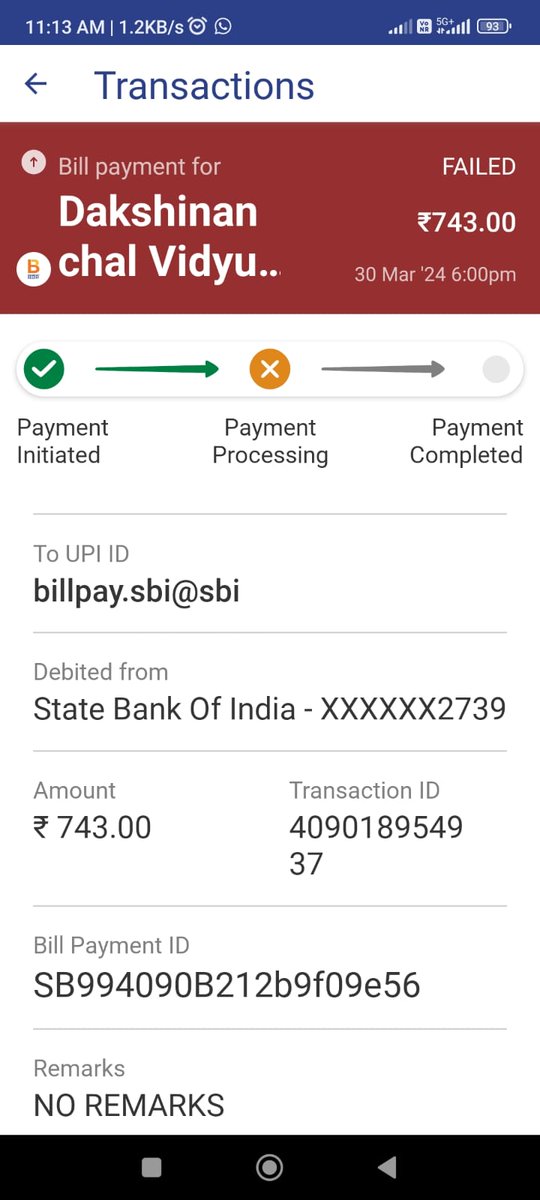

Hello BHIM State Bank of India ReserveBankOfIndia 2 times this is 13 th day money is not credited in my account .

This is 3rd time I tweet for this transaction.

Plz look in this ASAP.

Transaction failed but amount debited IFFCO TOKIO Paytm State Bank of India kindly refund my money UPI ReserveBankOfIndia

ReserveBankOfIndia Ministry of Finance NPCI BHIM Nirmala Sitharaman Office DFS why Bank of India imposing service charge on #Aeps transaction . Why should we pay ₹29 on first transaction in a month, In remote areas Aeps is backbone of banking.

The RuPay on the go four of the Match between KolkataKnightRiders & Rajasthan Royals goes to Sunil Narine

#TATAIPL | RuPay | #KKRvRR

Someone has fraud with me through Airtel payment bank, please help ReserveBankOfIndia Google Pay India Consumer Affairs BBR Airtel Payments Bank airtel India UPI

Hugging Face Victor NVIDIA AI Pathway (www.pathway.com) Local RAG has benefits. Especially around privacy.

Folks like NPCI, own the entire stack because security and privacy are paramount for them!

For your organization, you need to deeply assess if local RAG + complications around the journey of data make sense.

The RuPay on the go four of the Match between Gujarat Titans & Delhi Capitals goes to Rashid Khan

#TATAIPL | RuPay | #GTvDC

Axis Bank Support big time fraud this guy is calling and offering RuPay credit card he is sending fake otps...

Delhi Police Cyber Dost immediately take action

Is it just me or payments via HDFC Bank Tata Neu RuPay aren't going through.

TechnoFino Card Maven Ankur Mittal Card Insider Amazing Credit Cards Deals On Plastic CreditCardz #ccgeek NebulaWorld EnViCi Gajender Yadav Rewarding Spends || Kumar Satish Kumar Agarwal Hitesh