Babak 🇺🇦 🌻

@TN

Whatever the opposite of 'laser eyes' is...

ID:1188301

14-03-2007 22:53:13

18,0K Tweets

9,5K Followers

121 Following

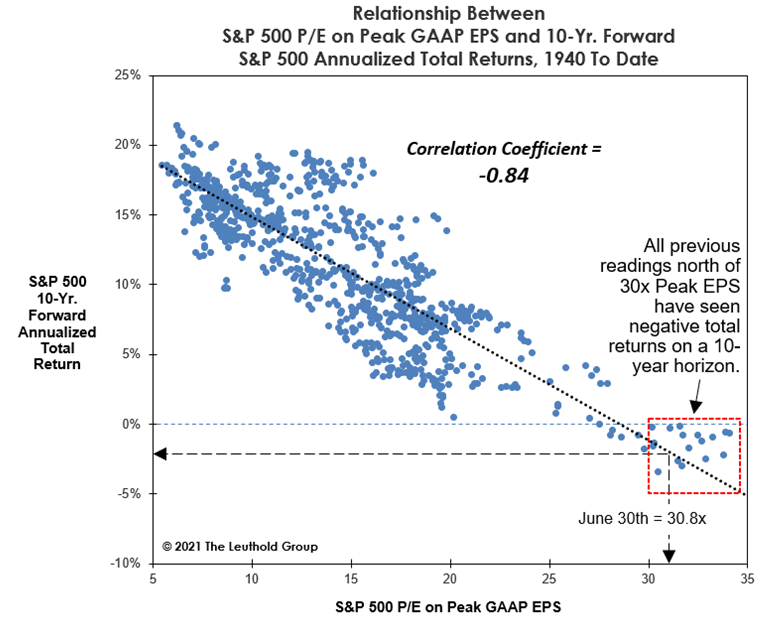

S&P 500's June 2021 peak PE at 30.8 (99th %tile, below Dec 1999's 35.8 an all time record which would put $SPX +5000) such high #valuation corresponds to poor long term returns - a slightly negative 10 year annualized total return!

chart via The Leuthold Group

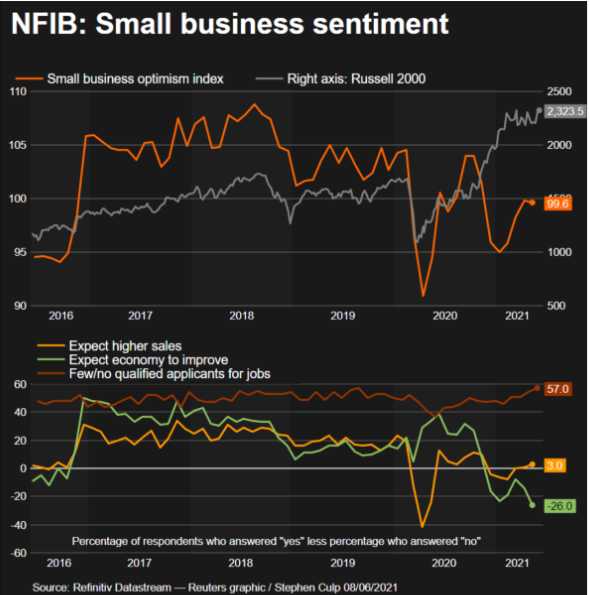

NFIB small business #sentiment 99.6 - notice the response regarding expectations of the economy improving in the lower panel

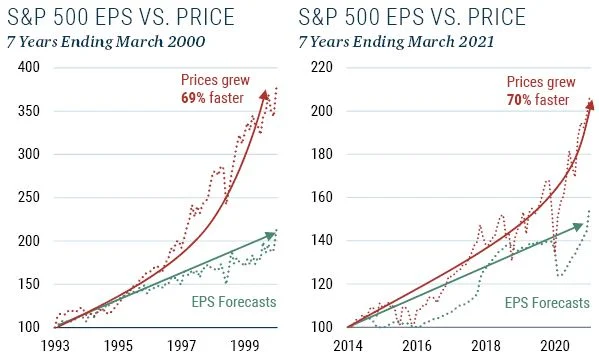

GMO cautions re #valuation by comparing EPS vs prices for 1990's market and today's

EPS forecasts are 2-year forecasts. In the first chart, EPS forecasts grew at an annualized rate of 11.1%; in the second chart, EPS forecasts grew at an annualized rate of 6.4%.