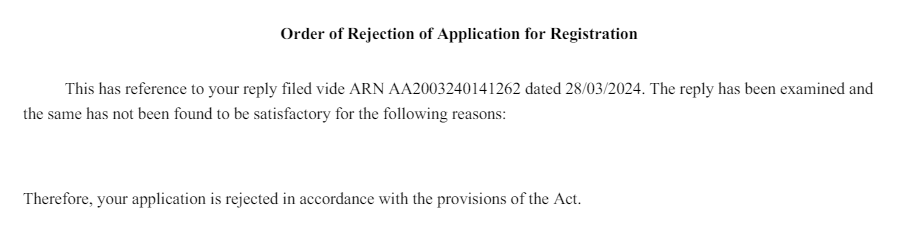

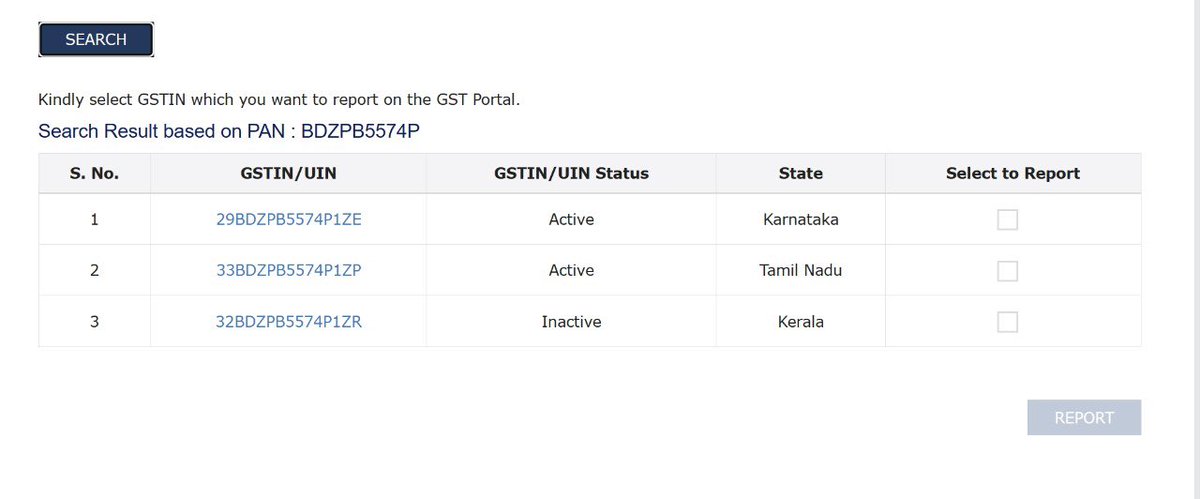

3 fake GSTIN has been taken on my PAN in Karnataka , TN, Kerala. I have complained it on GSTN & in Jaipur GST department on 20.03.24 but still no action has been taken.

I am a common man of this country, kindly take me out from this fraud.

CBIC

Nirmala Sitharaman (Modi Ka Parivar)

PMO India

Register the GST number of your company through Registration Guru.

For more information

Call us:- 9811536872

Visit us:- registrationguru.in/gst-registrati…

Email us:- [email protected]

#Gst #Gst registration #Gst tax #tax #TaxCompliance #registrationguru #GSTIndia #TaxFiling #GSTIN

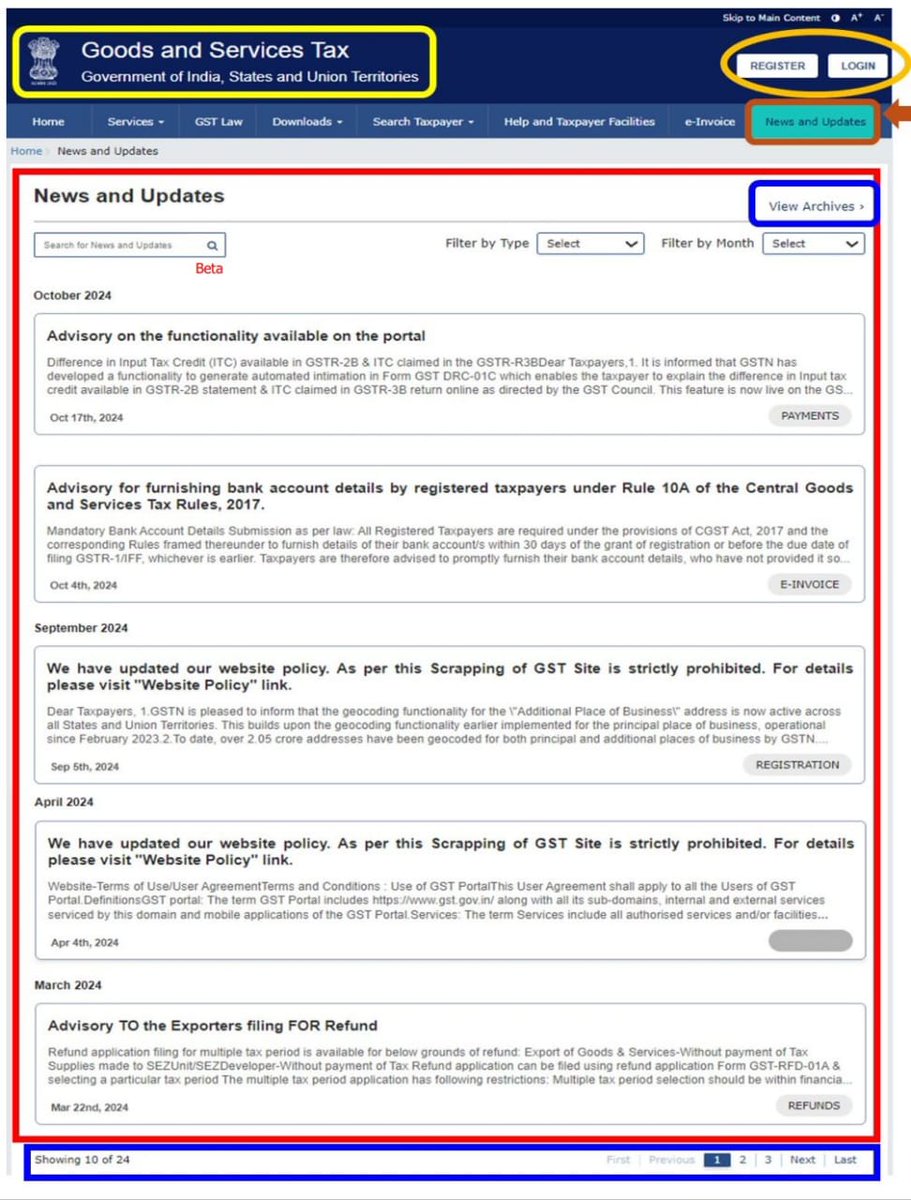

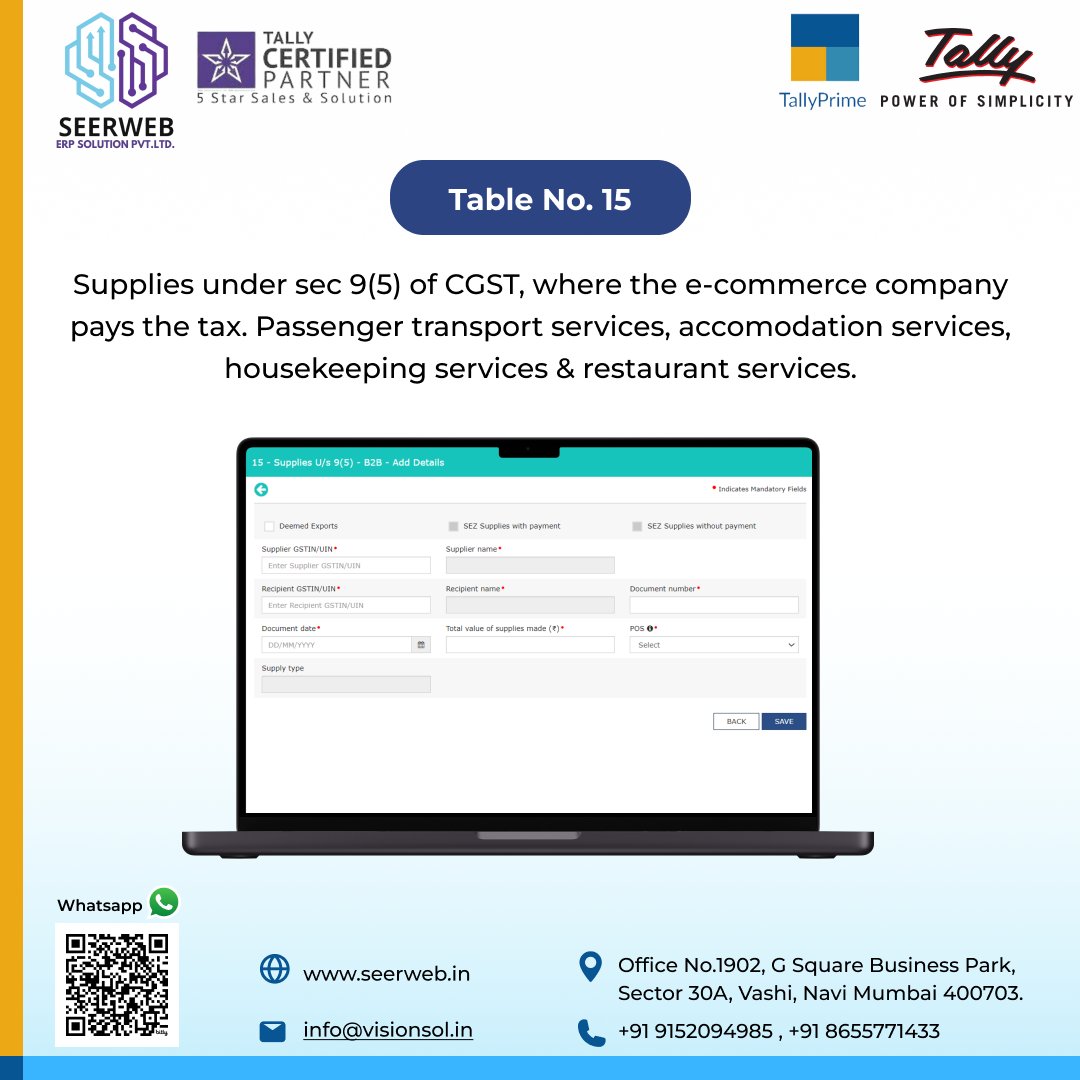

Stay updated! From January 2024, GSTIN introduced two new tables in GSTR-1 - Table 14 & Table 15.

Learn more with Seerweb.

📞+91 9152094985 / +91 8655771433

✉️[email protected]

Visit our website: seerweb.in

#GST #GST R1Update #seerweb Tally Solutions

GST Tech GST Insights 🇮🇳 GST Council Nirmala Sitharaman (Modi Ka Parivar)

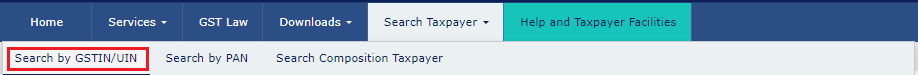

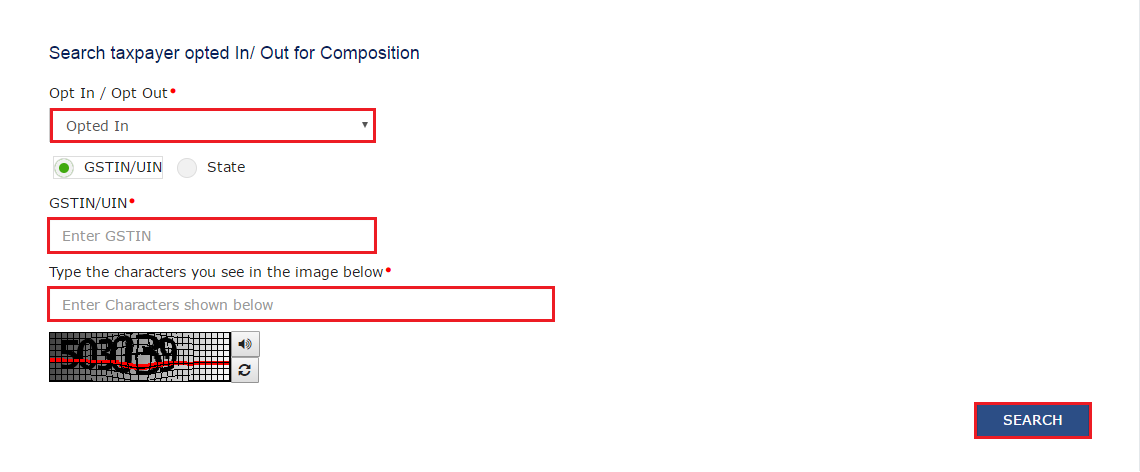

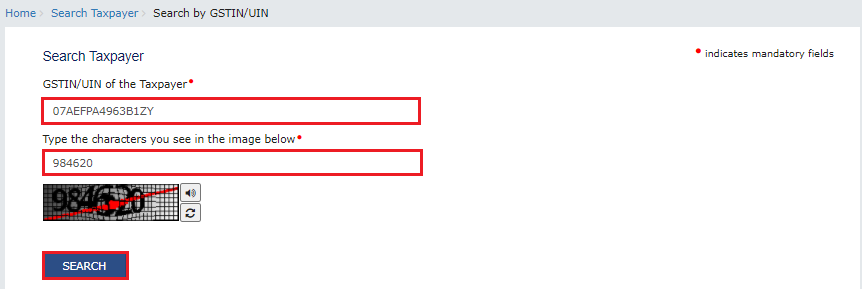

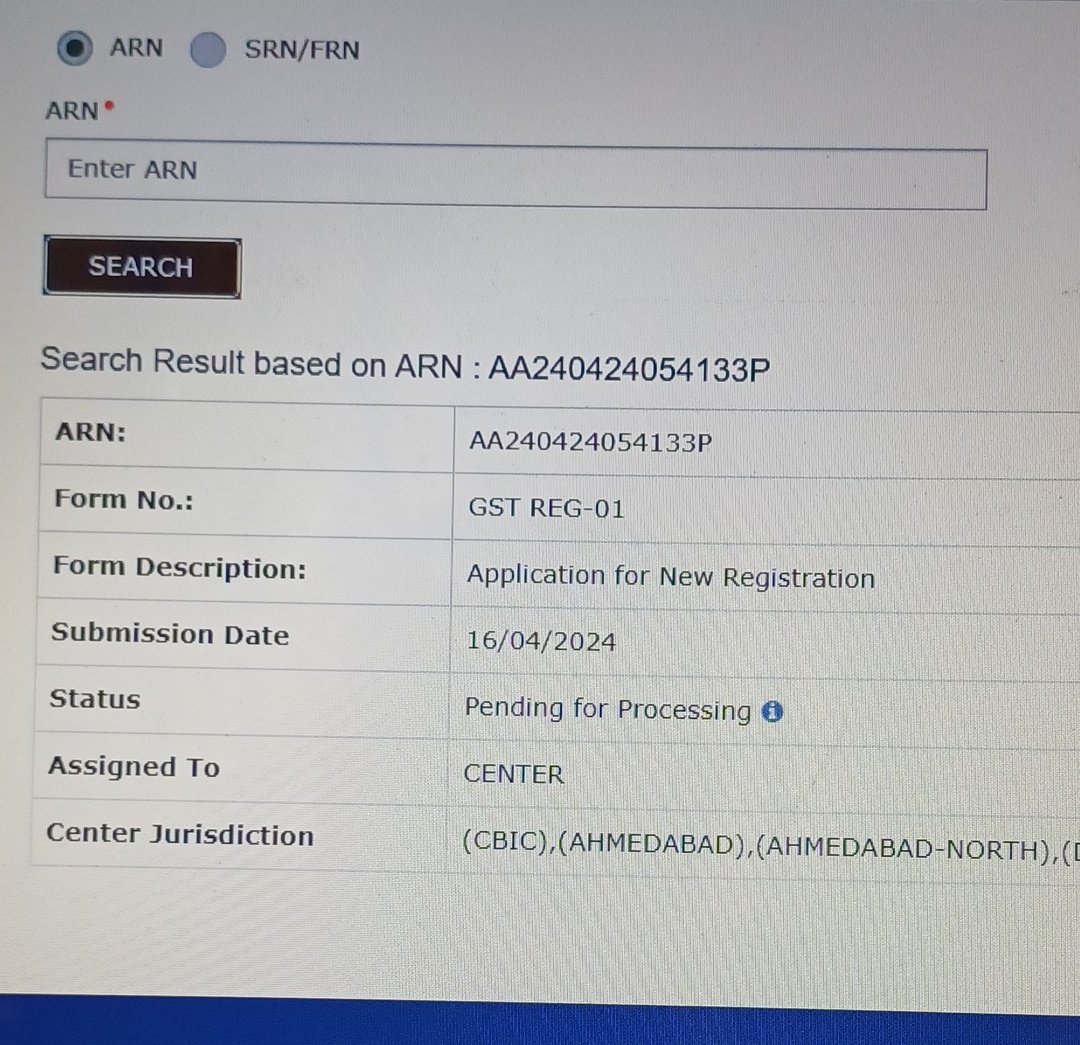

Kindly provide us the Gstin as 7 working days alelready have passed after my Gstin Application th Form Reg 01. Please provide the Gstin at the earliest...

Ficus retusa Available

Pls connect- 9319643200

GSTIN-09PDVPS0678M1Z0

Solar Landscape Chartered Institute of Horticulture

Veirdo please return my order and refund money in bank account, no customer support agent is available.

Please specify your gstin no.

Jago Grahak Jago Jaago Grahak

Provision providing for cancellation of GSTIN for non-filing of GST returns should be done away with as it serves no exact purpose. And more so because the revocation of GSTIN later on, is a murky affair.

PMO India: Report Card @PMOIndia