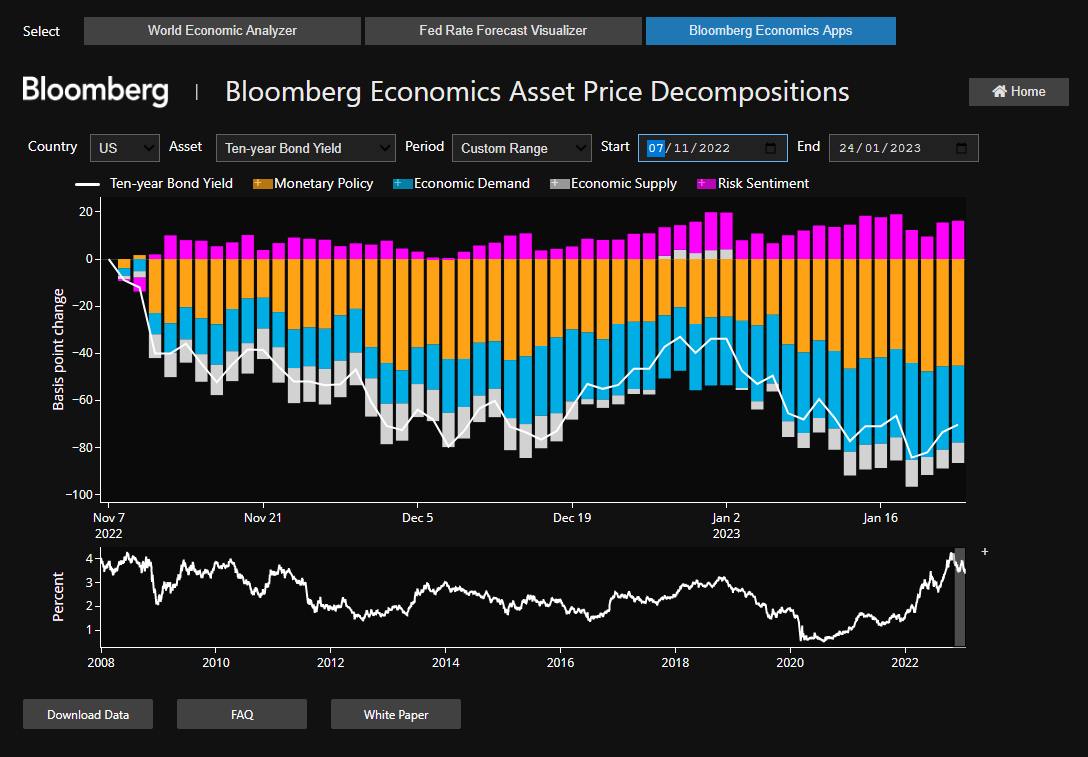

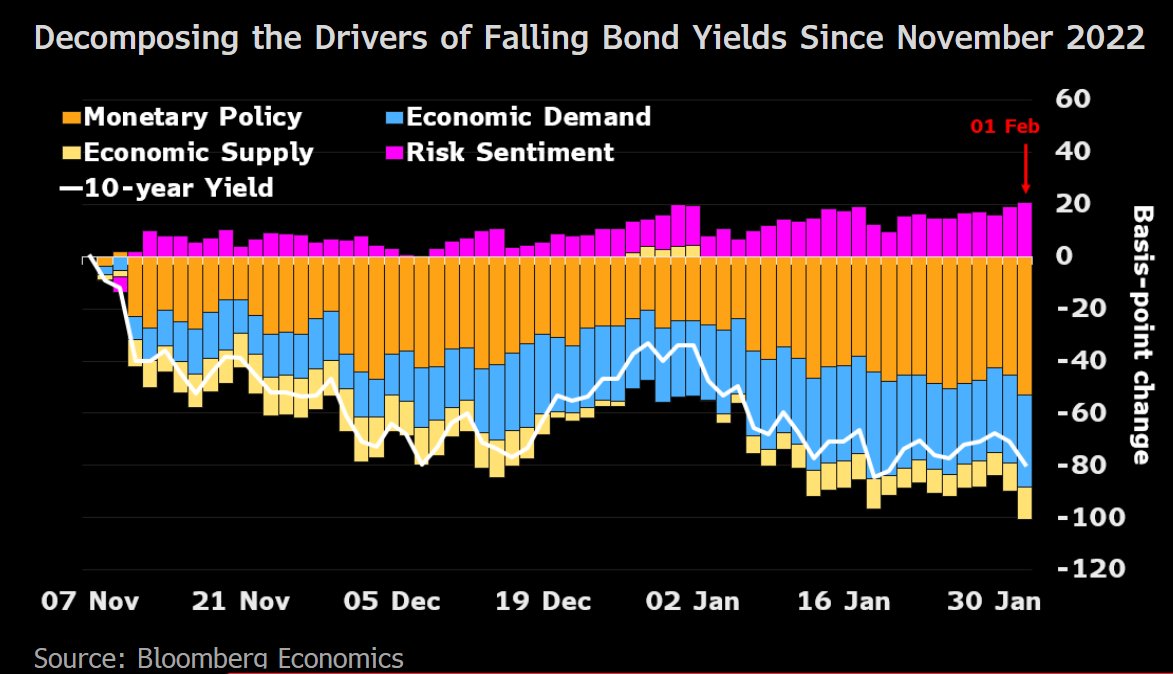

Markets dissented from Powell's hawkish FOMC message.

Bloomberg Economics' model shows expectations of a more dovish Fed driving the fall in yields.

Björn van Roye Anna Wong Bloomberg Economics

Jens Boysen-Hogrefe Rudi Bachmann Martino Ricci Kiel Institute (IfW Kiel) Bhargavi Sakthivel Scott Johnson Scott A. Brave michele lenza Domenico Giannone Juan Antolin-Diaz John Leer Alvaro Ortiz | @BBVAResearch & @IEbusiness Reade Pickert Owen Minde Michael Denicola Michael McDonough Andrea P Ferrero 🇮🇹🇪🇺🇺🇦 Bloomberg Economics tom keene

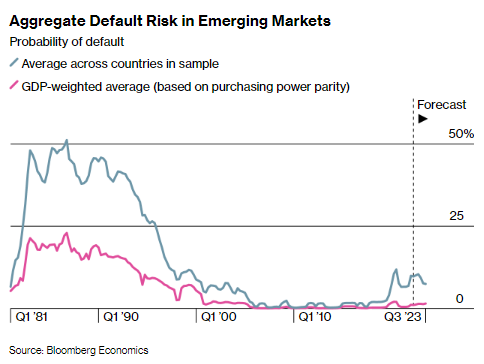

Emerging markets are under pressure from rising debt, slowing growth, and soaring yields

The consolation: A 1980s-style debt crisis looks unlikely

My Bloomberg New Economy piece, with Ana Beatriz Galvao and Scott Johnson

bloomberg.com/news/articles/…

BREAKING NEWS:

The Royal Swedish Academy of Sciences has decided to award the 2022 Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel to Ben S. Bernanke, Douglas W. Diamond and Philip H. Dybvig “for research on banks and financial crises.”

#NobelPrize