Eric Balchunas

@EricBalchunas

Senior ETF Analyst for @Bloomberg. Dad. Rutgers grad. Gen X-er. Author of "The Institutional ETF Toolbox" & "The Bogle Effect.” Co-host of Trillions & ETF IQ.

ID:149571760

https://www.amazon.com/Bogle-Effect-Vanguard-Investors-Trillions/dp/1637740719 29-05-2010 16:45:12

61,2K Tweets

267,6K Followers

2,7K Following

Follow People

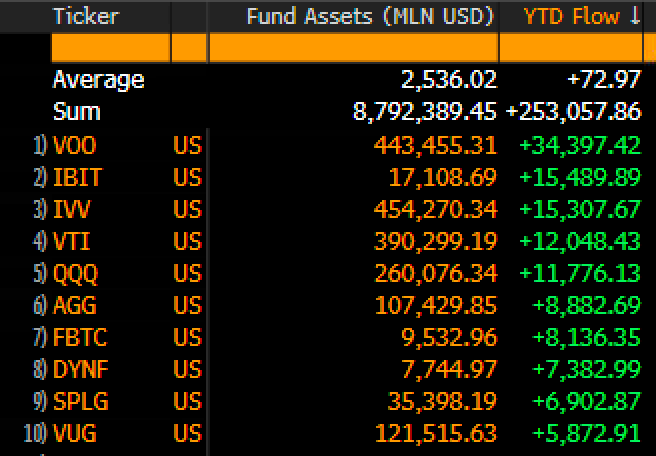

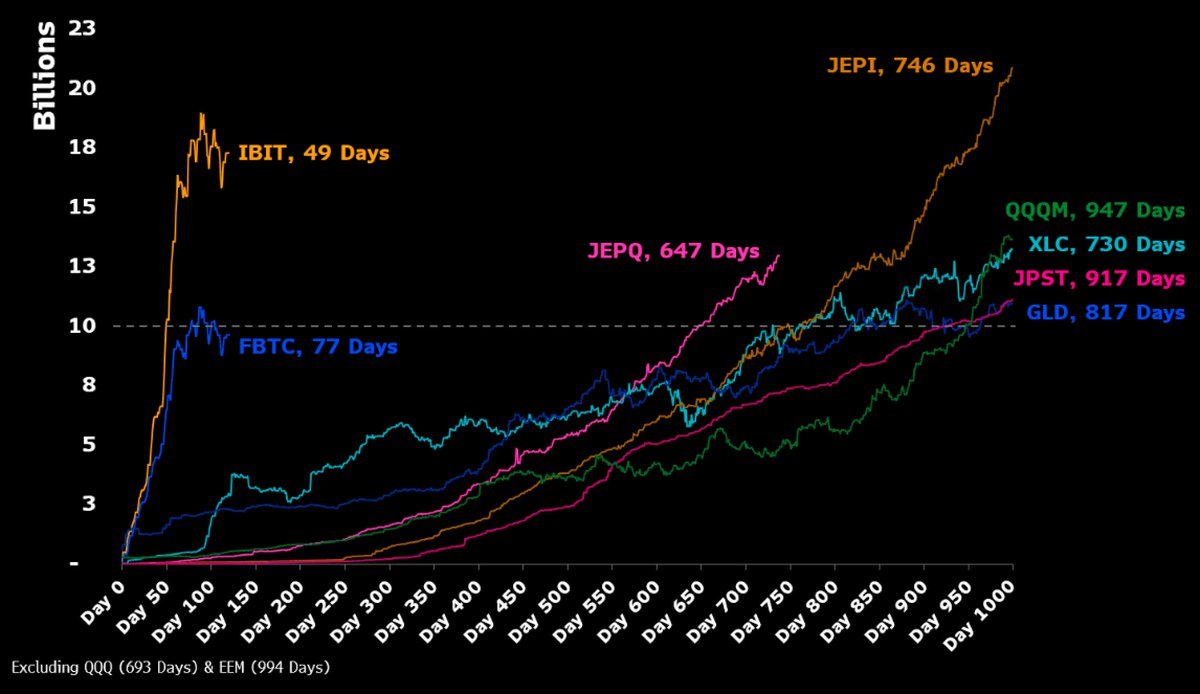

Prior to the bitcoin ETFs the record speed for an ETF to reach $10b in assets was held by $JEPQ who did it in 647 trading days (nearly three years). $IBIT got there in 49 days, $FBTC in 77 days. Cool visual from Sebastien Cabral

One of the unsung arts of ETF Terrordome survival for issuers is picking the fee- trying to strike the perfect equilibrium bt providing good value and making money. On latest Trillions we discuss ETF revenue w/ Athanasios Psarofagis Katie Greifeld Joel Weber bloomberg.com/news/articles/…

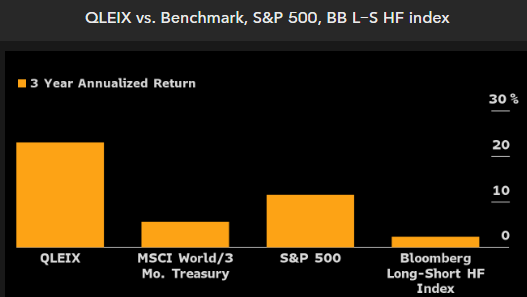

One of the best hedge funds is actually a mutual fund: AQR's long/short fund $QLEIX is tripling benchmark, doubling SPX and with only half the volatility and no correlation. Can't really ask for more from a HF strat. Good note on it from David Cohne blinks.bloomberg.com/news/stories/S…