So let’s do math:

$500,000 at 5% = $25,000/yr

$750,000 at 5% = $37,500/yr

$1,000,000 at 5% = $50,000/yr

$1,250,000 at 5% = $62,500/yr

$1,500,000 at 5% = $75,000/yr

🔥CDs 5%+

🔥Treasuries 5%+

🔥Dividend stocks 5%+

It’s not that complicated.

Start your #passiveincome plan 🫵💎💃

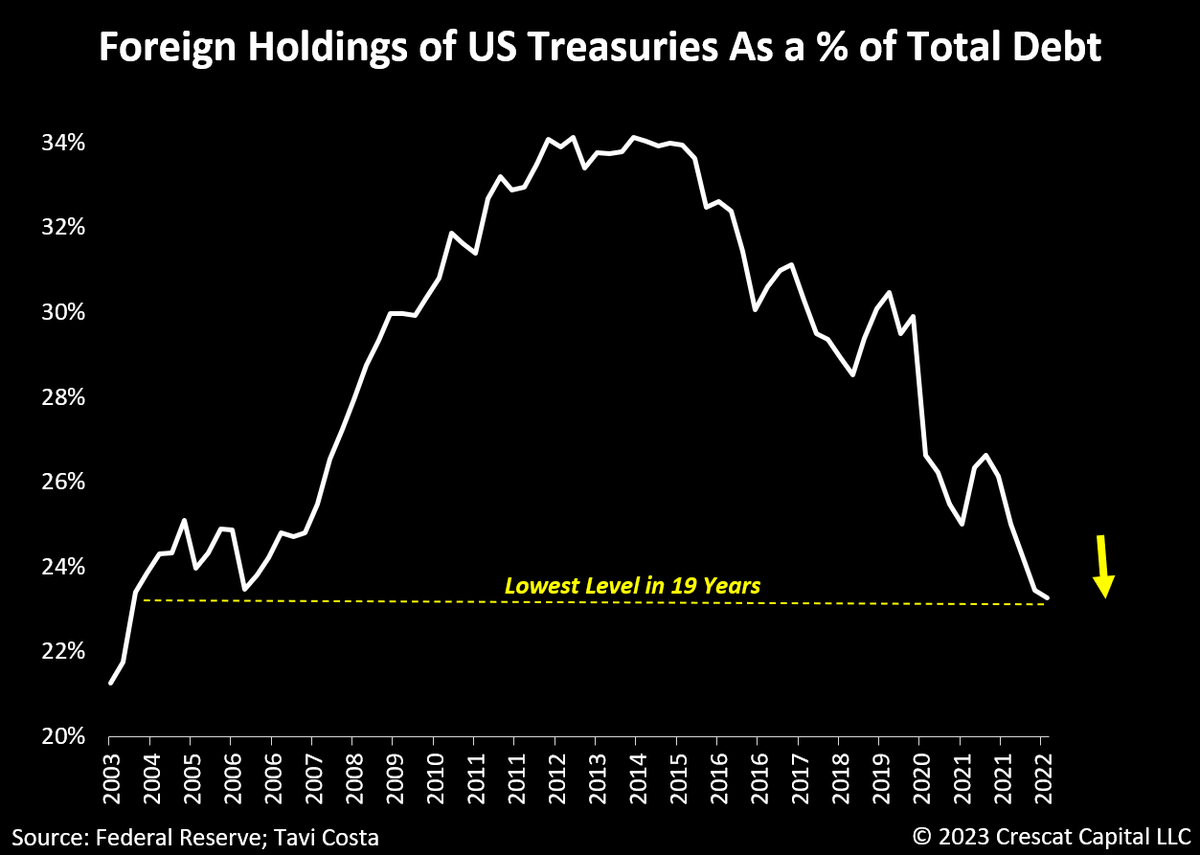

Skyleigh Heinen Bobby Kogan As the US Gov. deficit spends. Who buys the Treasuries? US corporations are the largest holders of US debt. We literally pay corporate America not to pay taxes.

#Circle has sold all #US Treasury bonds in #US DC reserves assets

#Crypto #cryptocurrency #Crypto currencyNews #Crypto News #cryptotrading #Crypto Update #Crypto Update #Web3 #blockchain #Bitcoin #ETH #NFTCommunity coindesk.com/markets/2023/0…