#HouseHunters

Hold up...grandma passed 10 years ago and there's still $400k on the mortgage?

Did someone refinance and pocket that money?

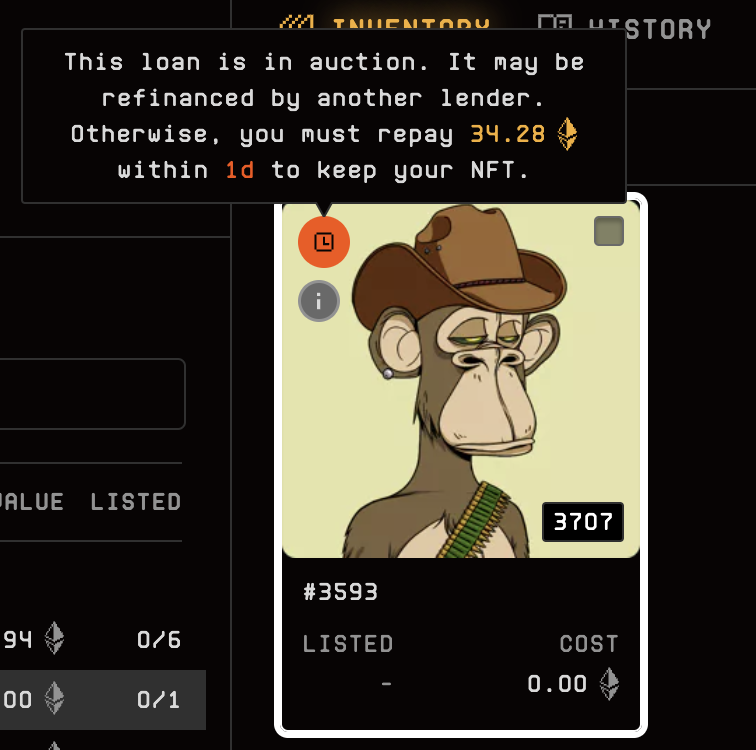

Nolukhanyo Reneilwe Mzozoyana (Laundry Girl) It’s like taking two loans at once the other one is higher say R150k the other one is R50k you pay 150k in instalment over 6-7 years but the R50k you will pay it later… I’m saying two loans at once because I know after 6-7 years you won’t have R50k cash so you will refinance.