Trent Dudenhoeffer, CFP® There's a big pile of free money on the table that any small city in America can take:

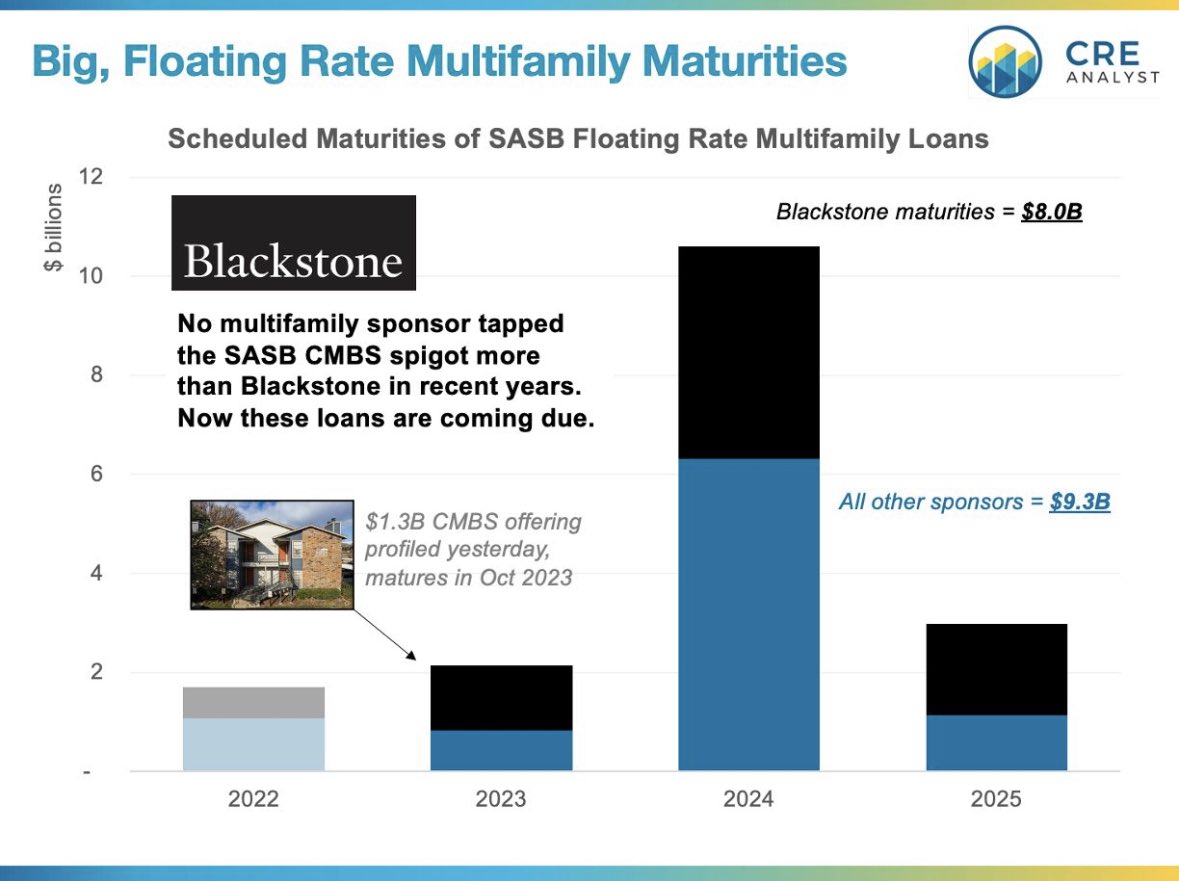

1. Issue a zero-coupon 10-year municipal revenue bond

2. Buy bitcoin

3. At maturity, sell half & pay it out to bondholders

4. Keep the rest

5. Borrow against it forever

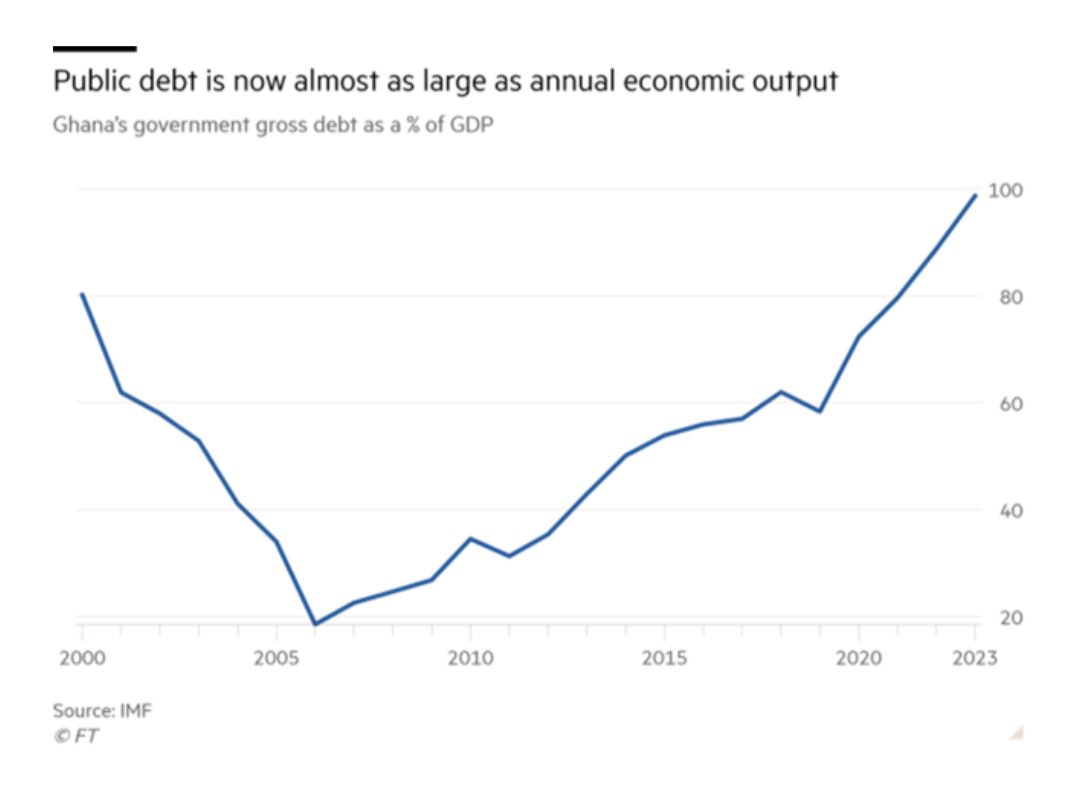

The Finance Minister should tell us when he is going to clear all arrears owed Pensioner Bondholders. - Prof. Godfred Bokpin, Economist #PMExpress

ERS (Next Up Leadville 10K) Wasn’t bailing out the UAW’s pension fund while giving bondholders the shaft, completely upending corporate law regarding the capital structure, the sin of 2009? That precedent led to municipalities doing the same thing. Bravo to all involved.

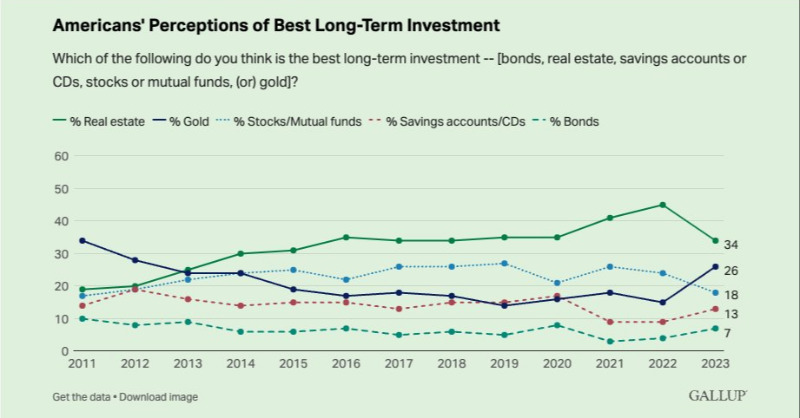

Here's the craziest part: This example comes from Bill Bengen's original 'determining safe withdrawal rates' 1994 analysis, and it makes the case that staying invested in stocks has — historically — been the right move.

Sponsored by Vin Social

Govt to settle coupon arrears of bondholders on June 30

Read more - rb.gy/ge61w #coupons #bondholders #Pensioners #INDNews

Pensioner Bondholders have once again gathered at the Ministry of Finance to vent their displeasure at the non-payments of some 6 outstanding coupons.

#MiddayLive

PerpetualValue Paul Hawkins Tendering bondholders are also being bribed to consent to the insertion of a call option. That's the only thing that worries me, otherwise I'm not minded to tender.