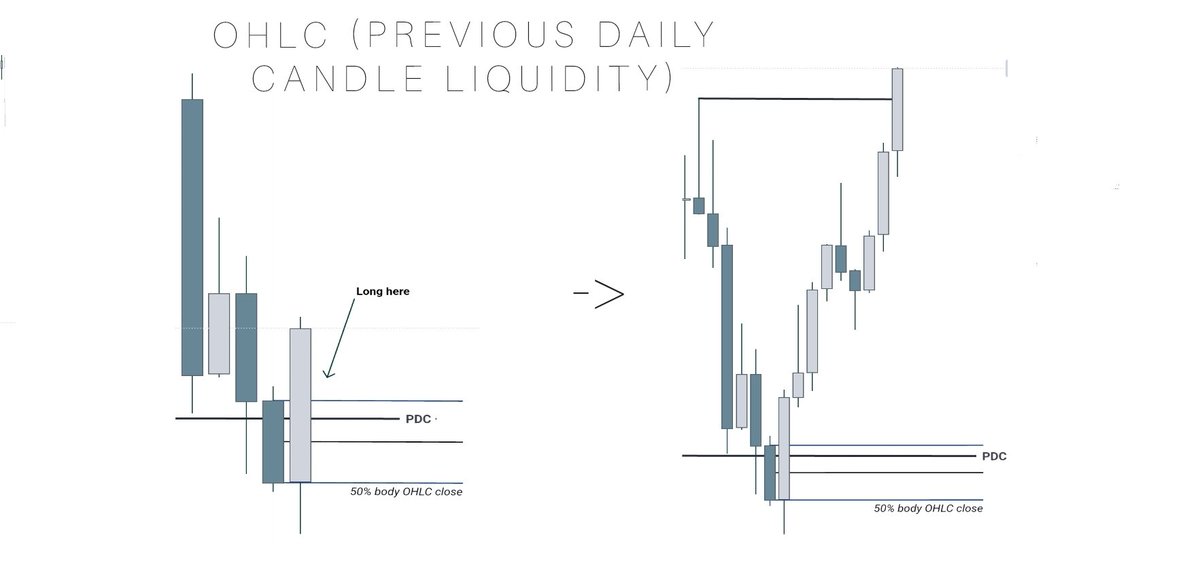

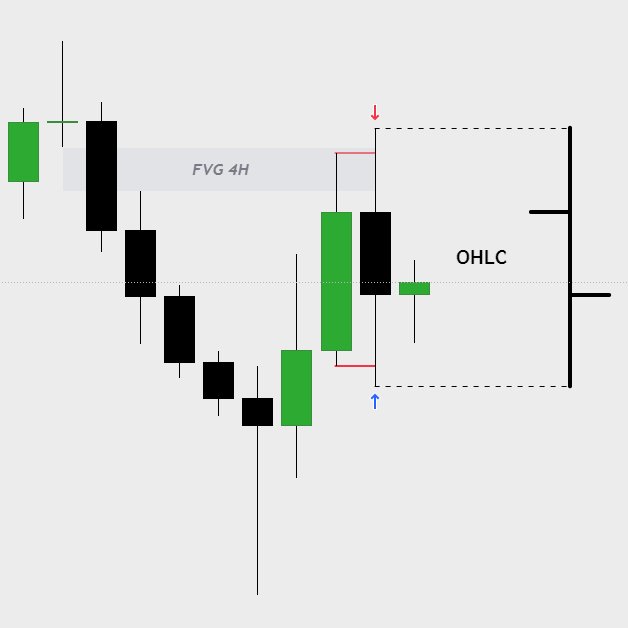

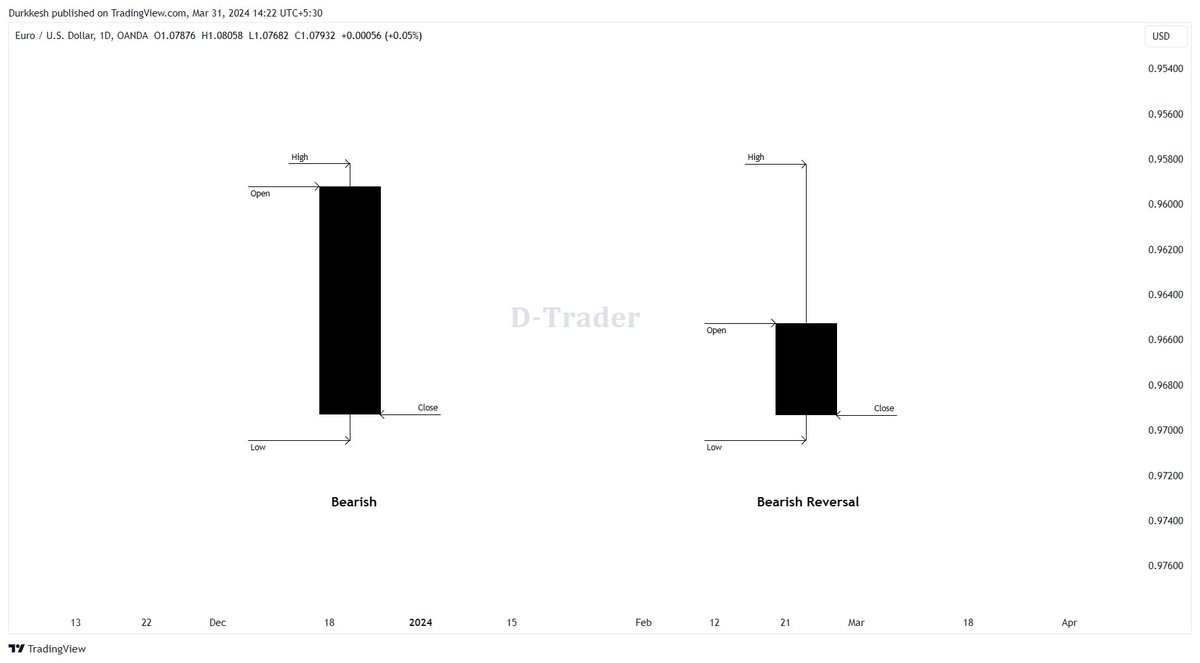

OHLC

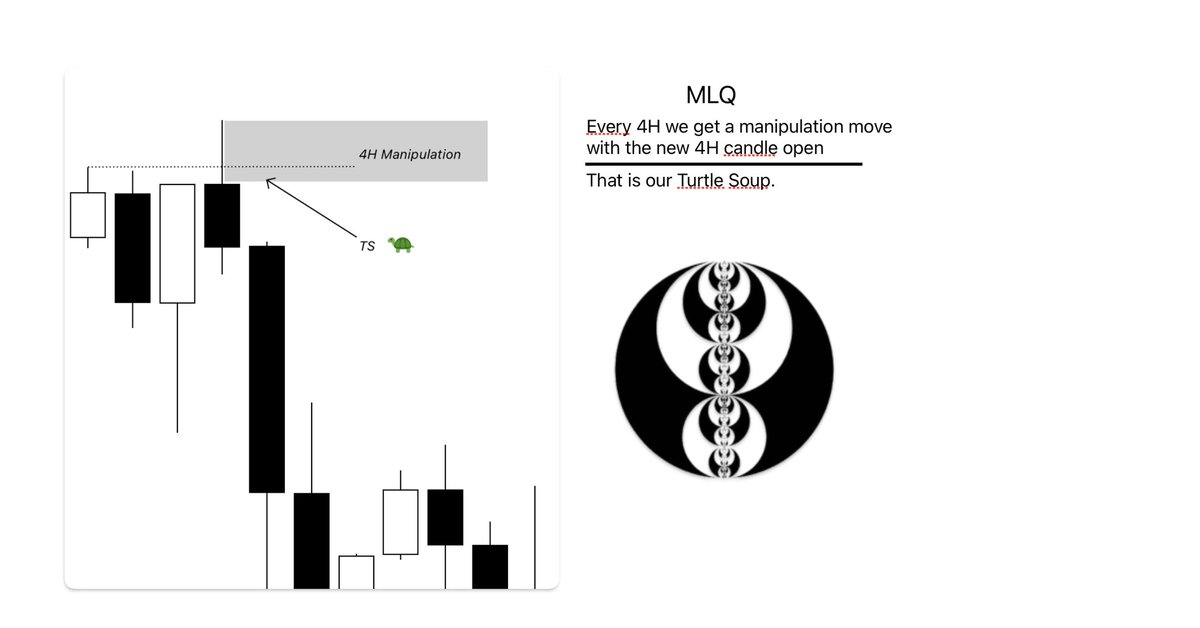

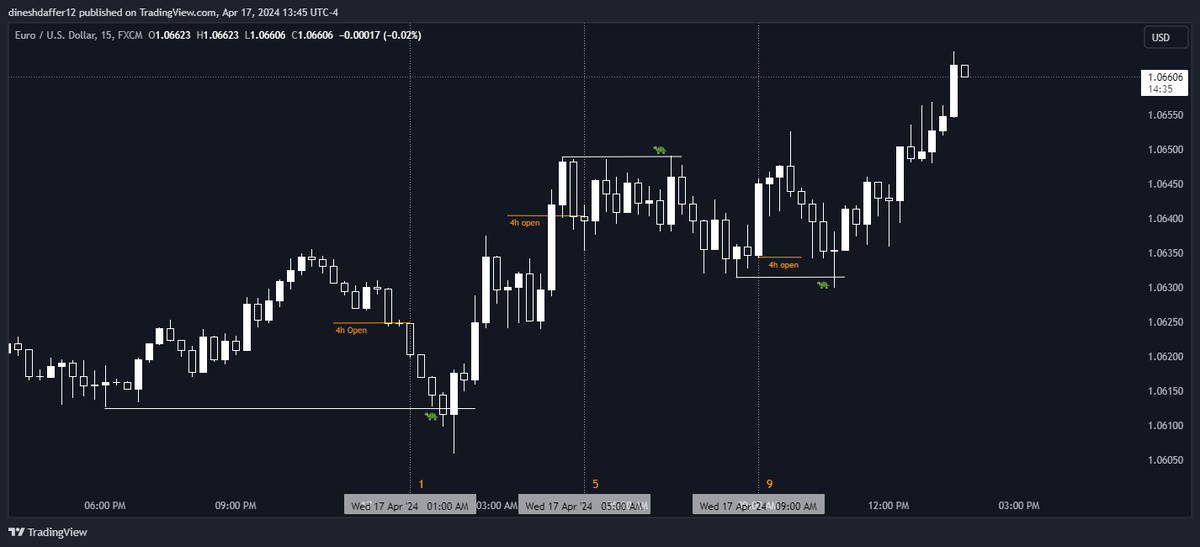

Don't overcomplicate the most basic thing you can trade. Many will regurgitate the same information and slap on a new label or name.

This has been around since the dawn of trading.

The Inner Circle Trader has taught this as well

Here it is for free: