#Annapurna Swadisht😋🍲

Swadisht results by the co.💥

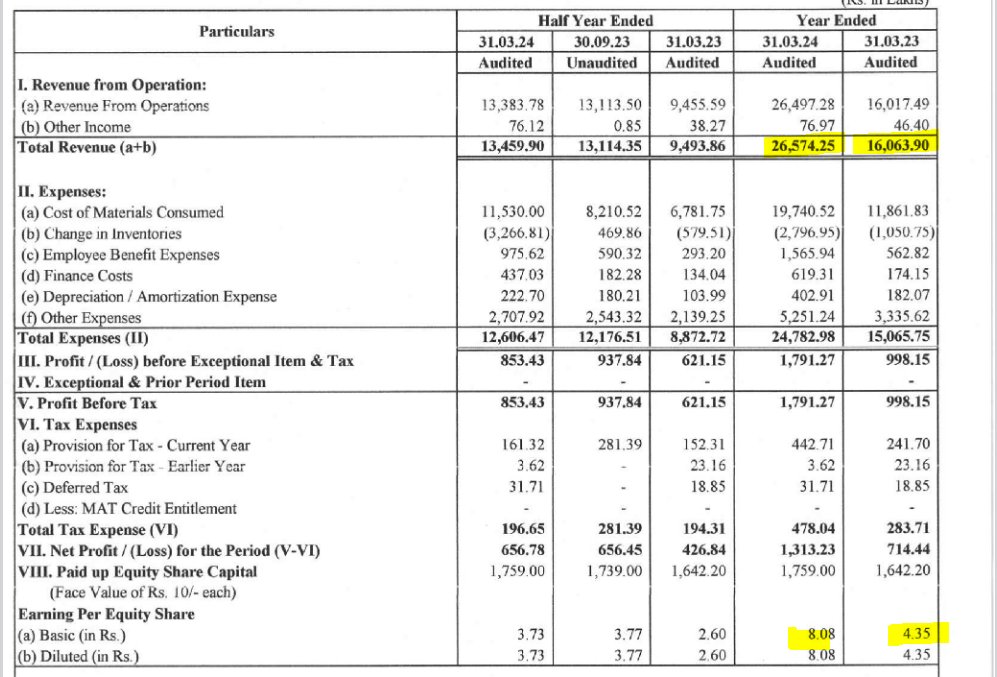

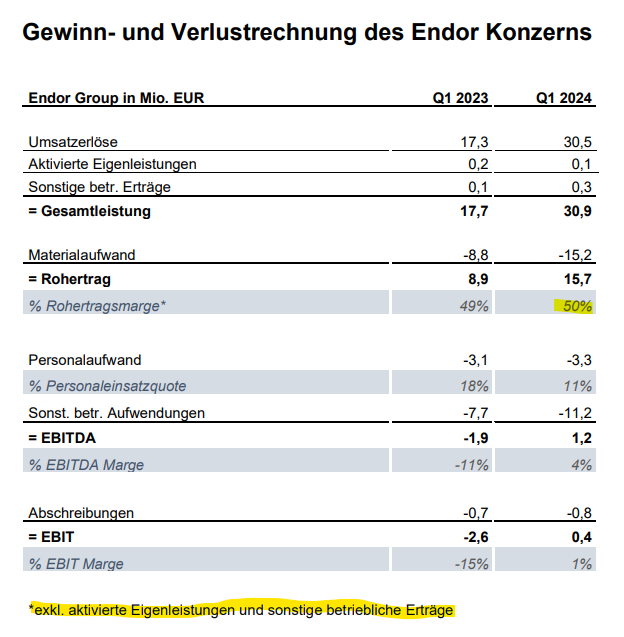

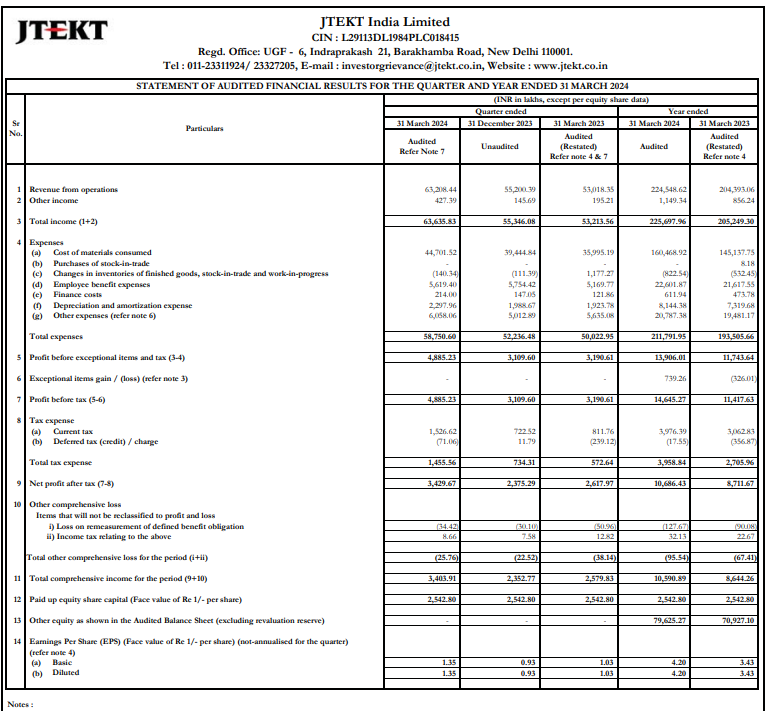

Fy24

Rev. up 65%🚀

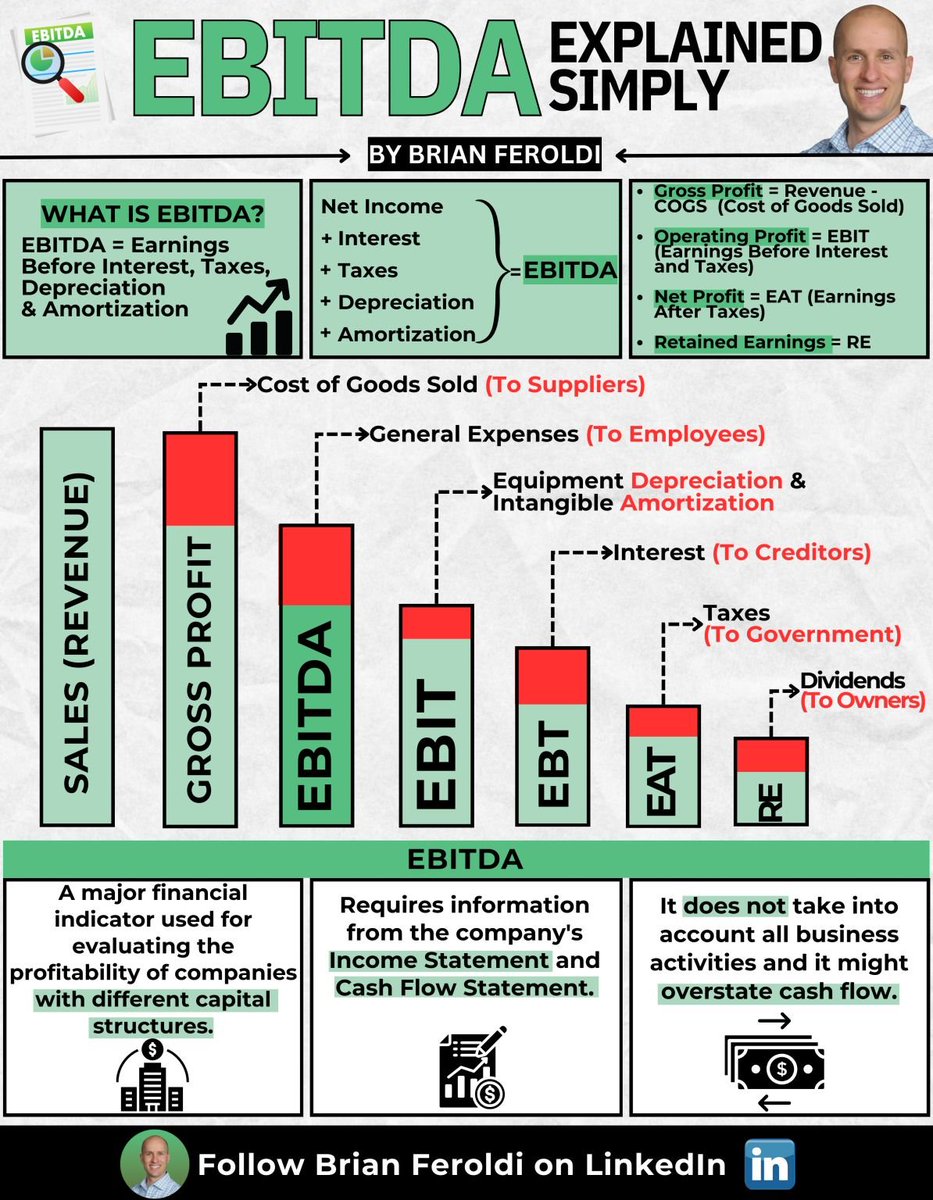

Ebitda up 2x

10.5% vs 8.4%

Pat up 84%🚀🚀

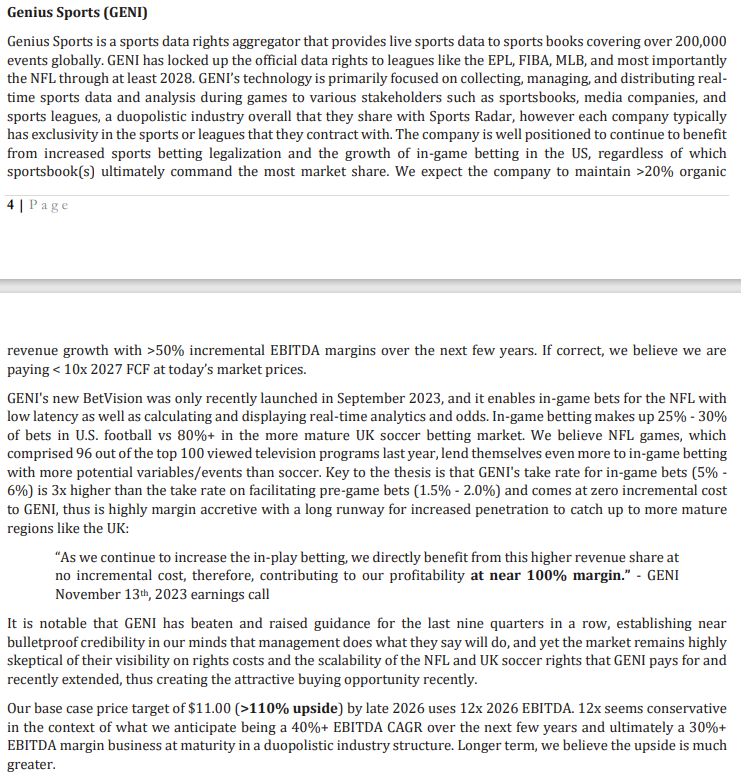

Looking to double its turnover in Fy25

130crs will be added via recent acq. & rest by organic growth

Hv hired professionals from industry to scale up operations