#4QWithCNBCTV18 | Equitas Small Finance Bank reports #Q4Results

Net profit at ₹207.6 cr vs CNBC-TV18 poll of ₹207.3 cr

#4QWithCNBCTV18 | Equitas Small Finance Bank reports #Q4Results

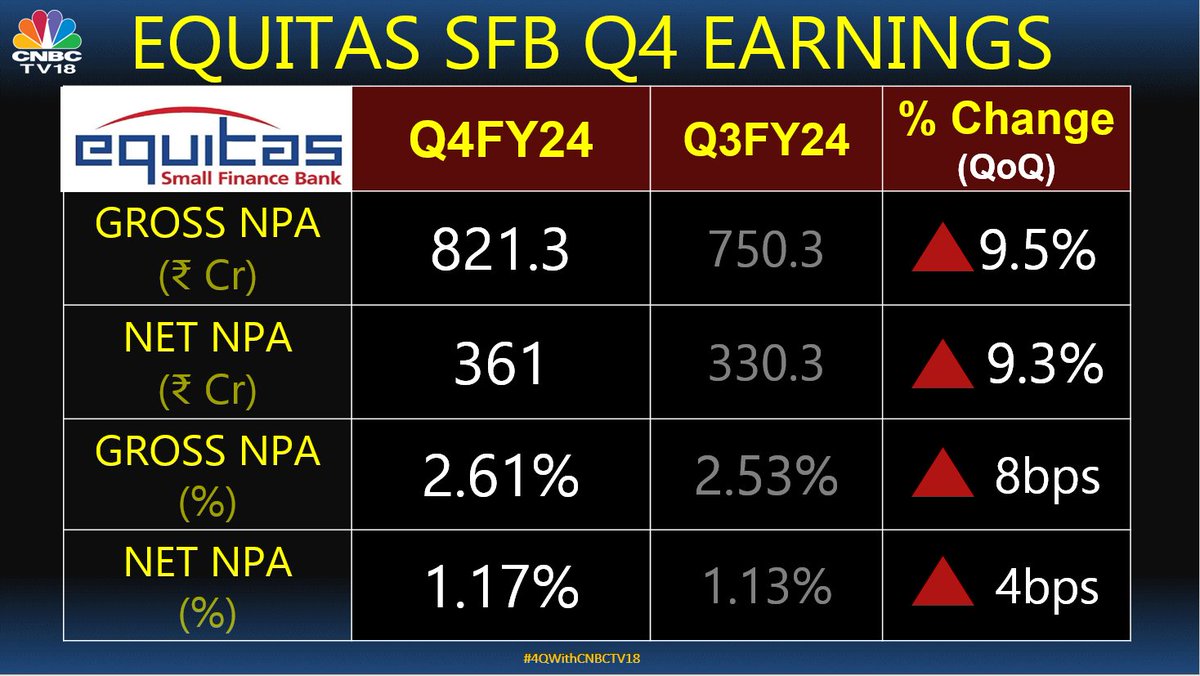

Gross NPA at ₹821.3 cr vs ₹750.3 cr (QoQ)

Here's more👇

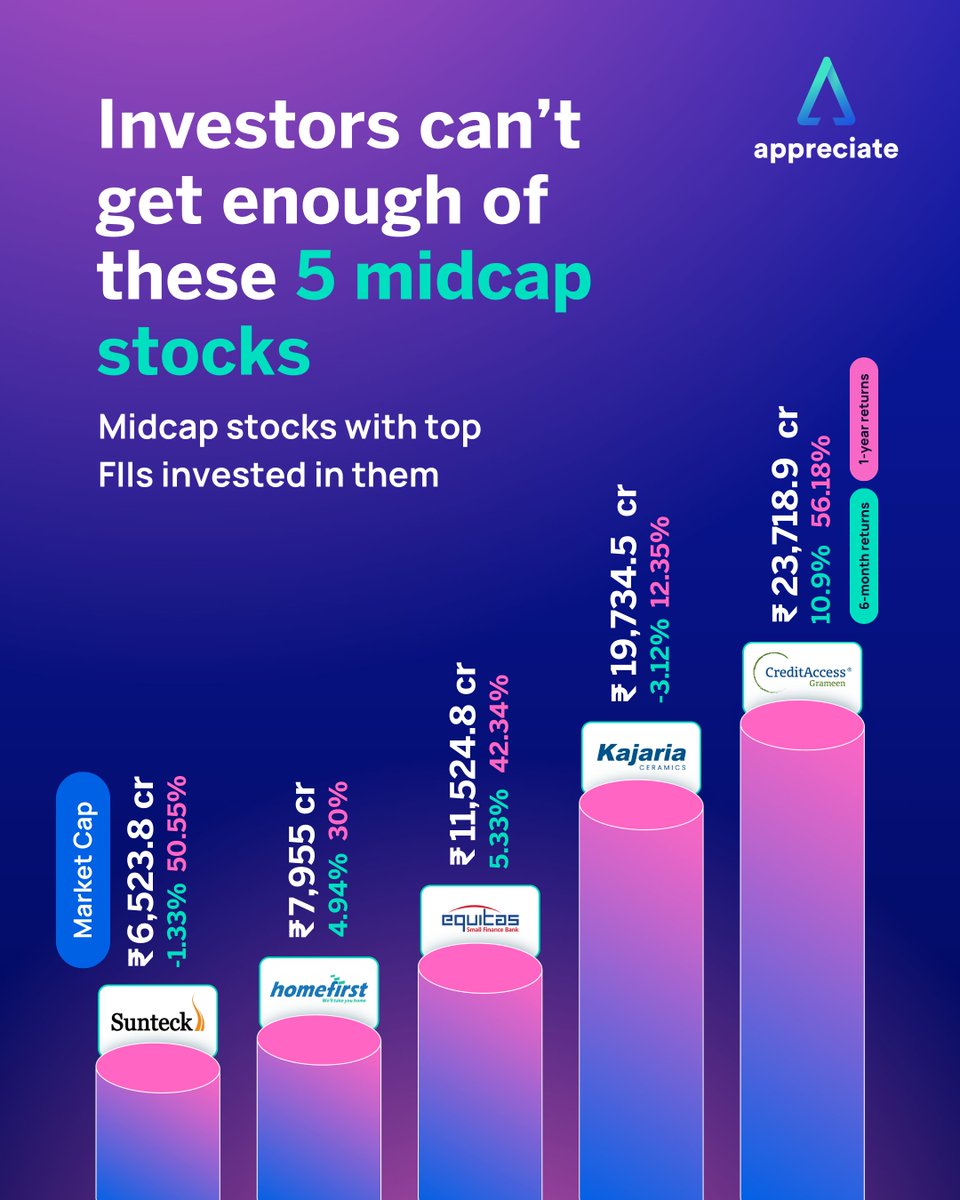

Equitas Small Finance Bank

#EquitasSmallFinanceBank #EQUITASBNK

#Q4FY24 #q4 results #results #earnings #q4 #Q4withTenshares #Tenshares

EQUITAS SMALL FINANCE BANK LIMITED Q4 RESULT FY24

#englopath

#Consolidated_Q4_Result_FY24

#EquitasSmallFinanceBankLimited

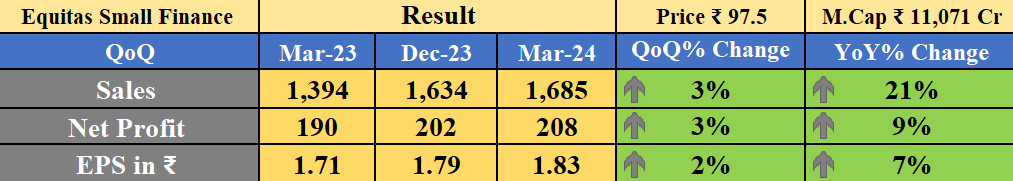

Equitas Small Finance Bank Result

-YoY ↑

-QoQ ↑

#banknifty #Nifty #Nifty Bank #nifty50 #stockmarketcrash #midcapnifty #smallcap #SmallCaps #EquitasSmallFinance

#Q4Results #Q4FY24

#equitassmallfin

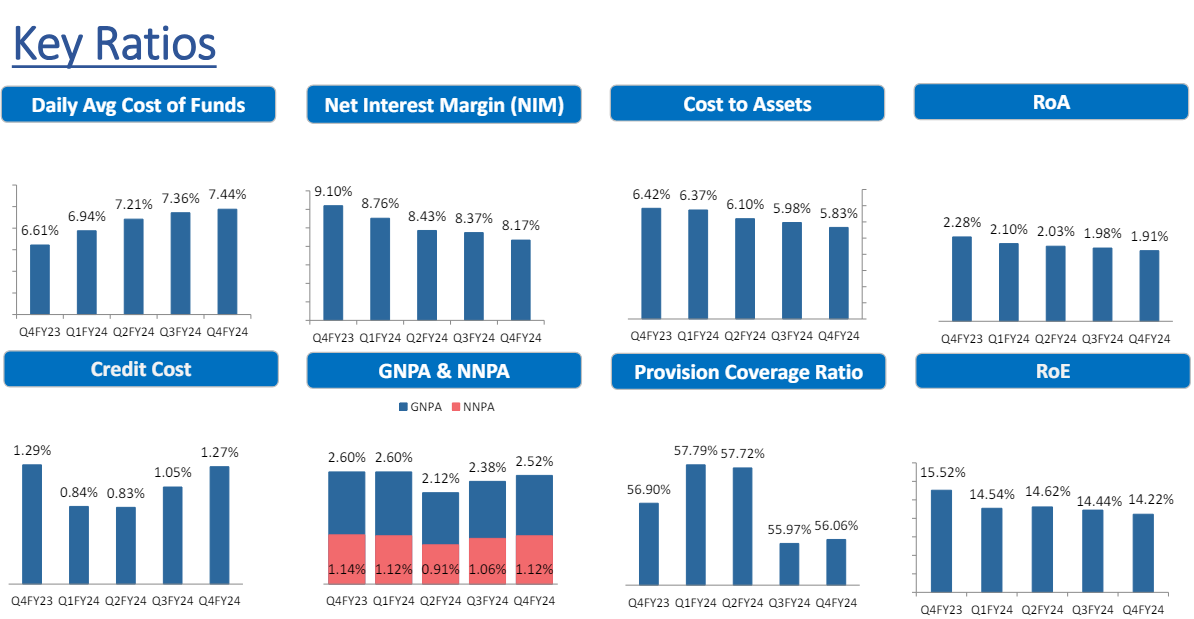

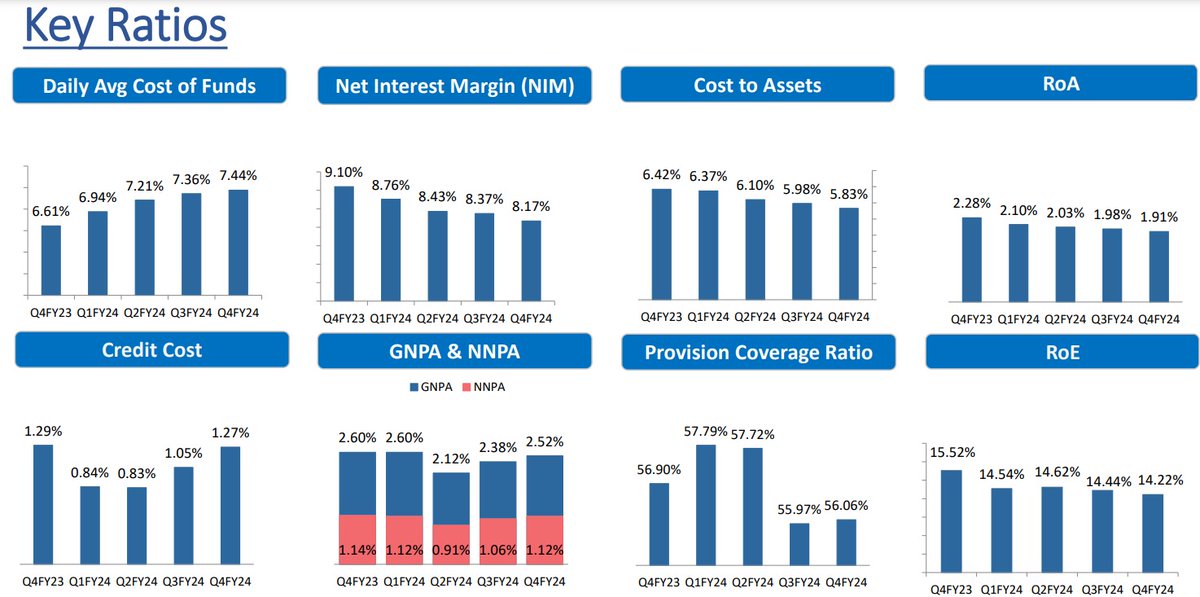

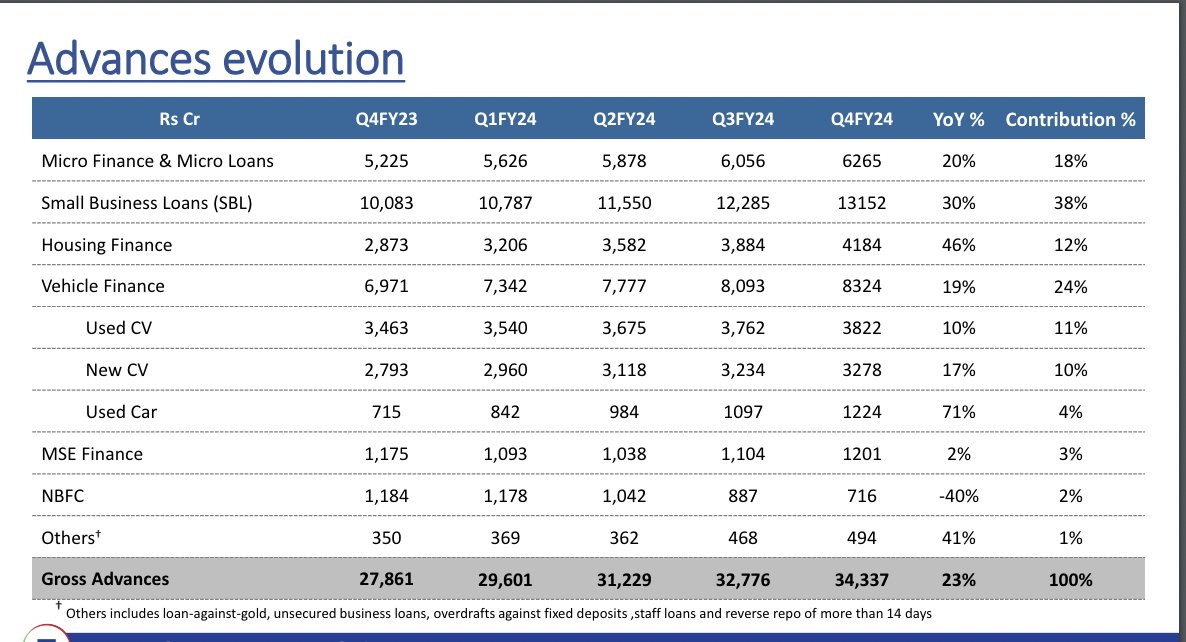

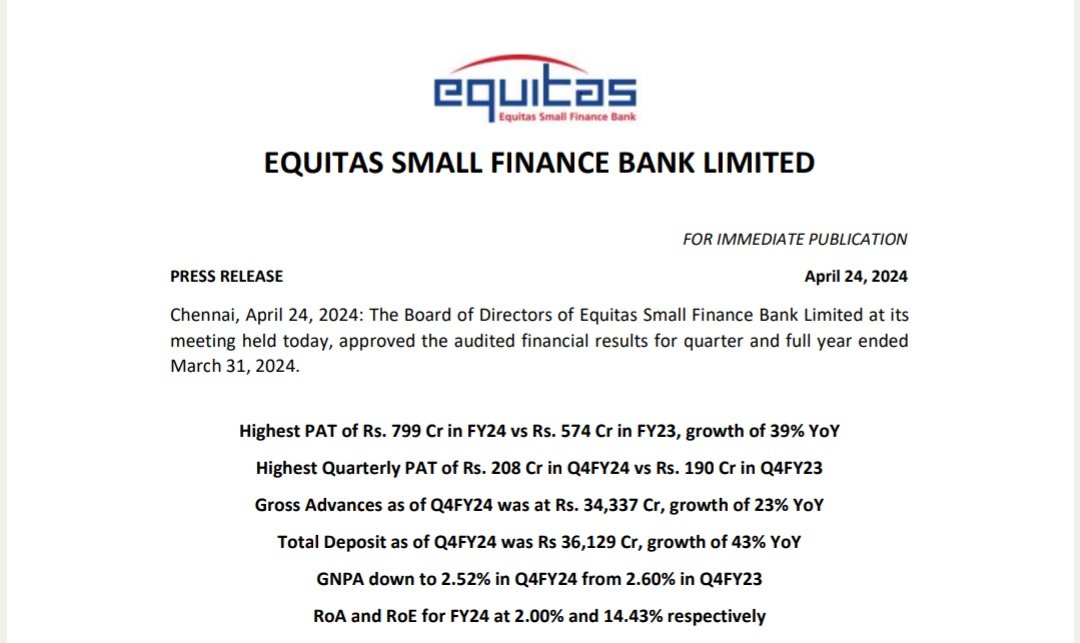

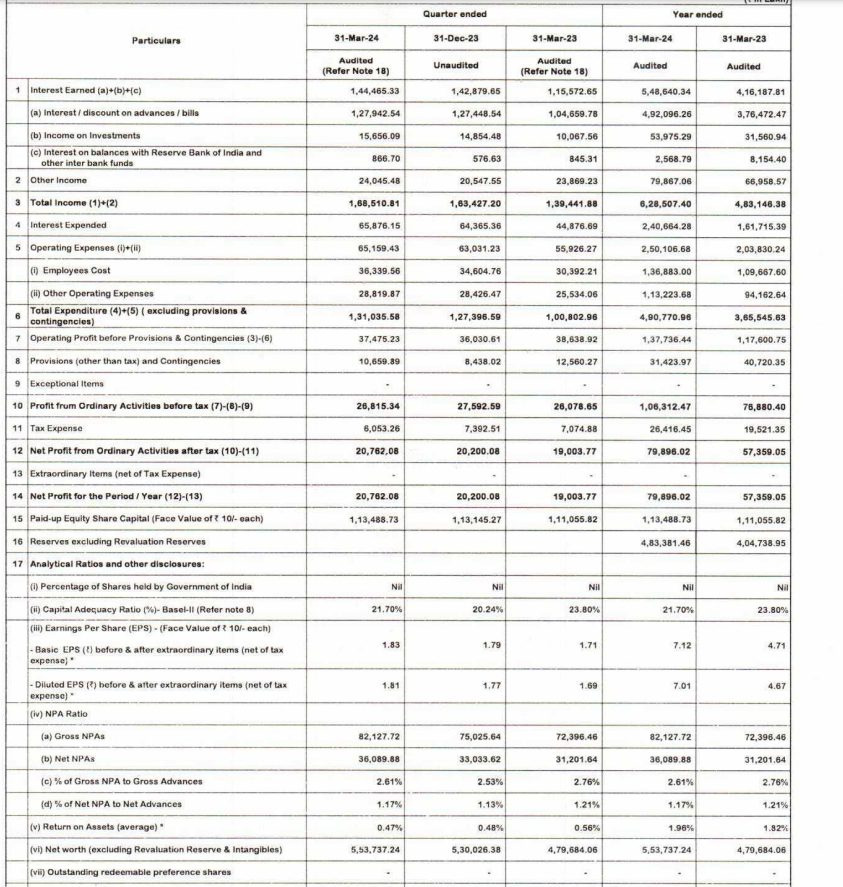

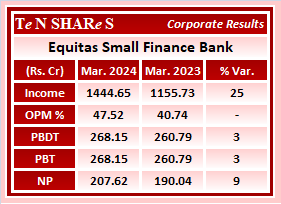

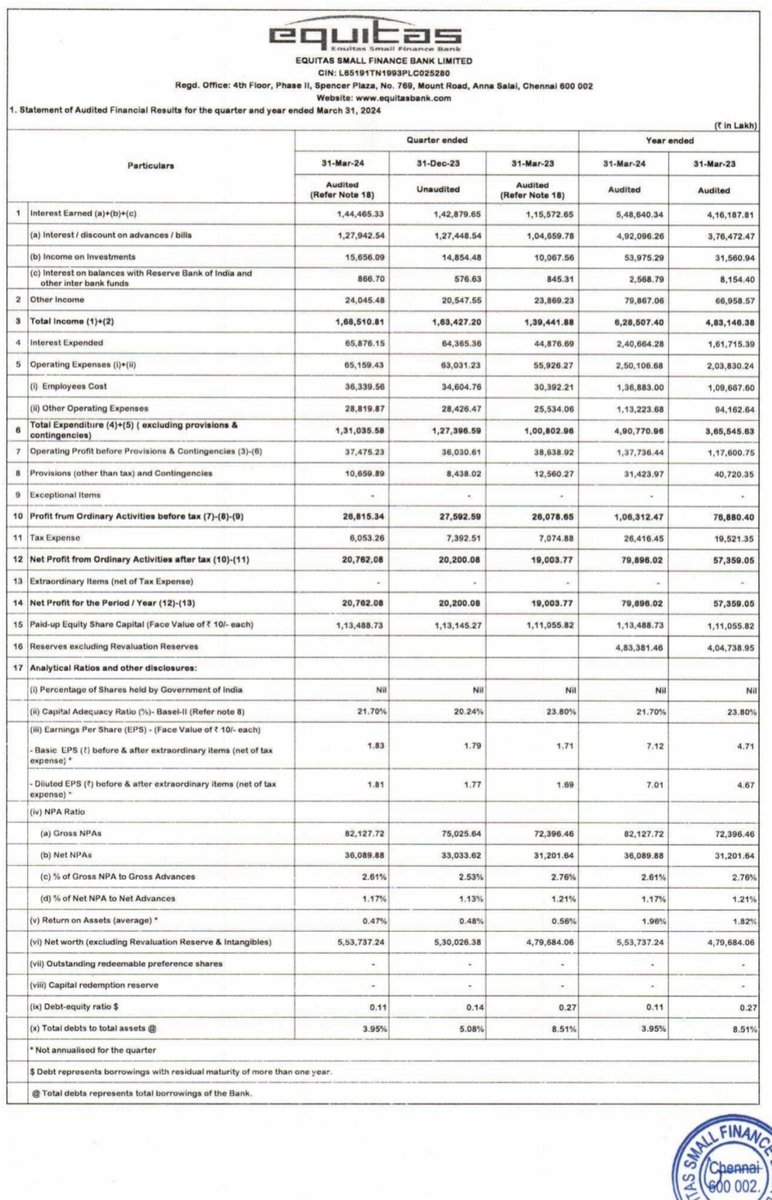

The Equitas Small Finance Bank has reported its financial results for the quarter ending March 31, 2024, with several key takeaways:

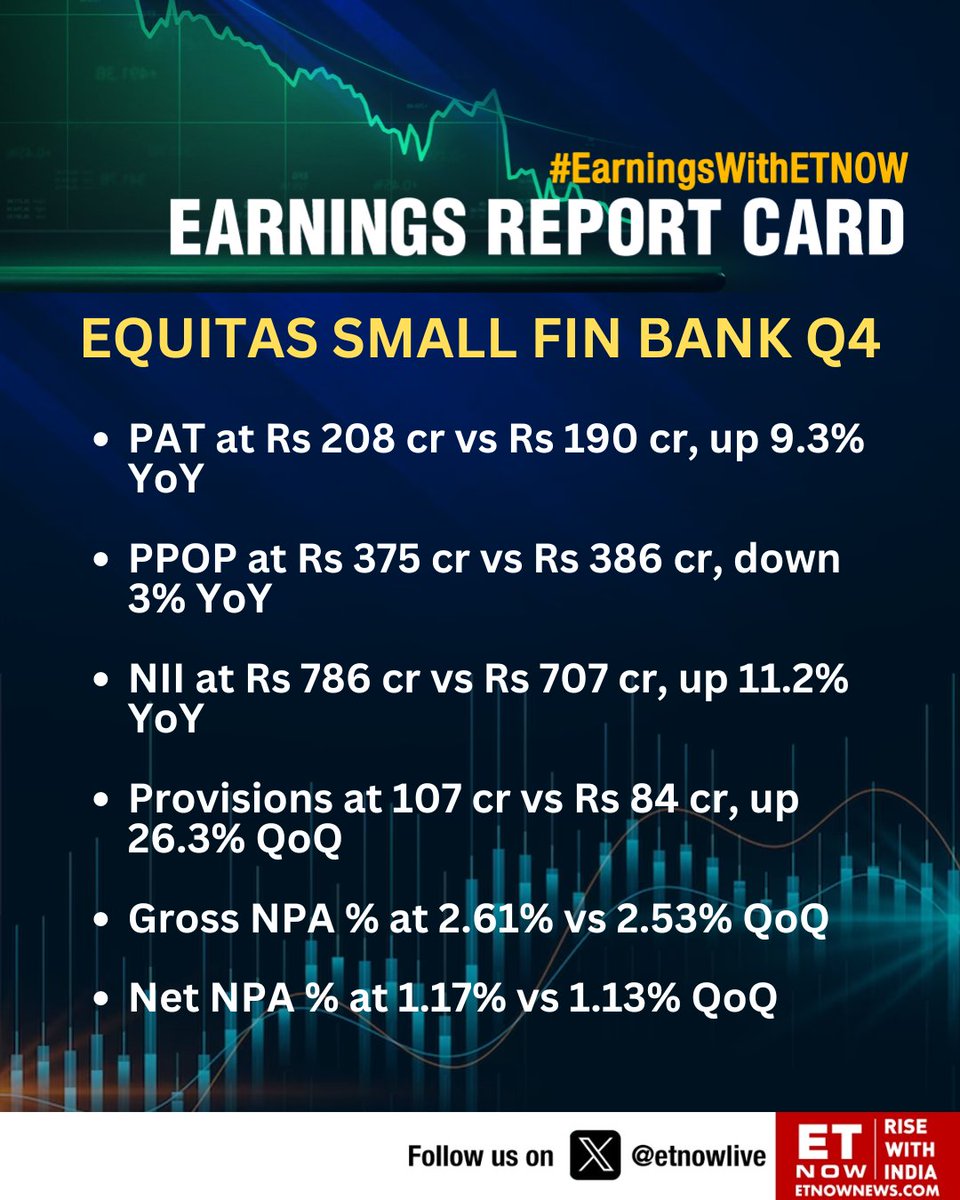

1. The bank's net profit after tax (PAT) for the quarter was Rs 207.62 crore, marking a year-on-year (YoY)

☎️ Con-call Highlights - #EquitasSmallFinanceBank Ltd

## Equitas Small Finance Bank Q4 FY24 Earnings Call: Key Takeaways

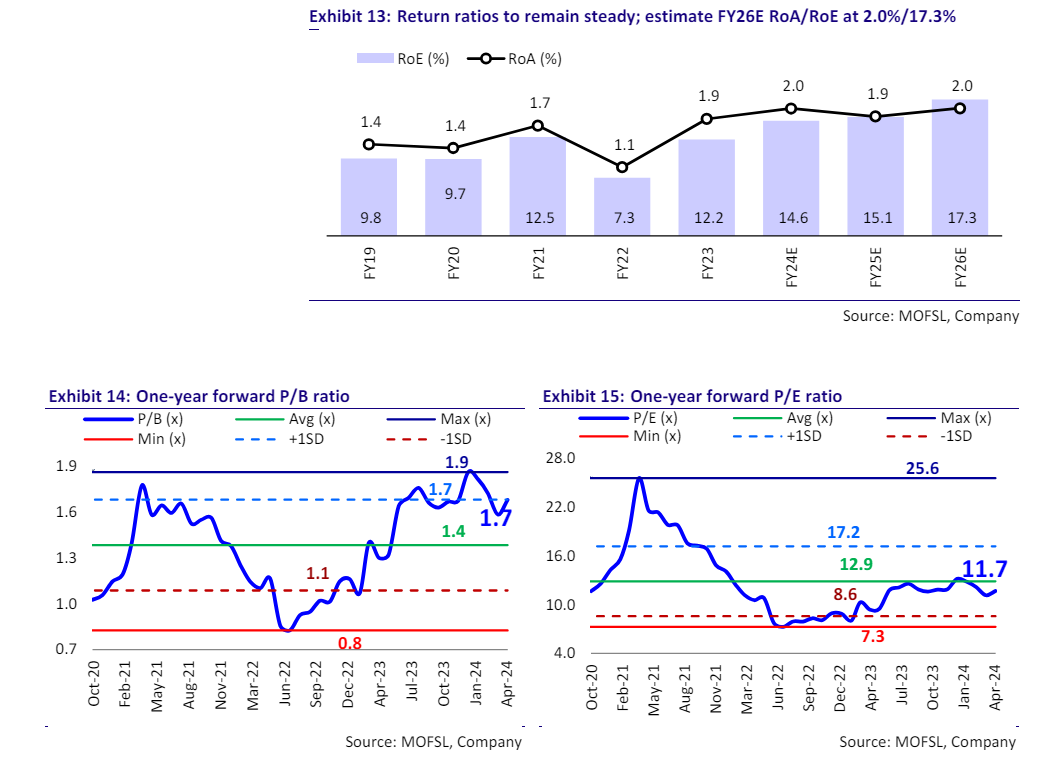

**Financial Performance:**

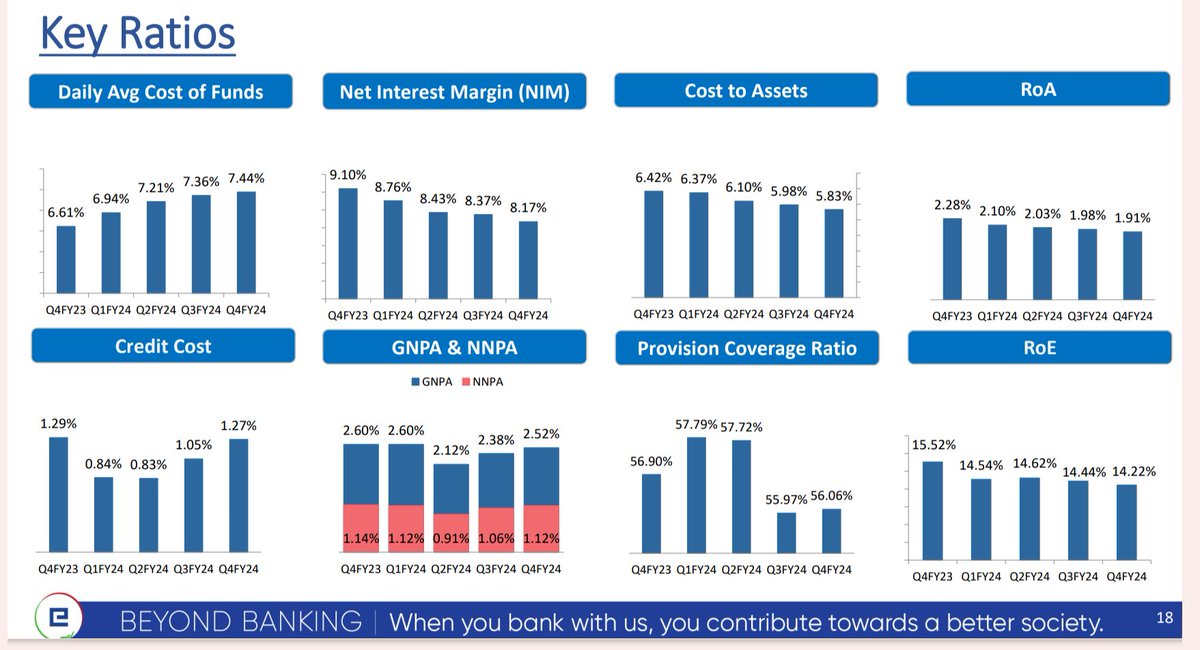

* **Profitability:** The bank delivered a strong bottom line, with a 11% YoY growth in net interest income and a 9% YoY growth