#BankIndia down by 10%..

Even after posting good results!!

Q-O-Q

• Sales ⬆️ 20%

• Net Profit ⬆️ 11%

• GNPA ⬇️ to 4.98% from 7.31%

• NNPA ⬇️ to 1.22% from 1.66%

I think it's a good opportunity..

What do you think??

Disclaimer: Not a recommendation to buy or sell.

เห็นจิ๋วววแว้วว ปิ๊ปๆ พิพึกยิ้มน่ารักง่า

CHAWARIN At 15thNTRJ

#ซีนุนิวที่งานนาฏราช

#นาฏราชครั้งที่15

#NuNew

Happy Birthday to the Hon Minister THE HONORABLE MINISTER LOUIS FARRAKHAN. Here is the minister in Feb 2024 at the age of 90. The most powerful tool against negativity is being an example of excellence in all its dimensions. NNPA REVOLT L.A. Sentinel News The Final Call News #HowToEatToLive #NOI

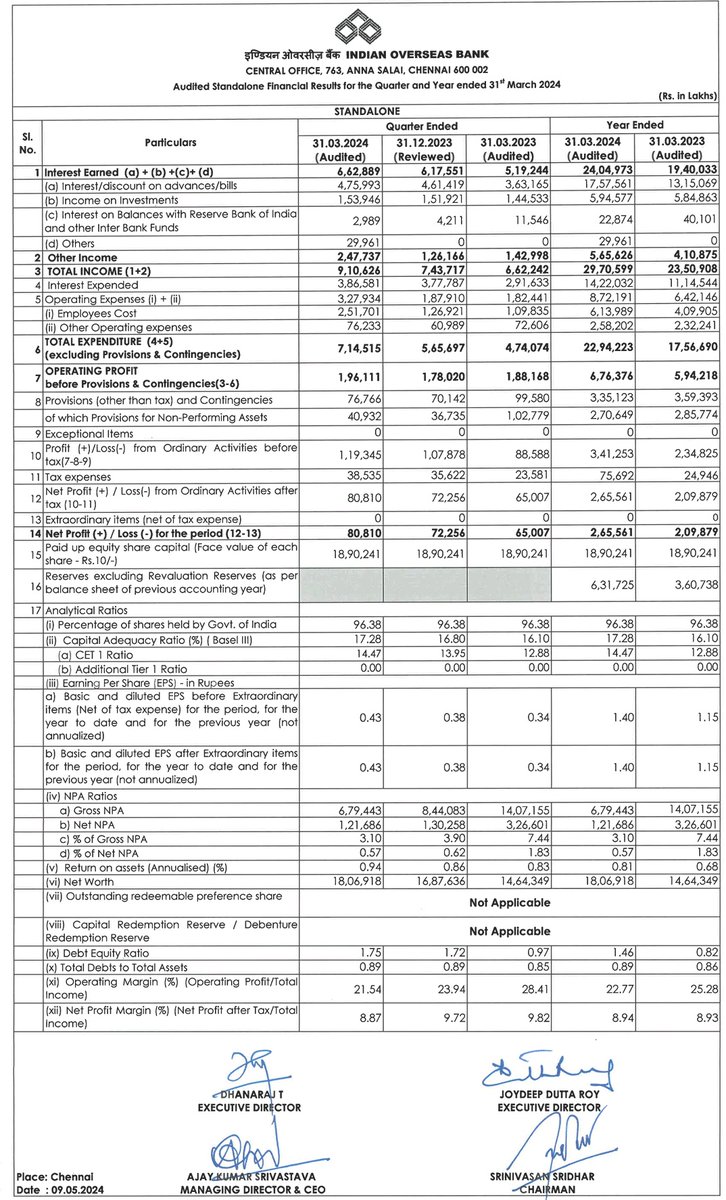

#IOB declares its #Q4Results today

Total Income- ₹9106 Cr vs ₹6622Cr

PAT- ₹808.1 cr vs ₹650 cr (YoY) 24.3%🔺

NII - ₹2,763.2 cr Vs ₹2,276.1 cr (YoY) 21.4%🔺

GNPA -3.10% vs 3.90% (QoQ)

NNPA -0.57% vs 0.62% (QoQ)

#KLRahul

#stockmarketcrash

#StockMarket

#nifty50

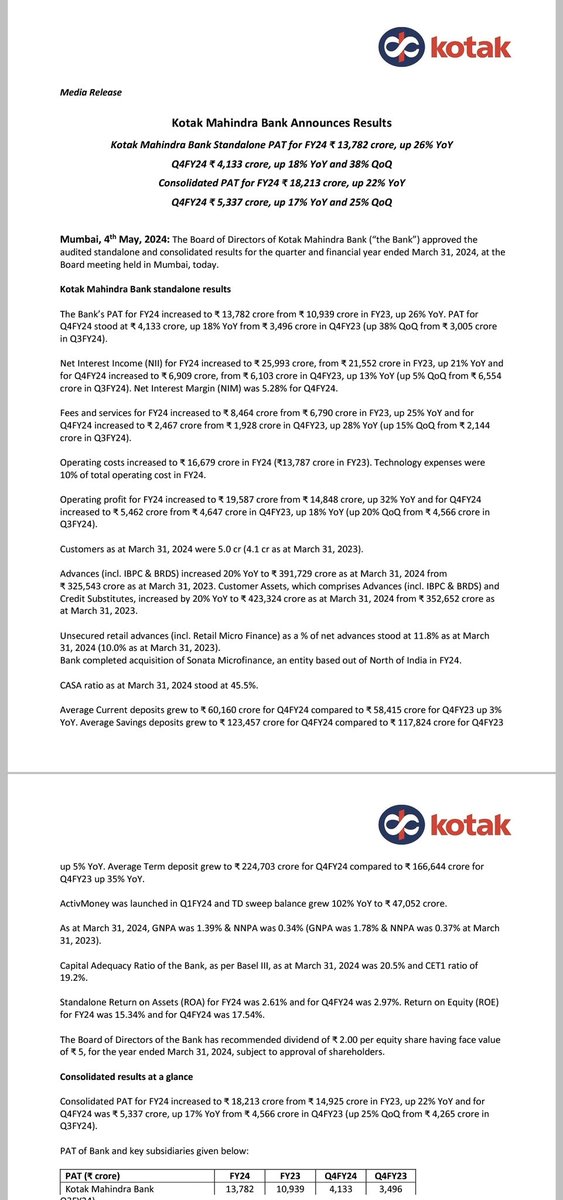

#kotakbank

Good numbers

fy24 PAT 13782 / 10939 cr ⬆️ 26% yoy Q4 PAT 4133/ 3496 cr ⬆️18%

Q3 3005 cr

NII 6909/ 6103 cr ⬆️13%

Customers 5/ 4.1 cr yoy

CASA ratio 45.5%

GNPA 1.38/ 1.79% yoy

NNPA 0.34/ 0.37%

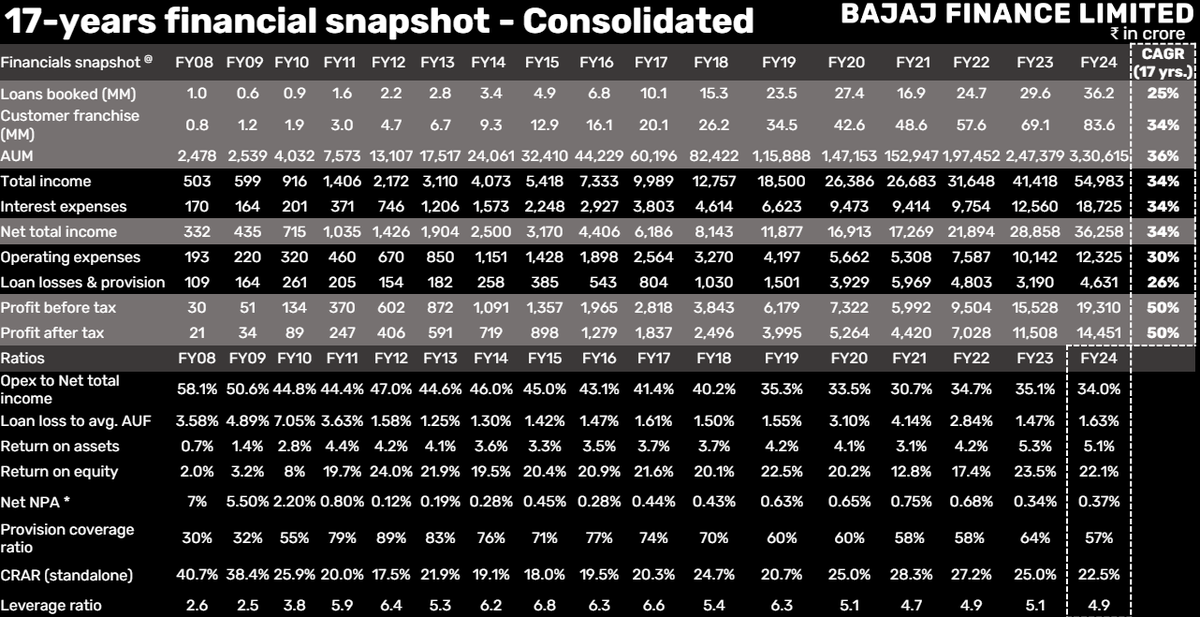

Bajaj Finance🔻6 %

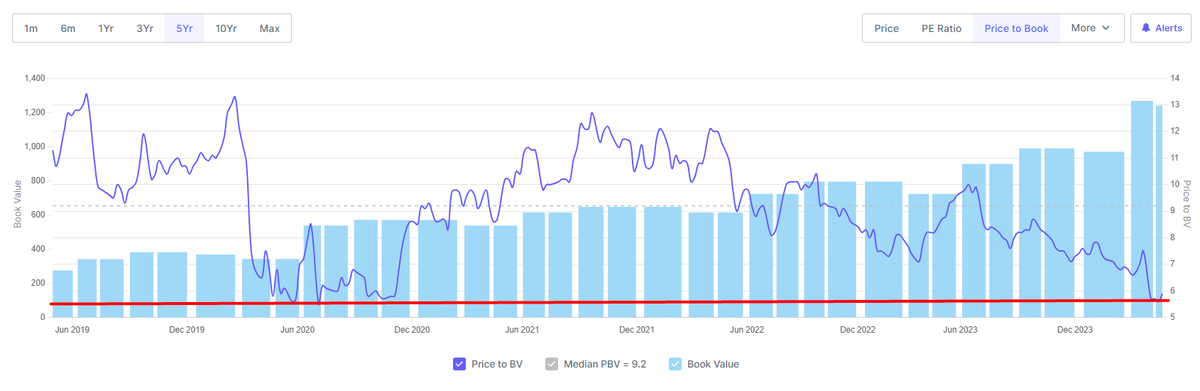

Currently at lowest ever valuations, Will you add ?

Latest P/B - 5.4

5 Year Median P/B - 9

Net Worth - 76,695 Cr

Long Term Guidance

- AUM : 25-27 %

- Profit Growth : 23-24 %

- NNPA : 0.4-0.5 %

- ROE : 21-23 %

#BAJAJFINANCE #BAJFIN #Bajajfinance

#PNB declares its #Q4Results today

Total Income - Rs 32361 Cr Vs Rs 27269 Cr (YoY) 🔺

Net Interest Income- Rs 10363 Cr Vs Rs 9498 Cr 🔺9.1%

PAT - Rs 3010.3 Cr Vs Rs 1158.6 Cr 🔺

GNPA - 5.73% Vs 6.24% 🔻(+ve)

NNPA- .73% Vs .73% 🔻( +ve)

#Dividend of Rs 1.5/sh

#stockmarketcrash

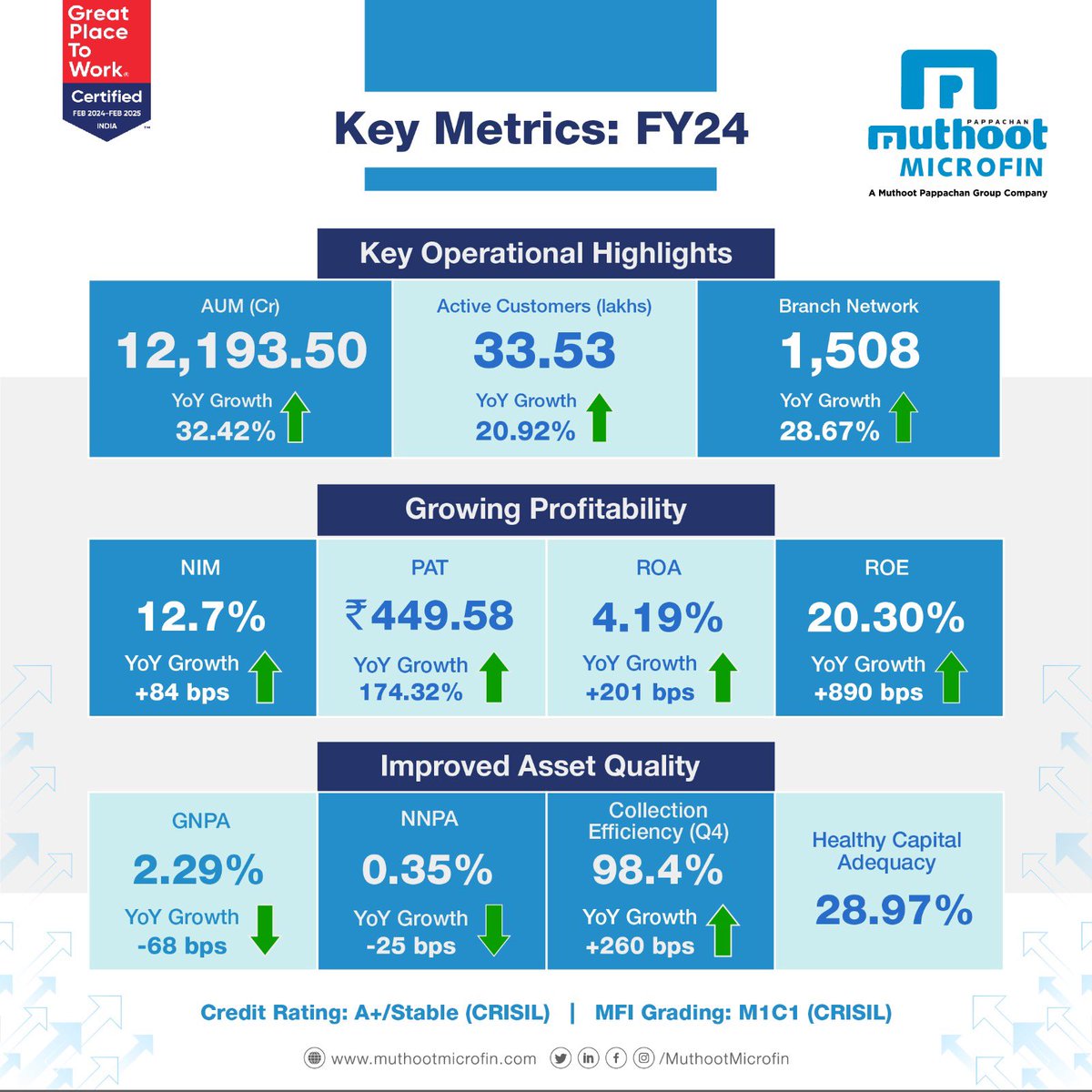

FY24 was a landmark financial year for Muthoot Microfin

- Highest disbursement in single FY ₹10,661 cr

- Highest number of new branches opened in a single year 336 ( overall branch network 1508)

- Highest ever PAT of ₹449.6 crore

- Robust asset quality with NNPA 0.35%, GNPA…

Medgar Evers, Rep. Clyburn, Among Nineteen Honored with Presidential Medal of Freedom — NNPA NEWSWIRE — “The National Newspaper Publishers Association (NNPA) j — blackpressusa.com/?p=1101001

Stacy Brown Media NNPA Dr. Benjamin F. Chavis, Jr. Joe Biden The White House Repekka Clyburn